Are you a seasoned IRS Agent (Internal Revenue Service Agent) seeking a new career path? Discover our professionally built IRS Agent (Internal Revenue Service Agent) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

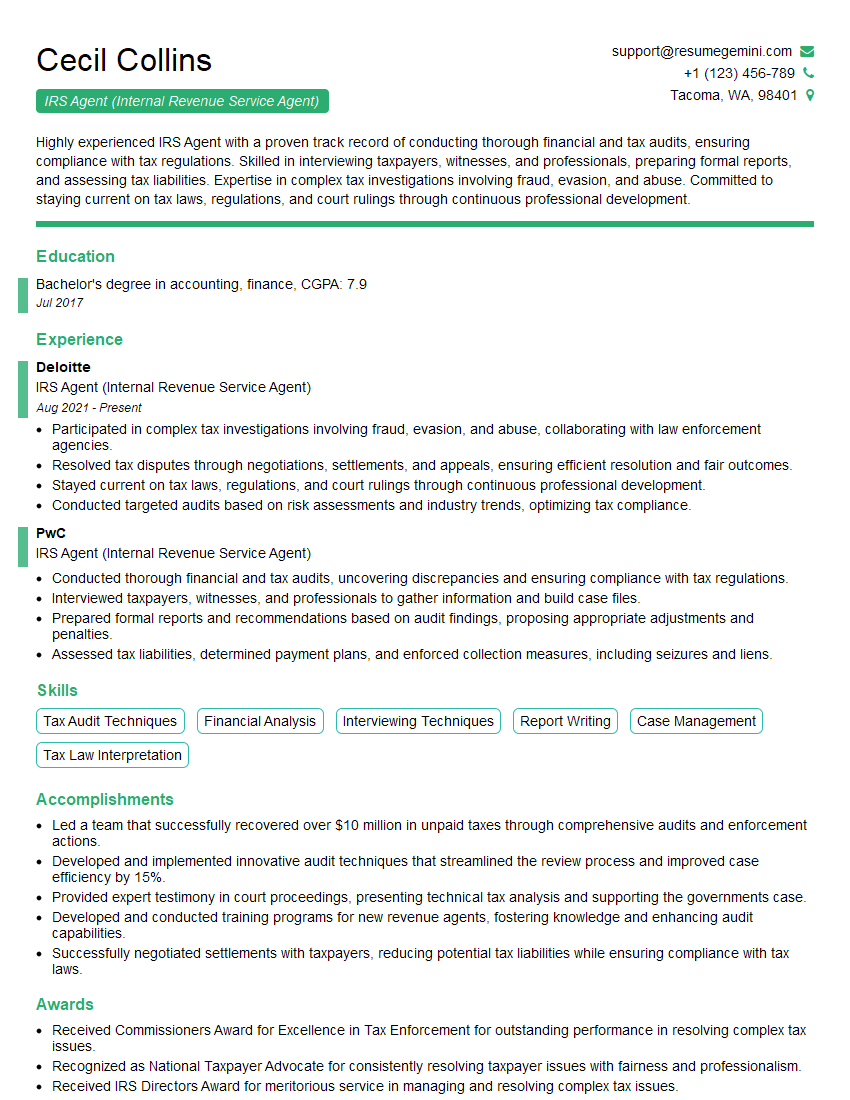

Cecil Collins

IRS Agent (Internal Revenue Service Agent)

Summary

Highly experienced IRS Agent with a proven track record of conducting thorough financial and tax audits, ensuring compliance with tax regulations. Skilled in interviewing taxpayers, witnesses, and professionals, preparing formal reports, and assessing tax liabilities. Expertise in complex tax investigations involving fraud, evasion, and abuse. Committed to staying current on tax laws, regulations, and court rulings through continuous professional development.

Education

Bachelor’s degree in accounting, finance

July 2017

Skills

- Tax Audit Techniques

- Financial Analysis

- Interviewing Techniques

- Report Writing

- Case Management

- Tax Law Interpretation

Work Experience

IRS Agent (Internal Revenue Service Agent)

- Participated in complex tax investigations involving fraud, evasion, and abuse, collaborating with law enforcement agencies.

- Resolved tax disputes through negotiations, settlements, and appeals, ensuring efficient resolution and fair outcomes.

- Stayed current on tax laws, regulations, and court rulings through continuous professional development.

- Conducted targeted audits based on risk assessments and industry trends, optimizing tax compliance.

IRS Agent (Internal Revenue Service Agent)

- Conducted thorough financial and tax audits, uncovering discrepancies and ensuring compliance with tax regulations.

- Interviewed taxpayers, witnesses, and professionals to gather information and build case files.

- Prepared formal reports and recommendations based on audit findings, proposing appropriate adjustments and penalties.

- Assessed tax liabilities, determined payment plans, and enforced collection measures, including seizures and liens.

Accomplishments

- Led a team that successfully recovered over $10 million in unpaid taxes through comprehensive audits and enforcement actions.

- Developed and implemented innovative audit techniques that streamlined the review process and improved case efficiency by 15%.

- Provided expert testimony in court proceedings, presenting technical tax analysis and supporting the governments case.

- Developed and conducted training programs for new revenue agents, fostering knowledge and enhancing audit capabilities.

- Successfully negotiated settlements with taxpayers, reducing potential tax liabilities while ensuring compliance with tax laws.

Awards

- Received Commissioners Award for Excellence in Tax Enforcement for outstanding performance in resolving complex tax issues.

- Recognized as National Taxpayer Advocate for consistently resolving taxpayer issues with fairness and professionalism.

- Received IRS Directors Award for meritorious service in managing and resolving complex tax issues.

- Recognized as IRS Employee of the Year for exceptional dedication and collaborative leadership within the organization.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For IRS Agent (Internal Revenue Service Agent)

- Highlight your technical skills in tax audit techniques, financial analysis, and tax law interpretation.

- Showcase your communication abilities, including interviewing techniques and report writing skills.

- Quantify your accomplishments and provide specific examples of successful audits or investigations.

- Emphasize your commitment to professional development and staying abreast of tax regulations.

Essential Experience Highlights for a Strong IRS Agent (Internal Revenue Service Agent) Resume

- Conduct thorough financial and tax audits to ensure compliance with tax regulations.

- Identify discrepancies and gather evidence to build strong case files.

- Interview taxpayers, witnesses, and professionals to obtain necessary information.

- Prepare formal reports and make recommendations based on audit findings.

- Assess tax liabilities, determine payment plans, and enforce collection measures.

- Participate in complex tax investigations involving fraud, evasion, and abuse.

Frequently Asked Questions (FAQ’s) For IRS Agent (Internal Revenue Service Agent)

What are the educational requirements to become an IRS Agent?

A bachelor’s degree in accounting, finance, or a related field is typically required

What are the key skills and abilities needed for this role?

Strong analytical and problem-solving skills, excellent communication and interpersonal skills, and proficiency in tax laws and regulations.

What are the career advancement opportunities for IRS Agents?

With experience and additional qualifications, IRS Agents can advance to supervisory and management positions within the IRS or pursue careers in tax law, accounting, or financial analysis.

Is the job of an IRS Agent stressful?

The job can be demanding and stressful at times, especially during tax season or when dealing with complex investigations.

What is the salary range for IRS Agents?

The salary range varies depending on experience, location, and performance, but IRS Agents typically earn a competitive salary and benefits package.

How can I prepare for an interview for an IRS Agent position?

Research the IRS and the specific role, practice answering common interview questions, and be prepared to discuss your technical skills and experience in tax auditing.