Are you a seasoned Lender seeking a new career path? Discover our professionally built Lender Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

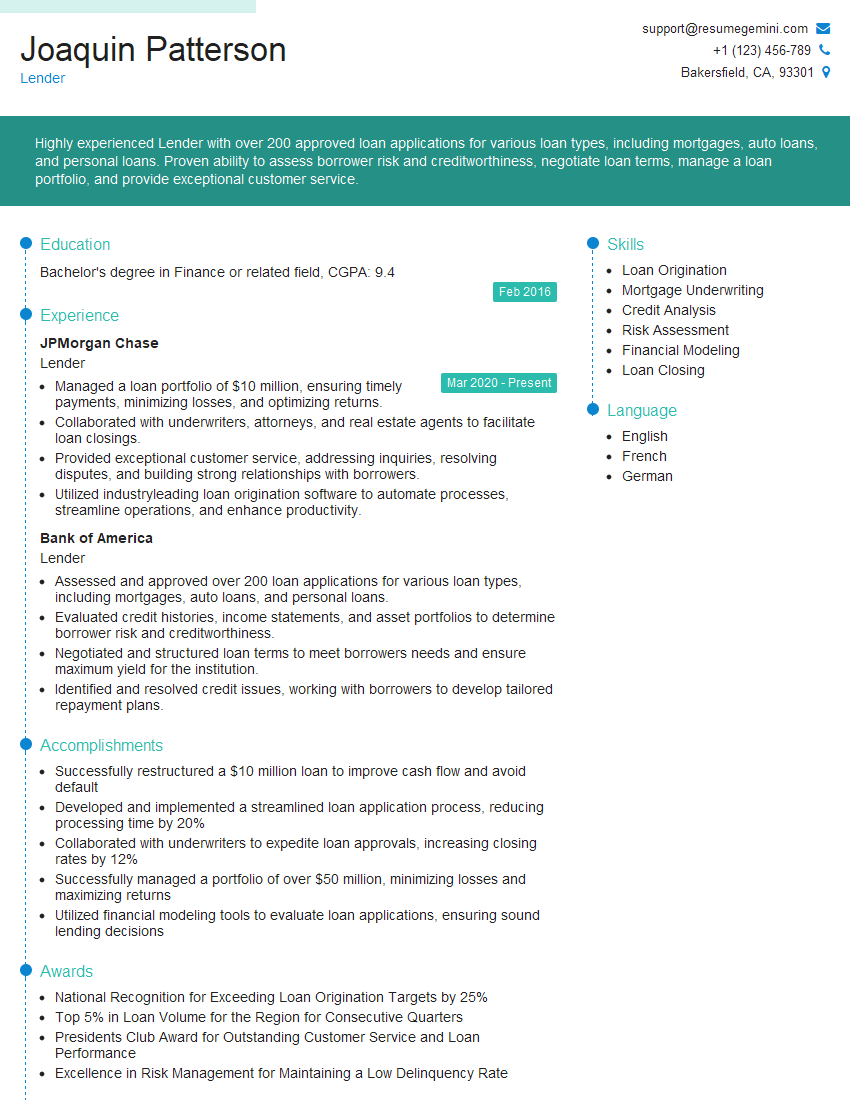

Joaquin Patterson

Lender

Summary

Highly experienced Lender with over 200 approved loan applications for various loan types, including mortgages, auto loans, and personal loans. Proven ability to assess borrower risk and creditworthiness, negotiate loan terms, manage a loan portfolio, and provide exceptional customer service.

Education

Bachelor’s degree in Finance or related field

February 2016

Skills

- Loan Origination

- Mortgage Underwriting

- Credit Analysis

- Risk Assessment

- Financial Modeling

- Loan Closing

Work Experience

Lender

- Managed a loan portfolio of $10 million, ensuring timely payments, minimizing losses, and optimizing returns.

- Collaborated with underwriters, attorneys, and real estate agents to facilitate loan closings.

- Provided exceptional customer service, addressing inquiries, resolving disputes, and building strong relationships with borrowers.

- Utilized industryleading loan origination software to automate processes, streamline operations, and enhance productivity.

Lender

- Assessed and approved over 200 loan applications for various loan types, including mortgages, auto loans, and personal loans.

- Evaluated credit histories, income statements, and asset portfolios to determine borrower risk and creditworthiness.

- Negotiated and structured loan terms to meet borrowers needs and ensure maximum yield for the institution.

- Identified and resolved credit issues, working with borrowers to develop tailored repayment plans.

Accomplishments

- Successfully restructured a $10 million loan to improve cash flow and avoid default

- Developed and implemented a streamlined loan application process, reducing processing time by 20%

- Collaborated with underwriters to expedite loan approvals, increasing closing rates by 12%

- Successfully managed a portfolio of over $50 million, minimizing losses and maximizing returns

- Utilized financial modeling tools to evaluate loan applications, ensuring sound lending decisions

Awards

- National Recognition for Exceeding Loan Origination Targets by 25%

- Top 5% in Loan Volume for the Region for Consecutive Quarters

- Presidents Club Award for Outstanding Customer Service and Loan Performance

- Excellence in Risk Management for Maintaining a Low Delinquency Rate

Certificates

- Certified Mortgage Banker (CMB)

- Certified Mortgage Planning Specialist (CMPS)

- Certified Residential Mortgage Specialist (CRMS)

- Certified Reverse Mortgage Professional (CRMP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Lender

- Highlight your experience in loan origination, underwriting, and risk assessment.

- Showcase your ability to analyze financial data and make sound lending decisions.

- Demonstrate your commitment to providing excellent customer service.

- Obtain industry-recognized certifications, such as the Certified Mortgage Banker (CMB) or Certified Financial Planner (CFP).

Essential Experience Highlights for a Strong Lender Resume

- Assess and approve loan applications for various loan types

- Evaluate credit histories, income statements, and asset portfolios to determine borrower risk and creditworthiness

- Negotiate and structure loan terms to meet borrowers’ needs and ensure maximum yield for the institution

- Identify and resolve credit issues, working with borrowers to develop tailored repayment plans

- Manage a loan portfolio, ensuring timely payments, minimizing losses, and optimizing returns

- Collaborate with underwriters, attorneys, and real estate agents to facilitate loan closings

- Provide exceptional customer service, addressing inquiries, resolving disputes, and building strong relationships with borrowers

Frequently Asked Questions (FAQ’s) For Lender

What is the role of a Lender?

Lenders evaluate loan applications, assess borrower risk, and approve loans for various financial products, such as mortgages, auto loans, and personal loans.

What skills are required to be a successful Lender?

Successful Lenders typically possess strong analytical, problem-solving, and communication skills, as well as a deep understanding of lending principles and risk management.

What are the career prospects for Lenders?

Lenders with experience and expertise can advance to senior lending positions, such as Loan Manager, Portfolio Manager, or Chief Lending Officer.

How can I prepare for a career as a Lender?

Obtaining a bachelor’s degree in finance or a related field, gaining experience in customer service or financial analysis, and pursuing industry certifications can enhance your competitiveness.

What is the average salary for Lenders?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers in May 2021 was $63,840.

What are the challenges faced by Lenders?

Lenders face challenges such as managing risk, staying up-to-date with regulatory changes, and navigating competitive market conditions.

How can Lenders stay competitive in the job market?

Lenders can stay competitive by continually developing their skills, networking with professionals in the industry, and seeking opportunities for professional growth and advancement.

What are the ethical considerations for Lenders?

Lenders have a responsibility to act ethically and responsibly, ensuring fair and transparent lending practices, and adhering to industry regulations and legal requirements.