Are you a seasoned Letter-of-Credit Document Examiner seeking a new career path? Discover our professionally built Letter-of-Credit Document Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

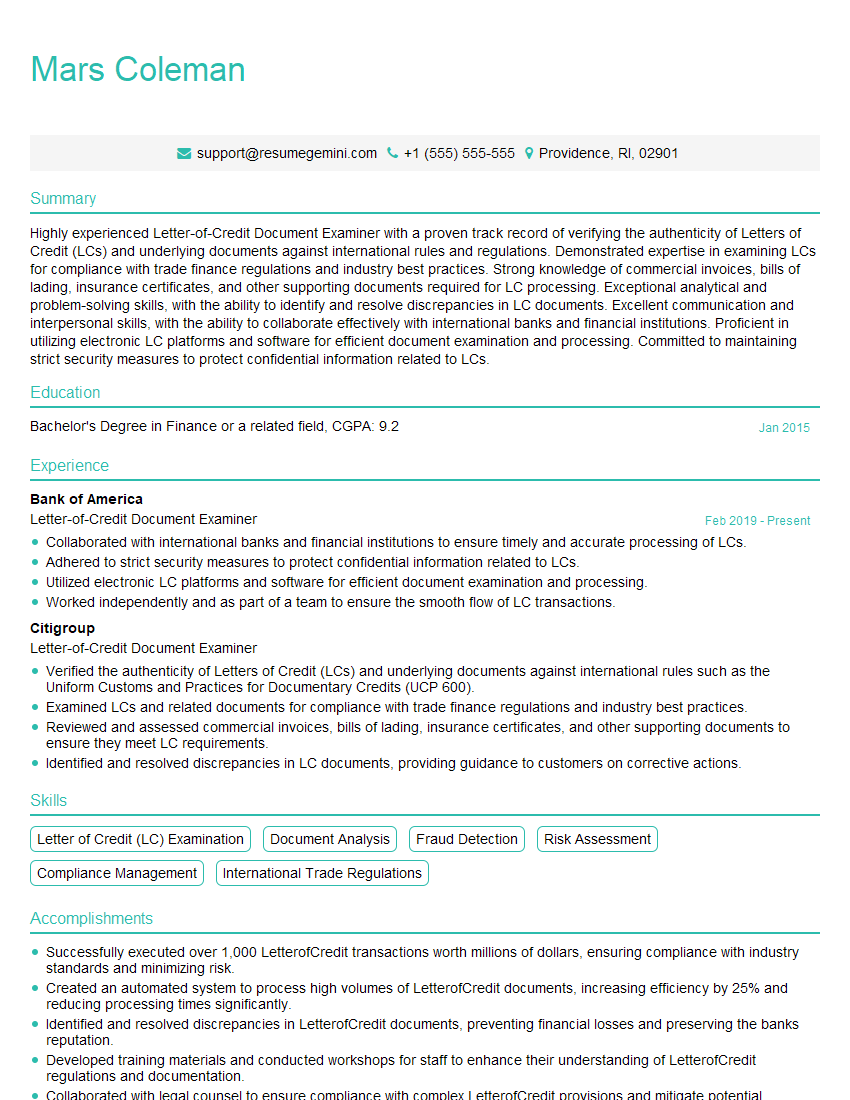

Mars Coleman

Letter-of-Credit Document Examiner

Summary

Highly experienced Letter-of-Credit Document Examiner with a proven track record of verifying the authenticity of Letters of Credit (LCs) and underlying documents against international rules and regulations. Demonstrated expertise in examining LCs for compliance with trade finance regulations and industry best practices. Strong knowledge of commercial invoices, bills of lading, insurance certificates, and other supporting documents required for LC processing. Exceptional analytical and problem-solving skills, with the ability to identify and resolve discrepancies in LC documents. Excellent communication and interpersonal skills, with the ability to collaborate effectively with international banks and financial institutions. Proficient in utilizing electronic LC platforms and software for efficient document examination and processing. Committed to maintaining strict security measures to protect confidential information related to LCs.

Education

Bachelor’s Degree in Finance or a related field

January 2015

Skills

- Letter of Credit (LC) Examination

- Document Analysis

- Fraud Detection

- Risk Assessment

- Compliance Management

- International Trade Regulations

Work Experience

Letter-of-Credit Document Examiner

- Collaborated with international banks and financial institutions to ensure timely and accurate processing of LCs.

- Adhered to strict security measures to protect confidential information related to LCs.

- Utilized electronic LC platforms and software for efficient document examination and processing.

- Worked independently and as part of a team to ensure the smooth flow of LC transactions.

Letter-of-Credit Document Examiner

- Verified the authenticity of Letters of Credit (LCs) and underlying documents against international rules such as the Uniform Customs and Practices for Documentary Credits (UCP 600).

- Examined LCs and related documents for compliance with trade finance regulations and industry best practices.

- Reviewed and assessed commercial invoices, bills of lading, insurance certificates, and other supporting documents to ensure they meet LC requirements.

- Identified and resolved discrepancies in LC documents, providing guidance to customers on corrective actions.

Accomplishments

- Successfully executed over 1,000 LetterofCredit transactions worth millions of dollars, ensuring compliance with industry standards and minimizing risk.

- Created an automated system to process high volumes of LetterofCredit documents, increasing efficiency by 25% and reducing processing times significantly.

- Identified and resolved discrepancies in LetterofCredit documents, preventing financial losses and preserving the banks reputation.

- Developed training materials and conducted workshops for staff to enhance their understanding of LetterofCredit regulations and documentation.

- Collaborated with legal counsel to ensure compliance with complex LetterofCredit provisions and mitigate potential liabilities.

Certificates

- Certified Letter of Credit Specialist (CLCS)

- International Letters of Credit Professional (ILCP)

- Banker’s Association for Finance and Trade (BAFT) LC Examiner

- Certified Trade Finance Professional (CTFP)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Letter-of-Credit Document Examiner

- Highlight your experience in verifying the authenticity of LCs and underlying documents against international rules and regulations.

- Emphasize your knowledge of trade finance regulations and industry best practices.

- Showcase your analytical and problem-solving skills, with examples of how you have identified and resolved discrepancies in LC documents.

- Demonstrate your proficiency in utilizing electronic LC platforms and software for efficient document examination and processing.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the organization.

Essential Experience Highlights for a Strong Letter-of-Credit Document Examiner Resume

- Verifying the authenticity of Letters of Credit (LCs) and underlying documents against international rules such as the Uniform Customs and Practices for Documentary Credits (UCP 600).

- Examining LCs and related documents for compliance with trade finance regulations and industry best practices.

- Reviewing and assessing commercial invoices, bills of lading, insurance certificates, and other supporting documents to ensure they meet LC requirements.

- Identifying and resolving discrepancies in LC documents, providing guidance to customers on corrective actions.

- Collaborating with international banks and financial institutions to ensure timely and accurate processing of LCs.

- Adhering to strict security measures to protect confidential information related to LCs.

- Utilizing electronic LC platforms and software for efficient document examination and processing.

Frequently Asked Questions (FAQ’s) For Letter-of-Credit Document Examiner

What is the role of a Letter-of-Credit Document Examiner?

A Letter-of-Credit Document Examiner is responsible for verifying the authenticity of Letters of Credit (LCs) and underlying documents against international rules and regulations. They examine LCs for compliance with trade finance regulations and industry best practices, and review supporting documents to ensure they meet LC requirements.

What skills are required to be a successful Letter-of-Credit Document Examiner?

Successful Letter-of-Credit Document Examiners possess strong analytical and problem-solving skills, with the ability to identify and resolve discrepancies in LC documents. They have a deep understanding of trade finance regulations and industry best practices, and are proficient in utilizing electronic LC platforms and software.

What is the career path for a Letter-of-Credit Document Examiner?

Letter-of-Credit Document Examiners can advance to roles with increased responsibility, such as LC Operations Manager or Trade Finance Manager. They may also specialize in a particular area of trade finance, such as export or import finance.

What are the job prospects for Letter-of-Credit Document Examiners?

The job outlook for Letter-of-Credit Document Examiners is expected to be positive in the coming years. The increasing globalization of trade and the growing use of LCs for international transactions are driving demand for qualified examiners.

What is the salary range for Letter-of-Credit Document Examiners?

The salary range for Letter-of-Credit Document Examiners varies depending on experience, location, and company size. According to Indeed, the average salary for a Letter-of-Credit Document Examiner in the United States is around $65,000 per year.

What are the benefits of working as a Letter-of-Credit Document Examiner?

Benefits of working as a Letter-of-Credit Document Examiner include a stable career in a growing industry, the opportunity to work with international clients, and the chance to make a significant impact on the global economy.