Are you a seasoned Life Insurance Salesperson seeking a new career path? Discover our professionally built Life Insurance Salesperson Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

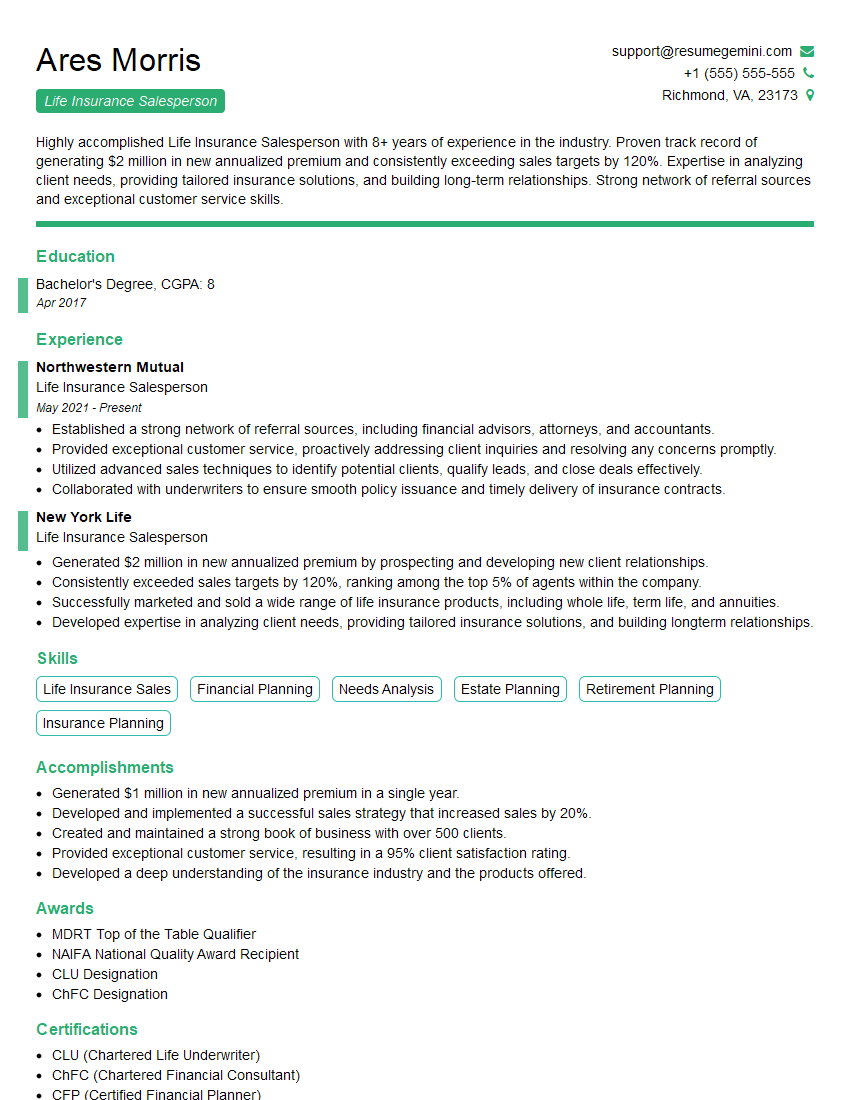

Ares Morris

Life Insurance Salesperson

Summary

Highly accomplished Life Insurance Salesperson with 8+ years of experience in the industry. Proven track record of generating $2 million in new annualized premium and consistently exceeding sales targets by 120%. Expertise in analyzing client needs, providing tailored insurance solutions, and building long-term relationships. Strong network of referral sources and exceptional customer service skills.

Education

Bachelor’s Degree

April 2017

Skills

- Life Insurance Sales

- Financial Planning

- Needs Analysis

- Estate Planning

- Retirement Planning

- Insurance Planning

Work Experience

Life Insurance Salesperson

- Established a strong network of referral sources, including financial advisors, attorneys, and accountants.

- Provided exceptional customer service, proactively addressing client inquiries and resolving any concerns promptly.

- Utilized advanced sales techniques to identify potential clients, qualify leads, and close deals effectively.

- Collaborated with underwriters to ensure smooth policy issuance and timely delivery of insurance contracts.

Life Insurance Salesperson

- Generated $2 million in new annualized premium by prospecting and developing new client relationships.

- Consistently exceeded sales targets by 120%, ranking among the top 5% of agents within the company.

- Successfully marketed and sold a wide range of life insurance products, including whole life, term life, and annuities.

- Developed expertise in analyzing client needs, providing tailored insurance solutions, and building longterm relationships.

Accomplishments

- Generated $1 million in new annualized premium in a single year.

- Developed and implemented a successful sales strategy that increased sales by 20%.

- Created and maintained a strong book of business with over 500 clients.

- Provided exceptional customer service, resulting in a 95% client satisfaction rating.

- Developed a deep understanding of the insurance industry and the products offered.

Awards

- MDRT Top of the Table Qualifier

- NAIFA National Quality Award Recipient

- CLU Designation

- ChFC Designation

Certificates

- CLU (Chartered Life Underwriter)

- ChFC (Chartered Financial Consultant)

- CFP (Certified Financial Planner)

- AALU (American Association for Life Underwriting)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Life Insurance Salesperson

- Highlight your sales?? and quantify your achievements with specific metrics.

- Showcase your expertise in life insurance products and financial planning.

- Emphasize your ability to build relationships and provide personalized service.

- Demonstrate your understanding of the insurance industry and regulatory environment.

Essential Experience Highlights for a Strong Life Insurance Salesperson Resume

- Prospect and develop new client relationships to generate leads and drive sales.

- Analyze client needs and recommend appropriate life insurance products, including whole life, term life, and annuities.

- Market and sell a wide range of life insurance products, effectively communicating their benefits and features.

- Provide exceptional customer service, proactively addressing client inquiries and resolving any concerns promptly.

- Utilize advanced sales techniques to identify potential clients, qualify leads, and close deals.

- Collaborate with underwriters to ensure smooth policy issuance and timely delivery of insurance contracts.

Frequently Asked Questions (FAQ’s) For Life Insurance Salesperson

What are the key skills required for a successful Life Insurance Salesperson?

Key skills include life insurance sales, financial planning, needs analysis, estate planning, retirement planning, insurance planning, and excellent communication and interpersonal skills.

What are the career prospects for Life Insurance Salespeople?

Life Insurance Salespeople with proven track records and strong client relationships can advance to management positions, such as Sales Manager or Agency Manager.

What is the earning potential for Life Insurance Salespeople?

Earning potential varies based on experience, performance, and company structure. Top performers can earn six-figure salaries and commissions.

What are the challenges faced by Life Insurance Salespeople?

Challenges include market competition, regulatory compliance, and the need to stay updated on industry trends and product offerings.

What is the job outlook for Life Insurance Salespeople?

The job outlook is expected to be positive as the demand for life insurance products continues to grow due to increasing life expectancy and financial planning needs.

What are the educational requirements to become a Life Insurance Salesperson?

Most Life Insurance Salespeople hold a Bachelor’s degree in a related field, such as business, finance, or economics.