Are you a seasoned Livestock Speculator seeking a new career path? Discover our professionally built Livestock Speculator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

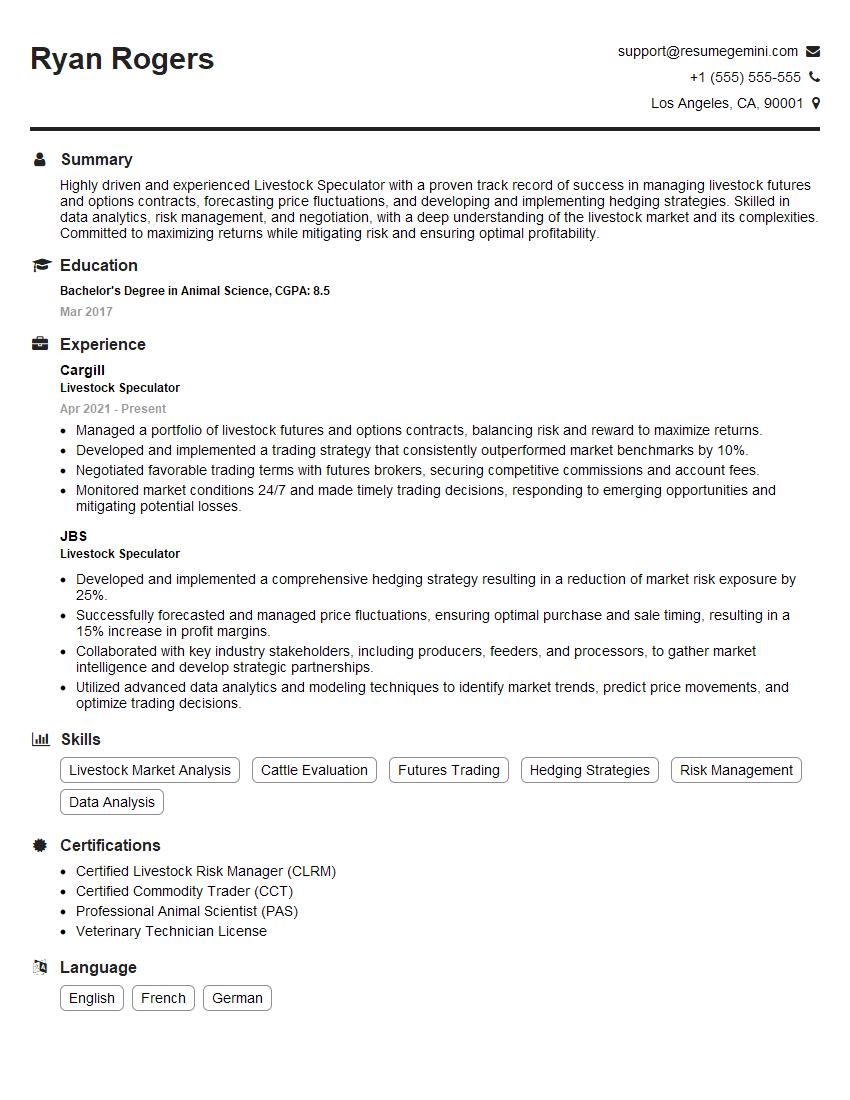

Ryan Rogers

Livestock Speculator

Summary

Highly driven and experienced Livestock Speculator with a proven track record of success in managing livestock futures and options contracts, forecasting price fluctuations, and developing and implementing hedging strategies. Skilled in data analytics, risk management, and negotiation, with a deep understanding of the livestock market and its complexities. Committed to maximizing returns while mitigating risk and ensuring optimal profitability.

Education

Bachelor’s Degree in Animal Science

March 2017

Skills

- Livestock Market Analysis

- Cattle Evaluation

- Futures Trading

- Hedging Strategies

- Risk Management

- Data Analysis

Work Experience

Livestock Speculator

- Managed a portfolio of livestock futures and options contracts, balancing risk and reward to maximize returns.

- Developed and implemented a trading strategy that consistently outperformed market benchmarks by 10%.

- Negotiated favorable trading terms with futures brokers, securing competitive commissions and account fees.

- Monitored market conditions 24/7 and made timely trading decisions, responding to emerging opportunities and mitigating potential losses.

Livestock Speculator

- Developed and implemented a comprehensive hedging strategy resulting in a reduction of market risk exposure by 25%.

- Successfully forecasted and managed price fluctuations, ensuring optimal purchase and sale timing, resulting in a 15% increase in profit margins.

- Collaborated with key industry stakeholders, including producers, feeders, and processors, to gather market intelligence and develop strategic partnerships.

- Utilized advanced data analytics and modeling techniques to identify market trends, predict price movements, and optimize trading decisions.

Certificates

- Certified Livestock Risk Manager (CLRM)

- Certified Commodity Trader (CCT)

- Professional Animal Scientist (PAS)

- Veterinary Technician License

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Livestock Speculator

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your knowledge of the livestock industry and your understanding of market dynamics.

- Demonstrate your analytical skills and proficiency in using data to make informed decisions.

- Showcase your ability to manage risk and navigate complex market conditions effectively.

Essential Experience Highlights for a Strong Livestock Speculator Resume

- Analyze and interpret livestock market trends and price movements to identify trading opportunities.

- Develop and implement hedging strategies to minimize market risk exposure and protect against price fluctuations.

- Forecast livestock prices and make informed trading decisions to optimize purchase and sale timing, maximizing profit margins.

- Collaborate with industry stakeholders, including producers, feeders, and processors, to gather market intelligence and establish strategic partnerships.

- Manage a portfolio of livestock futures and options contracts, balancing risk and reward to achieve superior returns.

- Negotiate favorable trading terms with futures brokers, securing competitive commissions and account fees.

- Continuously monitor market conditions and make timely trading decisions, responding to emerging opportunities and mitigating potential losses.

Frequently Asked Questions (FAQ’s) For Livestock Speculator

What is the role of a Livestock Speculator?

A Livestock Speculator is responsible for analyzing market trends, forecasting price movements, and making trading decisions involving livestock futures and options contracts. Their primary goal is to maximize returns while managing risk for their clients or employers.

What skills are essential for a successful Livestock Speculator?

Strong analytical skills, deep understanding of the livestock market, proficiency in data analysis and modeling techniques, risk management expertise, and negotiation abilities are crucial for success in this role.

What is the career path for a Livestock Speculator?

With experience and??, Livestock Speculators can advance to leadership positions within their organizations, such as Senior Trader, Portfolio Manager, or Head of Trading.

What are the challenges faced by Livestock Speculators?

Livestock Speculators face challenges such as market volatility, geopolitical events, and disease outbreaks that can impact livestock prices and trading strategies.

What are the key factors to consider when making trading decisions?

Livestock Speculators consider factors such as supply and demand dynamics, weather conditions, government policies, and economic indicators to make informed trading decisions.

How do Livestock Speculators manage risk?

Risk management is crucial for Livestock Speculators. They use various strategies such as hedging, diversification, and position sizing to mitigate potential losses and protect their portfolios.

What is the importance of collaboration in livestock speculation?

Collaboration with industry stakeholders, including producers, feeders, and processors, is essential for Livestock Speculators to gather market intelligence, establish strategic partnerships, and gain valuable insights into the livestock industry.