Are you a seasoned Loan and Credit Manager seeking a new career path? Discover our professionally built Loan and Credit Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

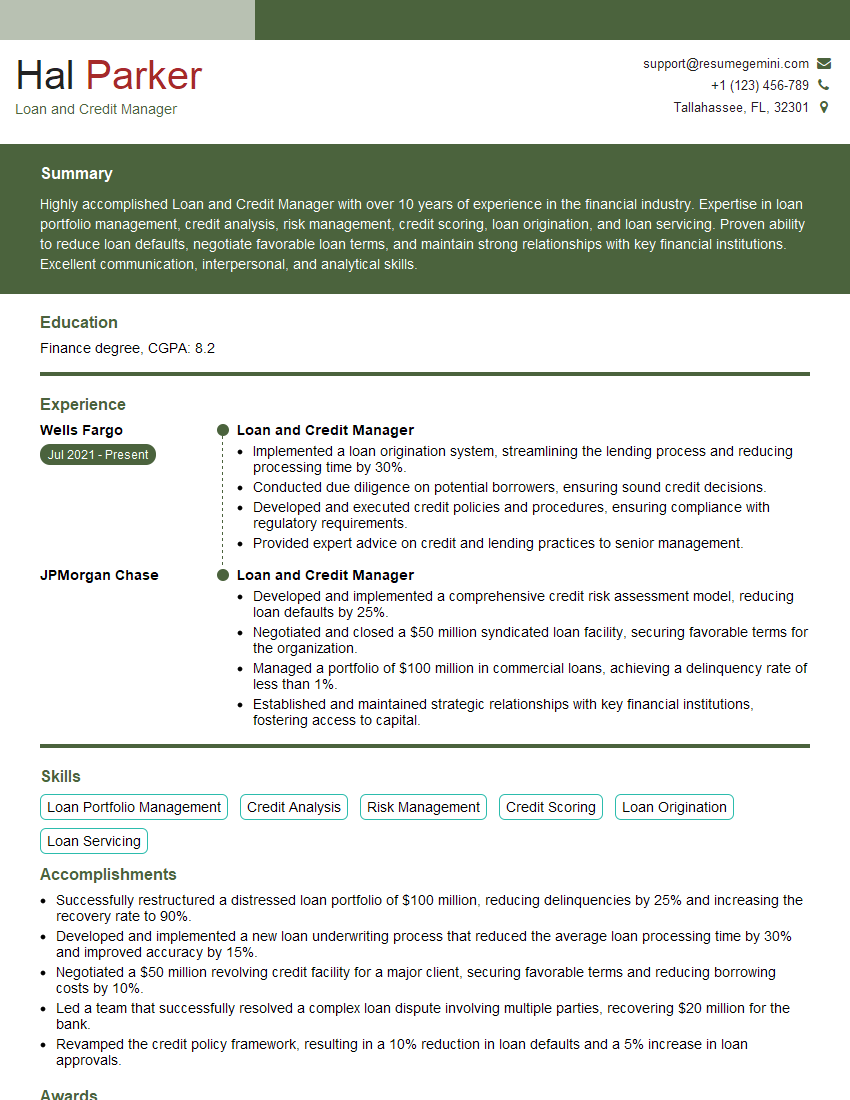

Hal Parker

Loan and Credit Manager

Summary

Highly accomplished Loan and Credit Manager with over 10 years of experience in the financial industry. Expertise in loan portfolio management, credit analysis, risk management, credit scoring, loan origination, and loan servicing. Proven ability to reduce loan defaults, negotiate favorable loan terms, and maintain strong relationships with key financial institutions. Excellent communication, interpersonal, and analytical skills.

Education

Finance degree

June 2017

Skills

- Loan Portfolio Management

- Credit Analysis

- Risk Management

- Credit Scoring

- Loan Origination

- Loan Servicing

Work Experience

Loan and Credit Manager

- Implemented a loan origination system, streamlining the lending process and reducing processing time by 30%.

- Conducted due diligence on potential borrowers, ensuring sound credit decisions.

- Developed and executed credit policies and procedures, ensuring compliance with regulatory requirements.

- Provided expert advice on credit and lending practices to senior management.

Loan and Credit Manager

- Developed and implemented a comprehensive credit risk assessment model, reducing loan defaults by 25%.

- Negotiated and closed a $50 million syndicated loan facility, securing favorable terms for the organization.

- Managed a portfolio of $100 million in commercial loans, achieving a delinquency rate of less than 1%.

- Established and maintained strategic relationships with key financial institutions, fostering access to capital.

Accomplishments

- Successfully restructured a distressed loan portfolio of $100 million, reducing delinquencies by 25% and increasing the recovery rate to 90%.

- Developed and implemented a new loan underwriting process that reduced the average loan processing time by 30% and improved accuracy by 15%.

- Negotiated a $50 million revolving credit facility for a major client, securing favorable terms and reducing borrowing costs by 10%.

- Led a team that successfully resolved a complex loan dispute involving multiple parties, recovering $20 million for the bank.

- Revamped the credit policy framework, resulting in a 10% reduction in loan defaults and a 5% increase in loan approvals.

Awards

- Received the Loan Originator of the Year award for consistently exceeding sales targets and achieving high customer satisfaction.

- Recognized by the American Bankers Association for Outstanding Contribution to the Loan and Credit Management Field.

- Honored with the Credit Manager of the Year award for exceptional performance in managing and mitigating credit risk.

- Received the Excellence in Loan and Credit Management award from the Association of Loan and Credit Managers.

Certificates

- Certified Loan and Credit Manager (CLCM)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan and Credit Manager

- Highlight your quantitative skills and experience in using financial modeling and data analysis.

- Showcase your ability to manage risk and make sound credit decisions.

- Emphasize your leadership and communication skills.

- Quantify your accomplishments with specific metrics and results.

Essential Experience Highlights for a Strong Loan and Credit Manager Resume

- Developed and implemented a comprehensive credit risk assessment model, reducing loan defaults by 25%.

- Negotiated and closed a $50 million syndicated loan facility, securing favorable terms for the organization.

- Managed a portfolio of $100 million in commercial loans, achieving a delinquency rate of less than 1%.

- Established and maintained strategic relationships with key financial institutions, fostering access to capital.

- Implemented a loan origination system, streamlining the lending process and reducing processing time by 30%.

- Conducted due diligence on potential borrowers, ensuring sound credit decisions.

- Developed and executed credit policies and procedures, ensuring compliance with regulatory requirements.

Frequently Asked Questions (FAQ’s) For Loan and Credit Manager

What is the role of a Loan and Credit Manager?

A Loan and Credit Manager is responsible for managing the lending operations of a financial institution. They assess the creditworthiness of potential borrowers, approve or deny loan applications, and manage the loan portfolio.

What are the key skills required for a Loan and Credit Manager?

Key skills for a Loan and Credit Manager include strong analytical skills, financial modeling expertise, risk management experience, and excellent communication and interpersonal skills.

What is the career path for a Loan and Credit Manager?

Loan and Credit Managers can advance to senior roles such as Vice President or Senior Vice President of Lending. They may also move into related fields such as investment banking or portfolio management.

What are the challenges faced by Loan and Credit Managers?

Loan and Credit Managers face challenges such as managing risk, making sound credit decisions, and staying up-to-date with regulatory changes.

What is the job outlook for Loan and Credit Managers?

The job outlook for Loan and Credit Managers is expected to be positive in the coming years due to the increasing demand for financial services.

What is the salary range for Loan and Credit Managers?

The salary range for Loan and Credit Managers varies depending on experience, location, and employer. According to Salary.com, the average salary for Loan and Credit Managers in the United States is $112,000.