Are you a seasoned Loan Auditor seeking a new career path? Discover our professionally built Loan Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

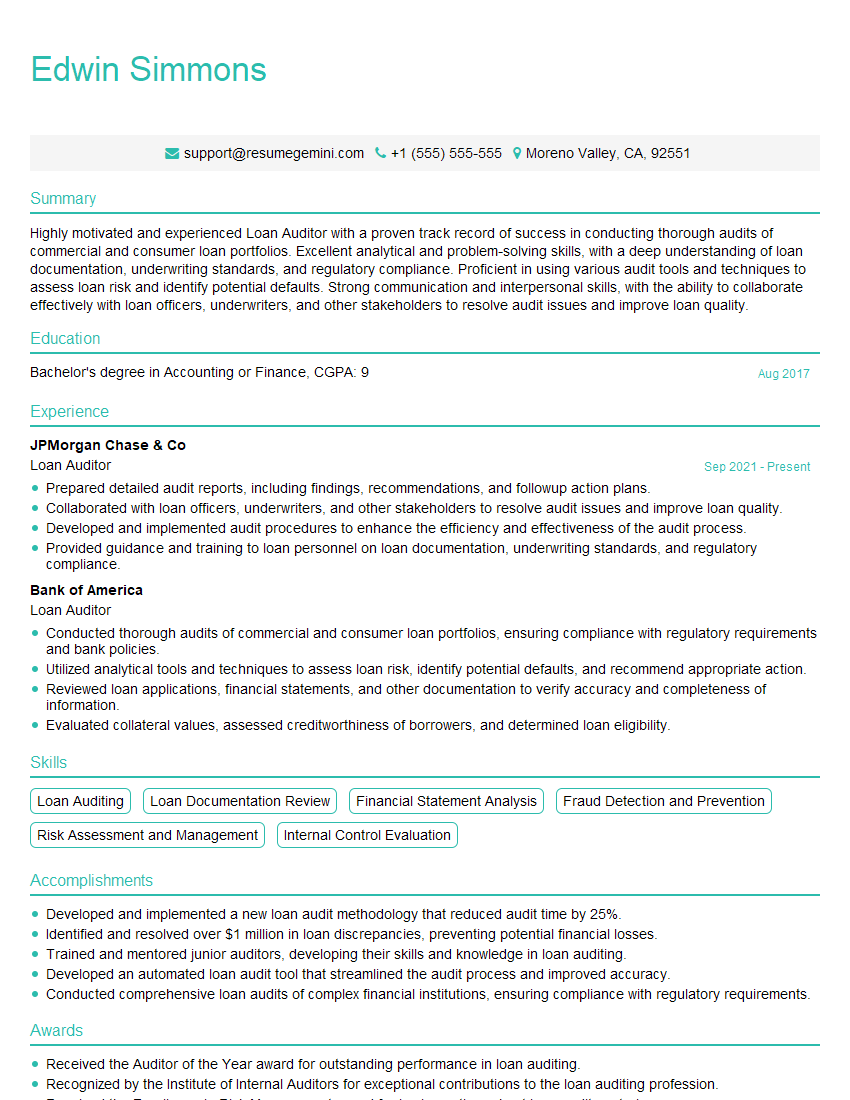

Edwin Simmons

Loan Auditor

Summary

Highly motivated and experienced Loan Auditor with a proven track record of success in conducting thorough audits of commercial and consumer loan portfolios. Excellent analytical and problem-solving skills, with a deep understanding of loan documentation, underwriting standards, and regulatory compliance. Proficient in using various audit tools and techniques to assess loan risk and identify potential defaults. Strong communication and interpersonal skills, with the ability to collaborate effectively with loan officers, underwriters, and other stakeholders to resolve audit issues and improve loan quality.

Education

Bachelor’s degree in Accounting or Finance

August 2017

Skills

- Loan Auditing

- Loan Documentation Review

- Financial Statement Analysis

- Fraud Detection and Prevention

- Risk Assessment and Management

- Internal Control Evaluation

Work Experience

Loan Auditor

- Prepared detailed audit reports, including findings, recommendations, and followup action plans.

- Collaborated with loan officers, underwriters, and other stakeholders to resolve audit issues and improve loan quality.

- Developed and implemented audit procedures to enhance the efficiency and effectiveness of the audit process.

- Provided guidance and training to loan personnel on loan documentation, underwriting standards, and regulatory compliance.

Loan Auditor

- Conducted thorough audits of commercial and consumer loan portfolios, ensuring compliance with regulatory requirements and bank policies.

- Utilized analytical tools and techniques to assess loan risk, identify potential defaults, and recommend appropriate action.

- Reviewed loan applications, financial statements, and other documentation to verify accuracy and completeness of information.

- Evaluated collateral values, assessed creditworthiness of borrowers, and determined loan eligibility.

Accomplishments

- Developed and implemented a new loan audit methodology that reduced audit time by 25%.

- Identified and resolved over $1 million in loan discrepancies, preventing potential financial losses.

- Trained and mentored junior auditors, developing their skills and knowledge in loan auditing.

- Developed an automated loan audit tool that streamlined the audit process and improved accuracy.

- Conducted comprehensive loan audits of complex financial institutions, ensuring compliance with regulatory requirements.

Awards

- Received the Auditor of the Year award for outstanding performance in loan auditing.

- Recognized by the Institute of Internal Auditors for exceptional contributions to the loan auditing profession.

- Received the Excellence in Risk Management award for implementing robust loan audit controls.

- Recognized by the American Institute of Certified Public Accountants for contributions to the advancement of loan auditing standards.

Certificates

- Certified Loan Auditor (CLA)

- Certified Internal Auditor (CIA)

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Auditor

- Quantify your accomplishments whenever possible. For example, instead of saying “Audited loan portfolios”, say “Audited a portfolio of over 1,000 loans, resulting in the identification of $1 million in potential losses.”

- Use keywords from the job description in your resume. This will help your resume get noticed by potential employers.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

- Highlight your experience in a clear and concise way.

Essential Experience Highlights for a Strong Loan Auditor Resume

- Conducted thorough audits of commercial and consumer loan portfolios, ensuring compliance with regulatory requirements and bank policies.

- Utilized analytical tools and techniques to assess loan risk, identify potential defaults, and recommend appropriate action.

- Reviewed loan applications, financial statements, and other documentation to verify accuracy and completeness of information.

- Evaluated collateral values, assessed creditworthiness of borrowers, and determined loan eligibility.

- Prepared detailed audit reports, including findings, recommendations, and followup action plans.

- Collaborated with loan officers, underwriters, and other stakeholders to resolve audit issues and improve loan quality.

- Developed and implemented audit procedures to enhance the efficiency and effectiveness of the audit process.

Frequently Asked Questions (FAQ’s) For Loan Auditor

What is the job outlook for loan auditors?

The job outlook for loan auditors is expected to grow faster than average in the coming years. This is due to the increasing complexity of financial regulations and the need for businesses to ensure that their loans are compliant.

What are the key skills needed to be a successful loan auditor?

The key skills needed to be a successful loan auditor include analytical skills, attention to detail, and strong communication skills. Loan auditors must also be able to work independently and as part of a team.

What are the different types of loan audits?

There are many different types of loan audits, including financial statement audits, compliance audits, and operational audits. Loan auditors may also specialize in a particular type of loan, such as commercial loans or consumer loans.

What is the average salary for a loan auditor?

The average salary for a loan auditor varies depending on experience, location, and employer. However, according to the Bureau of Labor Statistics, the median annual salary for loan auditors was $69,820 in May 2021.

What are the career advancement opportunities for loan auditors?

Loan auditors can advance their careers by taking on more responsibility, such as managing a team of auditors or becoming a lead auditor. They may also move into other roles within the financial services industry, such as risk management or compliance.

What are the challenges of being a loan auditor?

The challenges of being a loan auditor include the need to stay up-to-date on complex financial regulations and the need to work under tight deadlines. Loan auditors may also face pressure from management to meet certain goals, such as identifying a certain amount of potential losses.