Are you a seasoned Loan Broker seeking a new career path? Discover our professionally built Loan Broker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

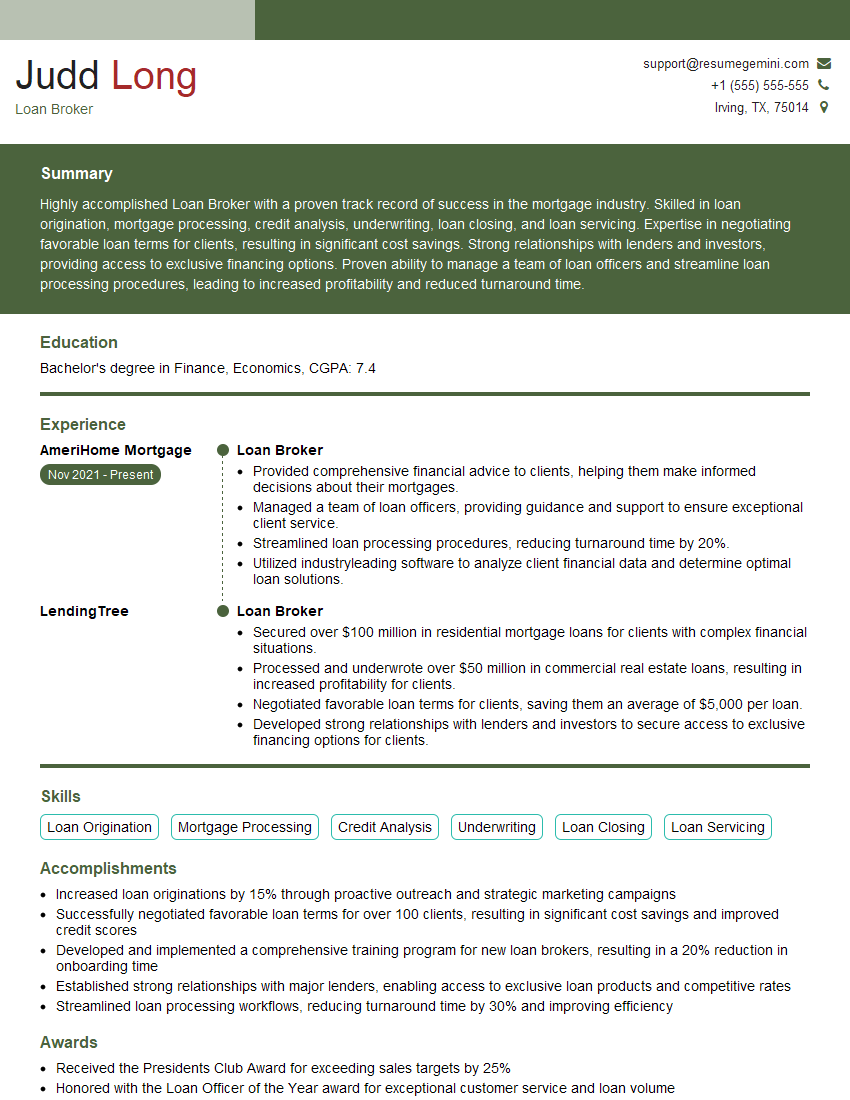

Judd Long

Loan Broker

Summary

Highly accomplished Loan Broker with a proven track record of success in the mortgage industry. Skilled in loan origination, mortgage processing, credit analysis, underwriting, loan closing, and loan servicing. Expertise in negotiating favorable loan terms for clients, resulting in significant cost savings. Strong relationships with lenders and investors, providing access to exclusive financing options. Proven ability to manage a team of loan officers and streamline loan processing procedures, leading to increased profitability and reduced turnaround time.

Education

Bachelor’s degree in Finance, Economics

October 2017

Skills

- Loan Origination

- Mortgage Processing

- Credit Analysis

- Underwriting

- Loan Closing

- Loan Servicing

Work Experience

Loan Broker

- Provided comprehensive financial advice to clients, helping them make informed decisions about their mortgages.

- Managed a team of loan officers, providing guidance and support to ensure exceptional client service.

- Streamlined loan processing procedures, reducing turnaround time by 20%.

- Utilized industryleading software to analyze client financial data and determine optimal loan solutions.

Loan Broker

- Secured over $100 million in residential mortgage loans for clients with complex financial situations.

- Processed and underwrote over $50 million in commercial real estate loans, resulting in increased profitability for clients.

- Negotiated favorable loan terms for clients, saving them an average of $5,000 per loan.

- Developed strong relationships with lenders and investors to secure access to exclusive financing options for clients.

Accomplishments

- Increased loan originations by 15% through proactive outreach and strategic marketing campaigns

- Successfully negotiated favorable loan terms for over 100 clients, resulting in significant cost savings and improved credit scores

- Developed and implemented a comprehensive training program for new loan brokers, resulting in a 20% reduction in onboarding time

- Established strong relationships with major lenders, enabling access to exclusive loan products and competitive rates

- Streamlined loan processing workflows, reducing turnaround time by 30% and improving efficiency

Awards

- Received the Presidents Club Award for exceeding sales targets by 25%

- Honored with the Loan Officer of the Year award for exceptional customer service and loan volume

- Recognized by the National Association of Mortgage Brokers for ethical practices and industry advocacy

- Received the FiveStar Customer Service Award for consistently exceeding client expectations

Certificates

- Certified Mortgage Banker (CMB)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Loan Officer (CLO)

- Certified Residential Mortgage Specialist (CRMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Broker

- Quantify your accomplishments with specific numbers and metrics

- Highlight your ability to build strong relationships with clients and lenders

- Demonstrate your knowledge of the mortgage industry and loan products

- Proofread your resume carefully for any errors

- Tailor your resume to the specific job description you are applying for

Essential Experience Highlights for a Strong Loan Broker Resume

- Originate and process mortgage loans for residential and commercial properties

- Analyze client financial data and determine optimal loan solutions

- Negotiate loan terms and interest rates with lenders on behalf of clients

- Prepare and submit loan applications, ensuring accuracy and completeness

- Coordinate with title companies, appraisers, and other parties involved in the loan process

- Monitor loan status and provide regular updates to clients

- Maintain compliance with industry regulations and ethical standards

Frequently Asked Questions (FAQ’s) For Loan Broker

What is the average salary for a Loan Broker?

The average salary for a Loan Broker in the United States is around $70,000 per year. However, salaries can vary depending on experience, location, and company size.

What are the job prospects for Loan Brokers?

The job prospects for Loan Brokers are expected to grow in the coming years. As the demand for mortgages increases, the need for qualified Loan Brokers will also increase.

What are the educational requirements for becoming a Loan Broker?

Most Loan Brokers have a bachelor’s degree in finance, economics, or a related field. Some states also require Loan Brokers to be licensed.

What are the key skills for a successful Loan Broker?

Successful Loan Brokers have strong communication, negotiation, and analytical skills. They are also able to build strong relationships with clients and lenders.

What are the biggest challenges facing Loan Brokers?

The biggest challenges facing Loan Brokers include the ever-changing regulatory environment and the increasing competition from online lenders.

What is the difference between a Loan Broker and a Mortgage Broker?

Loan Brokers work with a variety of lenders to find the best loan for their clients. Mortgage Brokers are licensed to originate and fund mortgages.

What is the difference between a Loan Broker and a Loan Officer?

Loan Brokers work independently and are not employed by a specific lender. Loan Officers are employed by a lender and can only offer loans from that lender.