Are you a seasoned Loan Clerk seeking a new career path? Discover our professionally built Loan Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

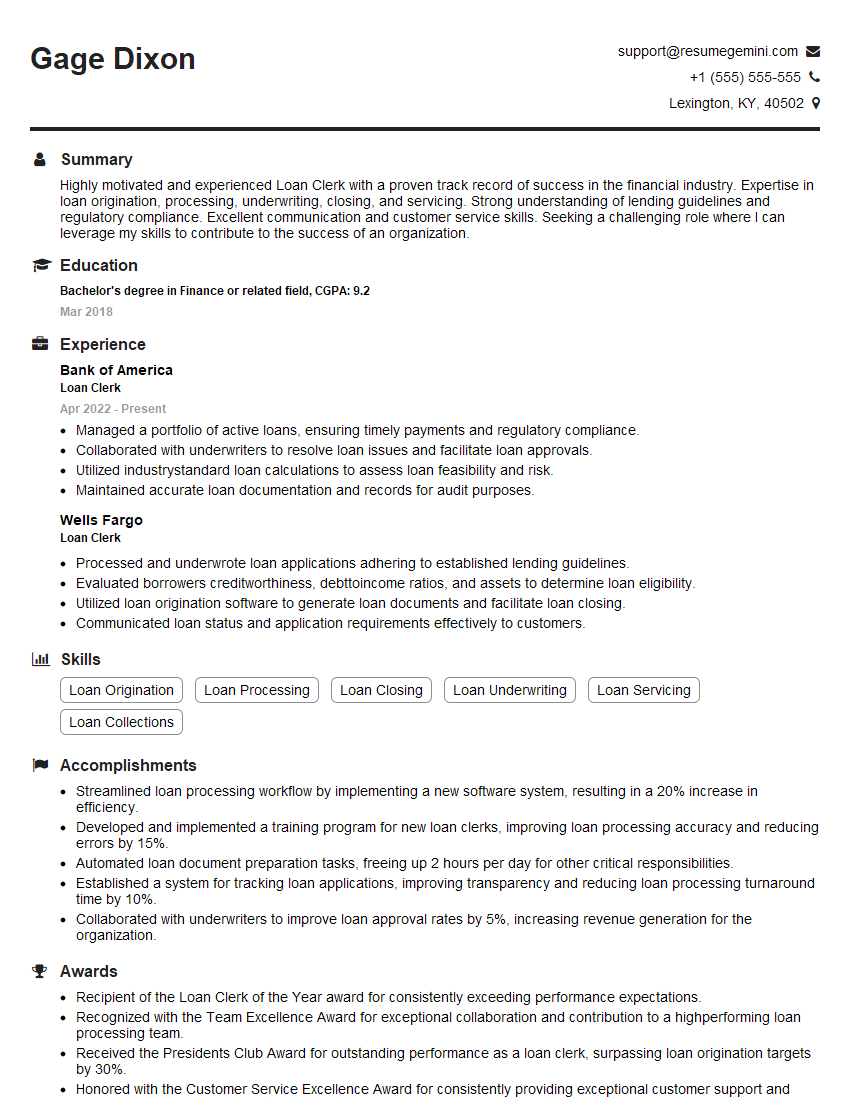

Gage Dixon

Loan Clerk

Summary

Highly motivated and experienced Loan Clerk with a proven track record of success in the financial industry. Expertise in loan origination, processing, underwriting, closing, and servicing. Strong understanding of lending guidelines and regulatory compliance. Excellent communication and customer service skills. Seeking a challenging role where I can leverage my skills to contribute to the success of an organization.

Education

Bachelor’s degree in Finance or related field

March 2018

Skills

- Loan Origination

- Loan Processing

- Loan Closing

- Loan Underwriting

- Loan Servicing

- Loan Collections

Work Experience

Loan Clerk

- Managed a portfolio of active loans, ensuring timely payments and regulatory compliance.

- Collaborated with underwriters to resolve loan issues and facilitate loan approvals.

- Utilized industrystandard loan calculations to assess loan feasibility and risk.

- Maintained accurate loan documentation and records for audit purposes.

Loan Clerk

- Processed and underwrote loan applications adhering to established lending guidelines.

- Evaluated borrowers creditworthiness, debttoincome ratios, and assets to determine loan eligibility.

- Utilized loan origination software to generate loan documents and facilitate loan closing.

- Communicated loan status and application requirements effectively to customers.

Accomplishments

- Streamlined loan processing workflow by implementing a new software system, resulting in a 20% increase in efficiency.

- Developed and implemented a training program for new loan clerks, improving loan processing accuracy and reducing errors by 15%.

- Automated loan document preparation tasks, freeing up 2 hours per day for other critical responsibilities.

- Established a system for tracking loan applications, improving transparency and reducing loan processing turnaround time by 10%.

- Collaborated with underwriters to improve loan approval rates by 5%, increasing revenue generation for the organization.

Awards

- Recipient of the Loan Clerk of the Year award for consistently exceeding performance expectations.

- Recognized with the Team Excellence Award for exceptional collaboration and contribution to a highperforming loan processing team.

- Received the Presidents Club Award for outstanding performance as a loan clerk, surpassing loan origination targets by 30%.

- Honored with the Customer Service Excellence Award for consistently providing exceptional customer support and resolving loan inquiries promptly.

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Mortgage Loan Processor (CMLP)

- Certified Mortgage Loan Underwriter (CMLU)

- Certified Mortgage Loan Servicer (CMLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Clerk

- Highlight your experience in loan processing, underwriting, and closing.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Proofread your resume carefully for any errors.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Network with professionals in the financial industry to learn about job openings and get your foot in the door.

Essential Experience Highlights for a Strong Loan Clerk Resume

- Processed and underwrote loan applications according to established lending guidelines.

- Evaluated borrowers’ creditworthiness, debt-to-income ratios, and assets to determine loan eligibility.

- Utilized loan origination software to generate loan documents and facilitate loan closing.

- Communicated loan status and application requirements effectively to customers.

- Managed a portfolio of active loans, ensuring timely payments and regulatory compliance.

- Collaborated with underwriters to resolve loan issues and facilitate loan approvals.

- Utilized industry-standard loan calculations to assess loan feasibility and risk.

- Maintained accurate loan documentation and records for audit purposes.

Frequently Asked Questions (FAQ’s) For Loan Clerk

What are the educational requirements for a Loan Clerk?

Most Loan Clerks have at least a high school diploma or equivalent. Some employers may prefer candidates with a bachelor’s degree in finance or a related field.

What are the key skills required for a Loan Clerk?

Key skills for a Loan Clerk include: loan processing, underwriting, closing, customer service, and attention to detail.

What are the career prospects for a Loan Clerk?

Loan Clerks can advance their careers by becoming Loan Officers or Loan Underwriters. With additional experience and education, they can also move into management positions.

What is the average salary for a Loan Clerk?

The average salary for a Loan Clerk in the United States is around $45,000 per year.

What is the job outlook for Loan Clerks?

The job outlook for Loan Clerks is expected to be good over the next few years, as the demand for loans continues to grow.

What are the benefits of working as a Loan Clerk?

Benefits of working as a Loan Clerk include: job security, opportunities for advancement, and the chance to help people achieve their financial goals.

What are the challenges of working as a Loan Clerk?

Challenges of working as a Loan Clerk include: dealing with difficult customers, working under pressure, and meeting deadlines.

What advice would you give to someone who is interested in becoming a Loan Clerk?

If you are interested in becoming a Loan Clerk, I would recommend that you start by getting a good education in finance or a related field. You should also develop strong customer service skills and attention to detail.