Are you a seasoned Loan Coordinator seeking a new career path? Discover our professionally built Loan Coordinator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

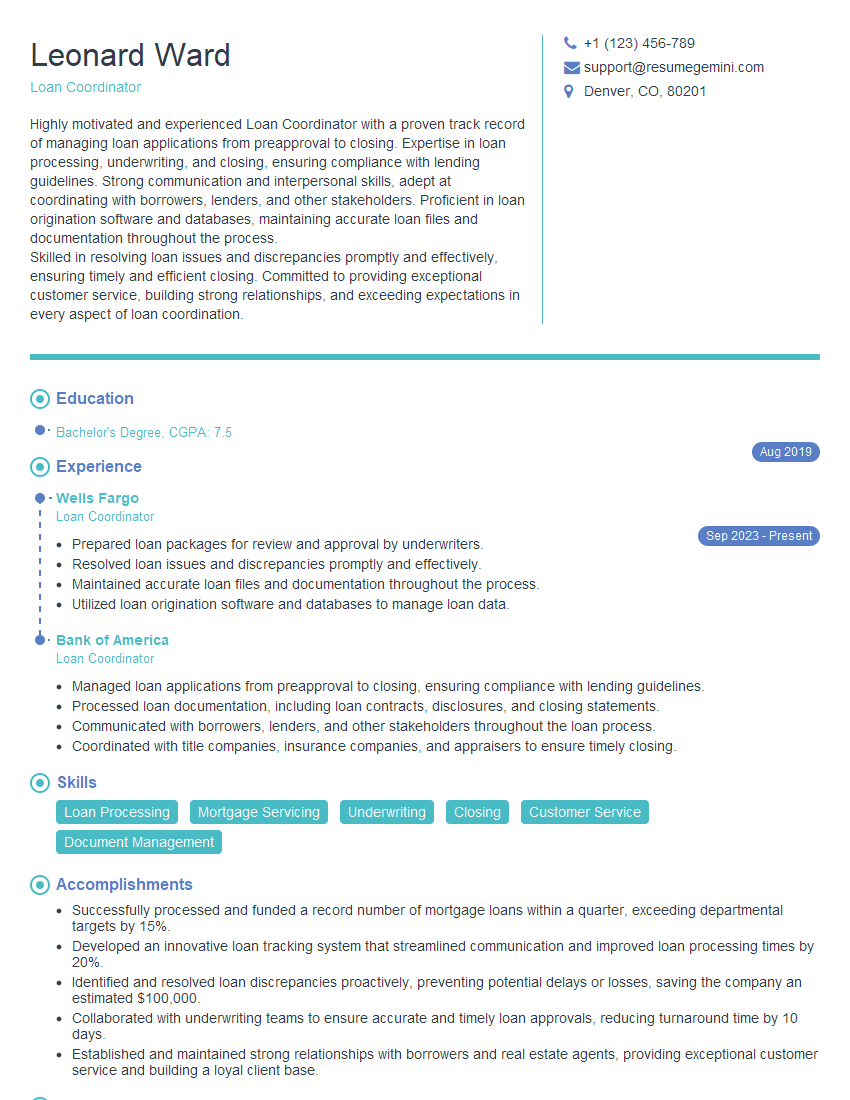

Leonard Ward

Loan Coordinator

Summary

Highly motivated and experienced Loan Coordinator with a proven track record of managing loan applications from preapproval to closing. Expertise in loan processing, underwriting, and closing, ensuring compliance with lending guidelines. Strong communication and interpersonal skills, adept at coordinating with borrowers, lenders, and other stakeholders. Proficient in loan origination software and databases, maintaining accurate loan files and documentation throughout the process.

Skilled in resolving loan issues and discrepancies promptly and effectively, ensuring timely and efficient closing. Committed to providing exceptional customer service, building strong relationships, and exceeding expectations in every aspect of loan coordination.

Education

Bachelor’s Degree

August 2019

Skills

- Loan Processing

- Mortgage Servicing

- Underwriting

- Closing

- Customer Service

- Document Management

Work Experience

Loan Coordinator

- Prepared loan packages for review and approval by underwriters.

- Resolved loan issues and discrepancies promptly and effectively.

- Maintained accurate loan files and documentation throughout the process.

- Utilized loan origination software and databases to manage loan data.

Loan Coordinator

- Managed loan applications from preapproval to closing, ensuring compliance with lending guidelines.

- Processed loan documentation, including loan contracts, disclosures, and closing statements.

- Communicated with borrowers, lenders, and other stakeholders throughout the loan process.

- Coordinated with title companies, insurance companies, and appraisers to ensure timely closing.

Accomplishments

- Successfully processed and funded a record number of mortgage loans within a quarter, exceeding departmental targets by 15%.

- Developed an innovative loan tracking system that streamlined communication and improved loan processing times by 20%.

- Identified and resolved loan discrepancies proactively, preventing potential delays or losses, saving the company an estimated $100,000.

- Collaborated with underwriting teams to ensure accurate and timely loan approvals, reducing turnaround time by 10 days.

- Established and maintained strong relationships with borrowers and real estate agents, providing exceptional customer service and building a loyal client base.

Awards

- Recipient of the Loan Coordinator of the Year award for consistently exceeding performance targets and maintaining exceptional customer satisfaction.

- Recognized for outstanding contributions to the implementation of a new loan origination system, resulting in increased efficiency and accuracy.

- Received a Certificate of Excellence for exceptional attention to detail and accuracy in loan processing, ensuring the seamless execution of transactions.

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Residential Mortgage Loan Officer (CRMLO)

- Certified Default Loan Servicer (CDLS)

- Certified Anti-Money Laundering Specialist (CAMLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Coordinator

Highlight your relevant skills and experience:

Tailor your resume to each job application, emphasizing the skills and experience that are most relevant to the specific loan coordinator position you are applying for.

Quantify your accomplishments:

Use numbers and metrics to demonstrate the impact of your work as a loan coordinator. For example, you could mention the number of loans you processed, the amount of money you saved borrowers, or the percentage of loans that closed on time.

Proofread your resume carefully:

Make sure your resume is free of errors in grammar, spelling, and punctuation. A well-written resume will make a positive impression on potential employers.

Get feedback from others:

Ask a friend, family member, or career counselor to review your resume and provide feedback. This can help you identify any areas that need improvement.

Essential Experience Highlights for a Strong Loan Coordinator Resume

- Managed loan applications from preapproval to closing, ensuring compliance with lending guidelines.

- Processed loan documentation, including loan contracts, disclosures, and closing statements.

- Communicated with borrowers, lenders, and other stakeholders throughout the loan process.

- Coordinated with title companies, insurance companies, and appraisers to ensure timely closing.

- Prepared loan packages for review and approval by underwriters.

- Resolved loan issues and discrepancies promptly and effectively.

- Maintained accurate loan files and documentation throughout the process.

- Utilized loan origination software and databases to manage loan data.

Frequently Asked Questions (FAQ’s) For Loan Coordinator

What are the primary responsibilities of a Loan Coordinator?

The primary responsibilities of a Loan Coordinator include managing loan applications from preapproval to closing, processing loan documentation, communicating with borrowers and lenders, coordinating with title companies and appraisers, preparing loan packages for review by underwriters, and resolving loan issues and discrepancies.

What are the essential skills and qualifications required for a Loan Coordinator?

Essential skills and qualifications for a Loan Coordinator include a strong understanding of loan processing, underwriting, and closing procedures, excellent communication and interpersonal skills, proficiency in loan origination software and databases, and a commitment to providing exceptional customer service.

What career advancement opportunities are available for Loan Coordinators?

Loan Coordinators can advance their careers by moving into roles such as Loan Officer, Loan Processor, or Underwriter. With additional experience and training, they may also be able to move into management positions.

What is the job outlook for Loan Coordinators?

The job outlook for Loan Coordinators is expected to be good over the next few years. As the economy continues to grow, there will be a need for more professionals to process and manage loans.

What is the average salary for a Loan Coordinator?

The average salary for a Loan Coordinator varies depending on experience, location, and company size. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers and Loan Counselors was $64,420 in May 2021.

What are the benefits of working as a Loan Coordinator?

Benefits of working as a Loan Coordinator include a stable and rewarding career, the opportunity to help people achieve their financial goals, and the chance to learn about different aspects of the financial industry.

What are the challenges of working as a Loan Coordinator?

Challenges of working as a Loan Coordinator include dealing with complex loan applications, working under tight deadlines, and resolving loan issues that may arise.