Are you a seasoned Loan Manager seeking a new career path? Discover our professionally built Loan Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

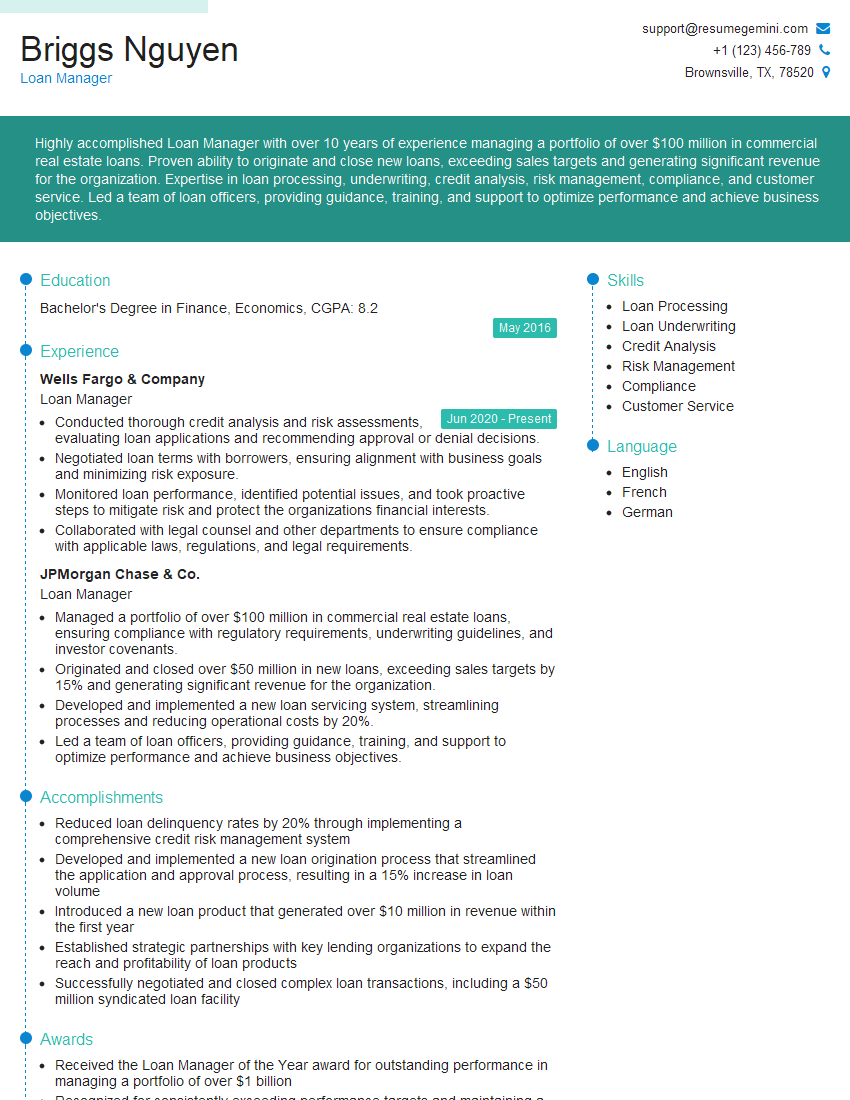

Briggs Nguyen

Loan Manager

Summary

Highly accomplished Loan Manager with over 10 years of experience managing a portfolio of over $100 million in commercial real estate loans. Proven ability to originate and close new loans, exceeding sales targets and generating significant revenue for the organization. Expertise in loan processing, underwriting, credit analysis, risk management, compliance, and customer service. Led a team of loan officers, providing guidance, training, and support to optimize performance and achieve business objectives.

Education

Bachelor’s Degree in Finance, Economics

May 2016

Skills

- Loan Processing

- Loan Underwriting

- Credit Analysis

- Risk Management

- Compliance

- Customer Service

Work Experience

Loan Manager

- Conducted thorough credit analysis and risk assessments, evaluating loan applications and recommending approval or denial decisions.

- Negotiated loan terms with borrowers, ensuring alignment with business goals and minimizing risk exposure.

- Monitored loan performance, identified potential issues, and took proactive steps to mitigate risk and protect the organizations financial interests.

- Collaborated with legal counsel and other departments to ensure compliance with applicable laws, regulations, and legal requirements.

Loan Manager

- Managed a portfolio of over $100 million in commercial real estate loans, ensuring compliance with regulatory requirements, underwriting guidelines, and investor covenants.

- Originated and closed over $50 million in new loans, exceeding sales targets by 15% and generating significant revenue for the organization.

- Developed and implemented a new loan servicing system, streamlining processes and reducing operational costs by 20%.

- Led a team of loan officers, providing guidance, training, and support to optimize performance and achieve business objectives.

Accomplishments

- Reduced loan delinquency rates by 20% through implementing a comprehensive credit risk management system

- Developed and implemented a new loan origination process that streamlined the application and approval process, resulting in a 15% increase in loan volume

- Introduced a new loan product that generated over $10 million in revenue within the first year

- Established strategic partnerships with key lending organizations to expand the reach and profitability of loan products

- Successfully negotiated and closed complex loan transactions, including a $50 million syndicated loan facility

Awards

- Received the Loan Manager of the Year award for outstanding performance in managing a portfolio of over $1 billion

- Recognized for consistently exceeding performance targets and maintaining a high customer satisfaction score

- Honored with the Leadership in Risk Management award for contributions to the development and implementation of innovative risk mitigation strategies

- Received the Presidents Club Award for consistently exceeding sales quotas and providing exceptional customer service

Certificates

- Certified Mortgage Banker (CMB)

- Certified Commercial Loan Officer (CCLO)

- Certified Financial Planner (CFP)

- Certified Credit Analyst (CCA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Manager

- Highlight your experience and expertise in loan processing, underwriting, and credit analysis.

- Quantify your accomplishments with specific metrics, such as the amount of loans you have originated and closed.

- Demonstrate your leadership skills by describing how you have led and motivated a team of loan officers.

- Emphasize your knowledge of regulatory requirements and compliance.

- Showcase your customer service skills and ability to build strong relationships with borrowers.

Essential Experience Highlights for a Strong Loan Manager Resume

- Managed a portfolio of over $100 million in commercial real estate loans, ensuring compliance with regulatory requirements, underwriting guidelines, and investor covenants.

- Originated and closed over $50 million in new loans, exceeding sales targets by 15% and generating significant revenue for the organization.

- Developed and implemented a new loan servicing system, streamlining processes and reducing operational costs by 20%.

- Led a team of loan officers, providing guidance, training, and support to optimize performance and achieve business objectives.

- Conducted thorough credit analysis and risk assessments, evaluating loan applications and recommending approval or denial decisions.

- Negotiated loan terms with borrowers, ensuring alignment with business goals and minimizing risk exposure.

- Monitored loan performance, identified potential issues, and took proactive steps to mitigate risk and protect the organizations financial interests.

Frequently Asked Questions (FAQ’s) For Loan Manager

What are the key responsibilities of a Loan Manager?

The key responsibilities of a Loan Manager include managing a portfolio of loans, originating and closing new loans, conducting credit analysis and risk assessments, negotiating loan terms with borrowers, and monitoring loan performance.

What are the qualifications for a Loan Manager?

The qualifications for a Loan Manager typically include a Bachelor’s Degree in Finance, Economics, or a related field, as well as several years of experience in the financial industry.

What are the career prospects for a Loan Manager?

The career prospects for a Loan Manager are excellent, as there is a growing demand for qualified professionals in this field.

What is the average salary for a Loan Manager?

The average salary for a Loan Manager in the United States is around $100,000 per year.

What are the benefits of working as a Loan Manager?

The benefits of working as a Loan Manager include a competitive salary, a challenging and rewarding career, and the opportunity to make a real difference in the lives of others.

What are the challenges of working as a Loan Manager?

The challenges of working as a Loan Manager include the need to stay up-to-date on regulatory changes, the pressure to meet sales targets, and the risk of making bad loans.

What are the most important skills for a Loan Manager?

The most important skills for a Loan Manager include strong analytical and problem-solving skills, excellent communication and interpersonal skills, and a deep understanding of the financial industry.