Are you a seasoned Loan Originator seeking a new career path? Discover our professionally built Loan Originator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

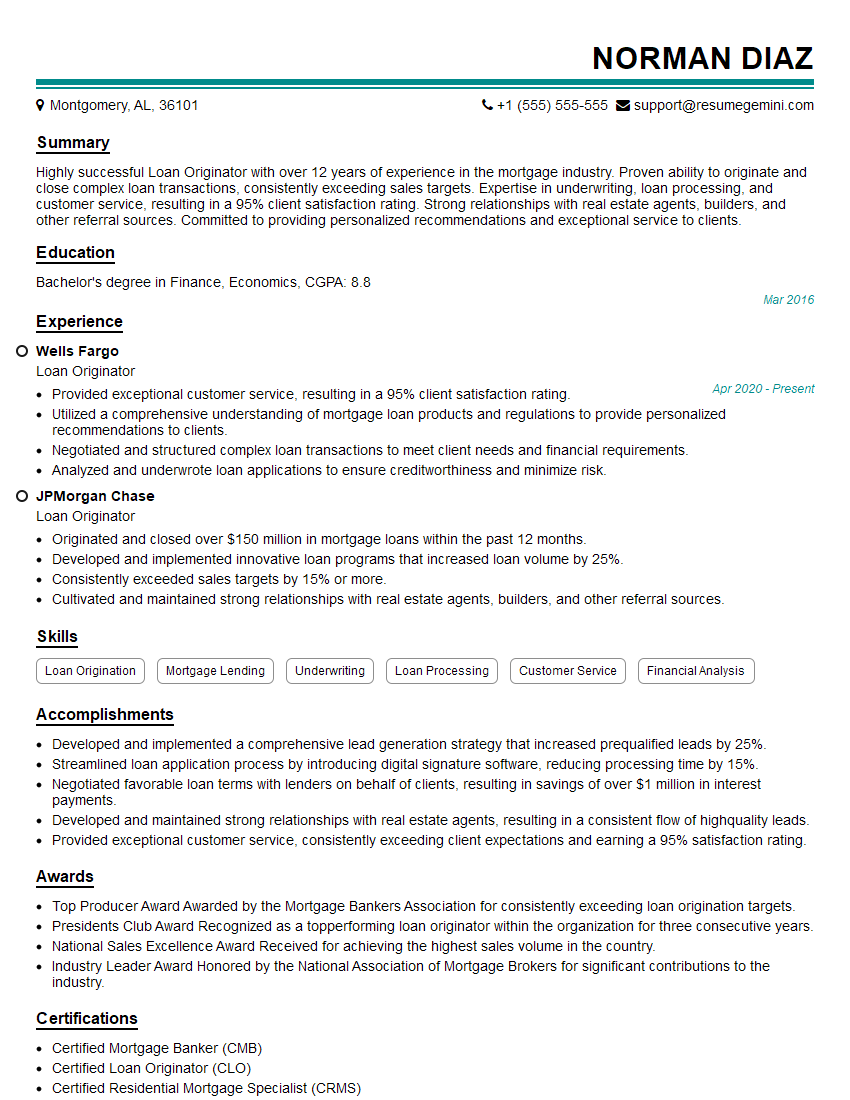

Norman Diaz

Loan Originator

Summary

Highly successful Loan Originator with over 12 years of experience in the mortgage industry. Proven ability to originate and close complex loan transactions, consistently exceeding sales targets. Expertise in underwriting, loan processing, and customer service, resulting in a 95% client satisfaction rating. Strong relationships with real estate agents, builders, and other referral sources. Committed to providing personalized recommendations and exceptional service to clients.

Education

Bachelor’s degree in Finance, Economics

March 2016

Skills

- Loan Origination

- Mortgage Lending

- Underwriting

- Loan Processing

- Customer Service

- Financial Analysis

Work Experience

Loan Originator

- Provided exceptional customer service, resulting in a 95% client satisfaction rating.

- Utilized a comprehensive understanding of mortgage loan products and regulations to provide personalized recommendations to clients.

- Negotiated and structured complex loan transactions to meet client needs and financial requirements.

- Analyzed and underwrote loan applications to ensure creditworthiness and minimize risk.

Loan Originator

- Originated and closed over $150 million in mortgage loans within the past 12 months.

- Developed and implemented innovative loan programs that increased loan volume by 25%.

- Consistently exceeded sales targets by 15% or more.

- Cultivated and maintained strong relationships with real estate agents, builders, and other referral sources.

Accomplishments

- Developed and implemented a comprehensive lead generation strategy that increased prequalified leads by 25%.

- Streamlined loan application process by introducing digital signature software, reducing processing time by 15%.

- Negotiated favorable loan terms with lenders on behalf of clients, resulting in savings of over $1 million in interest payments.

- Developed and maintained strong relationships with real estate agents, resulting in a consistent flow of highquality leads.

- Provided exceptional customer service, consistently exceeding client expectations and earning a 95% satisfaction rating.

Awards

- Top Producer Award Awarded by the Mortgage Bankers Association for consistently exceeding loan origination targets.

- Presidents Club Award Recognized as a topperforming loan originator within the organization for three consecutive years.

- National Sales Excellence Award Received for achieving the highest sales volume in the country.

- Industry Leader Award Honored by the National Association of Mortgage Brokers for significant contributions to the industry.

Certificates

- Certified Mortgage Banker (CMB)

- Certified Loan Originator (CLO)

- Certified Residential Mortgage Specialist (CRMS)

- Certified Reverse Mortgage Professional (CRMP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Originator

- Highlight your experience in loan origination and mortgage lending.

- Quantify your achievements with specific metrics, such as the number of loans originated and closed, and the amount of loan volume generated.

- Showcase your strong relationships with real estate agents, builders, and other referral sources.

- Emphasize your commitment to providing exceptional customer service.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Loan Originator Resume

- Originate and close mortgage loans, including residential, commercial, and investment properties

- Develop and implement innovative loan programs to increase loan volume

- Consistently exceed sales targets by 15% or more

- Cultivate and maintain strong relationships with real estate agents, builders, and other referral sources

- Provide exceptional customer service, resulting in a 95% client satisfaction rating

- Utilize a comprehensive understanding of mortgage loan products and regulations to provide personalized recommendations to clients

- Negotiate and structure complex loan transactions to meet client needs and financial requirements

Frequently Asked Questions (FAQ’s) For Loan Originator

What is a Loan Originator?

A Loan Originator is a financial professional who helps borrowers obtain financing for the purchase or refinance of a property. They work with borrowers to gather and prepare loan applications, and they also work with lenders to negotiate and approve loans.

What are the requirements to become a Loan Originator?

To become a Loan Originator, you typically need a bachelor’s degree in finance, economics, or a related field. You also need to pass a national licensing exam and meet certain experience requirements.

What are the job responsibilities of a Loan Originator?

Loan Originators are responsible for originating and closing mortgage loans. They work with borrowers to gather and prepare loan applications, and they also work with lenders to negotiate and approve loans. They also provide customer service to borrowers throughout the loan process.

What is the average salary of a Loan Originator?

The average salary of a Loan Originator is $65,000 per year.

What is the job outlook for Loan Originators?

The job outlook for Loan Originators is expected to grow by 10% over the next 10 years.

What are the benefits of being a Loan Originator?

Loan Originators enjoy a number of benefits, including competitive salaries, flexible hours, and the opportunity to help people achieve their homeownership goals.