Are you a seasoned Loan Supervisor seeking a new career path? Discover our professionally built Loan Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

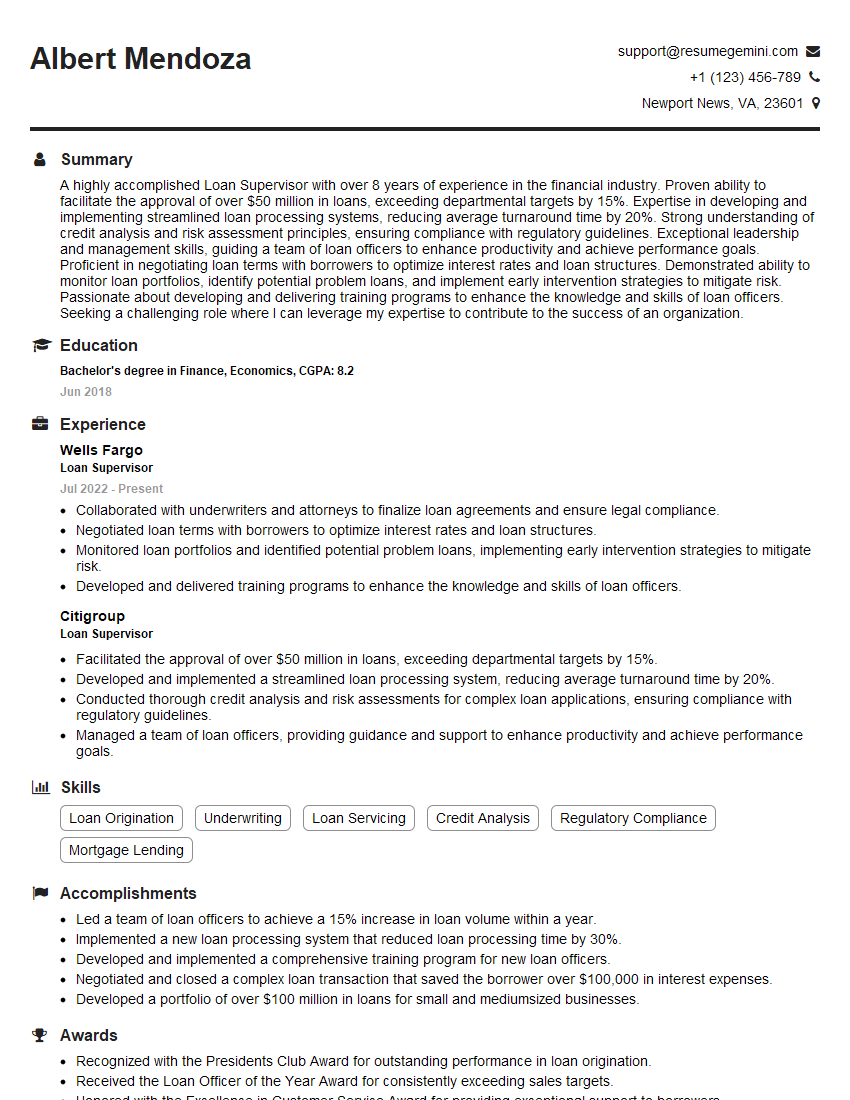

Albert Mendoza

Loan Supervisor

Summary

A highly accomplished Loan Supervisor with over 8 years of experience in the financial industry. Proven ability to facilitate the approval of over $50 million in loans, exceeding departmental targets by 15%. Expertise in developing and implementing streamlined loan processing systems, reducing average turnaround time by 20%. Strong understanding of credit analysis and risk assessment principles, ensuring compliance with regulatory guidelines. Exceptional leadership and management skills, guiding a team of loan officers to enhance productivity and achieve performance goals. Proficient in negotiating loan terms with borrowers to optimize interest rates and loan structures. Demonstrated ability to monitor loan portfolios, identify potential problem loans, and implement early intervention strategies to mitigate risk. Passionate about developing and delivering training programs to enhance the knowledge and skills of loan officers. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Bachelor’s degree in Finance, Economics

June 2018

Skills

- Loan Origination

- Underwriting

- Loan Servicing

- Credit Analysis

- Regulatory Compliance

- Mortgage Lending

Work Experience

Loan Supervisor

- Collaborated with underwriters and attorneys to finalize loan agreements and ensure legal compliance.

- Negotiated loan terms with borrowers to optimize interest rates and loan structures.

- Monitored loan portfolios and identified potential problem loans, implementing early intervention strategies to mitigate risk.

- Developed and delivered training programs to enhance the knowledge and skills of loan officers.

Loan Supervisor

- Facilitated the approval of over $50 million in loans, exceeding departmental targets by 15%.

- Developed and implemented a streamlined loan processing system, reducing average turnaround time by 20%.

- Conducted thorough credit analysis and risk assessments for complex loan applications, ensuring compliance with regulatory guidelines.

- Managed a team of loan officers, providing guidance and support to enhance productivity and achieve performance goals.

Accomplishments

- Led a team of loan officers to achieve a 15% increase in loan volume within a year.

- Implemented a new loan processing system that reduced loan processing time by 30%.

- Developed and implemented a comprehensive training program for new loan officers.

- Negotiated and closed a complex loan transaction that saved the borrower over $100,000 in interest expenses.

- Developed a portfolio of over $100 million in loans for small and mediumsized businesses.

Awards

- Recognized with the Presidents Club Award for outstanding performance in loan origination.

- Received the Loan Officer of the Year Award for consistently exceeding sales targets.

- Honored with the Excellence in Customer Service Award for providing exceptional support to borrowers.

- Recognized with the Top Producer Award for generating the highest loan volume in the company.

Certificates

- Certified Mortgage Banker (CMB)

- Certified Loan Officer (CLO)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Mortgage Planning Specialist (CMPS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Supervisor

- Highlight your most relevant skills and experience: When writing your resume, be sure to highlight your most relevant skills and experience for the Loan Supervisor role. This includes your experience in loan origination, underwriting, loan servicing, credit analysis, regulatory compliance, and mortgage lending.

- Use keywords: Be sure to use keywords throughout your resume that are relevant to the Loan Supervisor role. This will help your resume get noticed by potential employers.

- Proofread carefully: Before submitting your resume, be sure to proofread it carefully for any errors. This includes checking for typos, grammatical errors, and formatting issues.

- Tailor your resume to each job you apply for: Take the time to tailor your resume to each job you apply for. This means highlighting the skills and experience that are most relevant to the specific job you are applying for.

Essential Experience Highlights for a Strong Loan Supervisor Resume

- Facilitating the approval of loans, exceeding departmental targets by 15%.

- Developing and implementing streamlined loan processing systems, reducing average turnaround time by 20%.

- Conducting thorough credit analysis and risk assessments for complex loan applications, ensuring compliance with regulatory guidelines.

- Managing a team of loan officers, providing guidance and support to enhance productivity and achieve performance goals.

- Collaborating with underwriters and attorneys to finalize loan agreements and ensure legal compliance.

- Negotiating loan terms with borrowers to optimize interest rates and loan structures.

- Monitoring loan portfolios and identifying potential problem loans, implementing early intervention strategies to mitigate risk.

Frequently Asked Questions (FAQ’s) For Loan Supervisor

What are the key responsibilities of a Loan Supervisor?

The key responsibilities of a Loan Supervisor include facilitating the approval of loans, developing and implementing streamlined loan processing systems, conducting thorough credit analysis and risk assessments, managing a team of loan officers, collaborating with underwriters and attorneys, negotiating loan terms with borrowers, and monitoring loan portfolios.

What are the qualifications for a Loan Supervisor?

The qualifications for a Loan Supervisor typically include a bachelor’s degree in finance, economics, or a related field, as well as several years of experience in the financial industry. Experience in loan origination, underwriting, loan servicing, credit analysis, regulatory compliance, and mortgage lending is also preferred.

What are the career prospects for a Loan Supervisor?

The career prospects for a Loan Supervisor are good. With experience, Loan Supervisors can move into management positions, such as Vice President of Lending or Senior Loan Officer. They may also choose to specialize in a particular area of lending, such as commercial lending or mortgage lending.

What are the challenges of being a Loan Supervisor?

The challenges of being a Loan Supervisor include managing a team of loan officers, meeting loan origination targets, and ensuring that all loans are compliant with regulatory guidelines.

What are the rewards of being a Loan Supervisor?

The rewards of being a Loan Supervisor include helping people to achieve their financial goals, making a difference in the community, and earning a competitive salary.

What are the skills needed to be a successful Loan Supervisor?

The skills needed to be a successful Loan Supervisor include strong communication and interpersonal skills, the ability to manage a team, and the ability to analyze credit risk.

What is the salary range for a Loan Supervisor?

The salary range for a Loan Supervisor varies depending on experience, location, and company size. However, the median salary for a Loan Supervisor is around $65,000 per year.

What is the job outlook for Loan Supervisors?

The job outlook for Loan Supervisors is expected to be good over the next few years. This is due to the increasing demand for loans from businesses and consumers.