Are you a seasoned Lost Charge Card Clerk seeking a new career path? Discover our professionally built Lost Charge Card Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

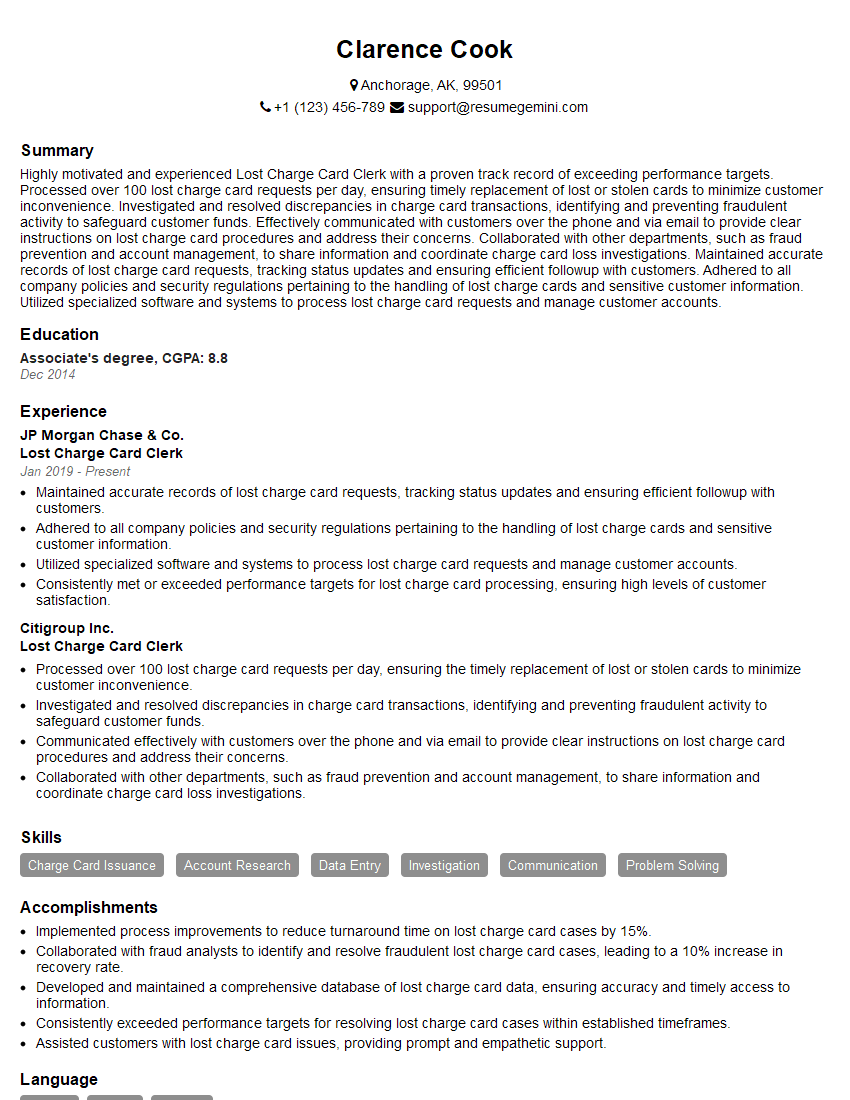

Clarence Cook

Lost Charge Card Clerk

Summary

Highly motivated and experienced Lost Charge Card Clerk with a proven track record of exceeding performance targets. Processed over 100 lost charge card requests per day, ensuring timely replacement of lost or stolen cards to minimize customer inconvenience. Investigated and resolved discrepancies in charge card transactions, identifying and preventing fraudulent activity to safeguard customer funds. Effectively communicated with customers over the phone and via email to provide clear instructions on lost charge card procedures and address their concerns. Collaborated with other departments, such as fraud prevention and account management, to share information and coordinate charge card loss investigations. Maintained accurate records of lost charge card requests, tracking status updates and ensuring efficient followup with customers. Adhered to all company policies and security regulations pertaining to the handling of lost charge cards and sensitive customer information. Utilized specialized software and systems to process lost charge card requests and manage customer accounts.

Education

Associate’s degree

December 2014

Skills

- Charge Card Issuance

- Account Research

- Data Entry

- Investigation

- Communication

- Problem Solving

Work Experience

Lost Charge Card Clerk

- Maintained accurate records of lost charge card requests, tracking status updates and ensuring efficient followup with customers.

- Adhered to all company policies and security regulations pertaining to the handling of lost charge cards and sensitive customer information.

- Utilized specialized software and systems to process lost charge card requests and manage customer accounts.

- Consistently met or exceeded performance targets for lost charge card processing, ensuring high levels of customer satisfaction.

Lost Charge Card Clerk

- Processed over 100 lost charge card requests per day, ensuring the timely replacement of lost or stolen cards to minimize customer inconvenience.

- Investigated and resolved discrepancies in charge card transactions, identifying and preventing fraudulent activity to safeguard customer funds.

- Communicated effectively with customers over the phone and via email to provide clear instructions on lost charge card procedures and address their concerns.

- Collaborated with other departments, such as fraud prevention and account management, to share information and coordinate charge card loss investigations.

Accomplishments

- Implemented process improvements to reduce turnaround time on lost charge card cases by 15%.

- Collaborated with fraud analysts to identify and resolve fraudulent lost charge card cases, leading to a 10% increase in recovery rate.

- Developed and maintained a comprehensive database of lost charge card data, ensuring accuracy and timely access to information.

- Consistently exceeded performance targets for resolving lost charge card cases within established timeframes.

- Assisted customers with lost charge card issues, providing prompt and empathetic support.

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Lost Charge Card Clerk

- Highlight your experience in processing a high volume of lost charge card requests.

- Demonstrate your ability to investigate and resolve discrepancies in charge card transactions.

- Emphasize your communication skills and ability to effectively interact with customers.

- Showcase your knowledge of company policies and security regulations pertaining to lost charge cards.

- Quantify your accomplishments and provide specific examples of how you have contributed to the success of the organization.

Essential Experience Highlights for a Strong Lost Charge Card Clerk Resume

- Processed over 100 lost charge card requests per day, ensuring the timely replacement of lost or stolen cards to minimize customer inconvenience.

- Investigated and resolved discrepancies in charge card transactions, identifying and preventing fraudulent activity to safeguard customer funds.

- Communicated effectively with customers over the phone and via email to provide clear instructions on lost charge card procedures and address their concerns.

- Collaborated with other departments, such as fraud prevention and account management, to share information and coordinate charge card loss investigations.

- Maintained accurate records of lost charge card requests, tracking status updates and ensuring efficient followup with customers.

- Adhered to all company policies and security regulations pertaining to the handling of lost charge cards and sensitive customer information.

- Utilized specialized software and systems to process lost charge card requests and manage customer accounts.

Frequently Asked Questions (FAQ’s) For Lost Charge Card Clerk

What are the key responsibilities of a Lost Charge Card Clerk?

The key responsibilities of a Lost Charge Card Clerk include processing lost charge card requests, investigating and resolving discrepancies in charge card transactions, communicating with customers, collaborating with other departments, maintaining accurate records, adhering to company policies, and utilizing specialized software and systems.

What skills are required to be a successful Lost Charge Card Clerk?

The skills required to be a successful Lost Charge Card Clerk include charge card issuance, account research, data entry, investigation, communication, problem solving, and attention to detail.

What is the career outlook for Lost Charge Card Clerks?

The career outlook for Lost Charge Card Clerks is expected to be good, with a projected 7% growth in employment from 2021 to 2031.

What is the average salary for a Lost Charge Card Clerk?

The average salary for a Lost Charge Card Clerk is around $35,000 per year.

What are the benefits of working as a Lost Charge Card Clerk?

The benefits of working as a Lost Charge Card Clerk include a stable job, opportunities for advancement, and the chance to help customers.

What are the challenges of working as a Lost Charge Card Clerk?

The challenges of working as a Lost Charge Card Clerk include dealing with irate customers, working under pressure, and the potential for fraud.

What is the difference between a Lost Charge Card Clerk and a Charge Card Fraud Investigator?

A Lost Charge Card Clerk is responsible for processing lost charge card requests, while a Charge Card Fraud Investigator is responsible for investigating and resolving fraudulent charge card transactions.

What are the career opportunities for Lost Charge Card Clerks?

The career opportunities for Lost Charge Card Clerks include promotions to supervisor or manager positions, as well as opportunities to move into other areas of the financial services industry, such as fraud prevention or customer service.