Are you a seasoned Market Risk Specialist seeking a new career path? Discover our professionally built Market Risk Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

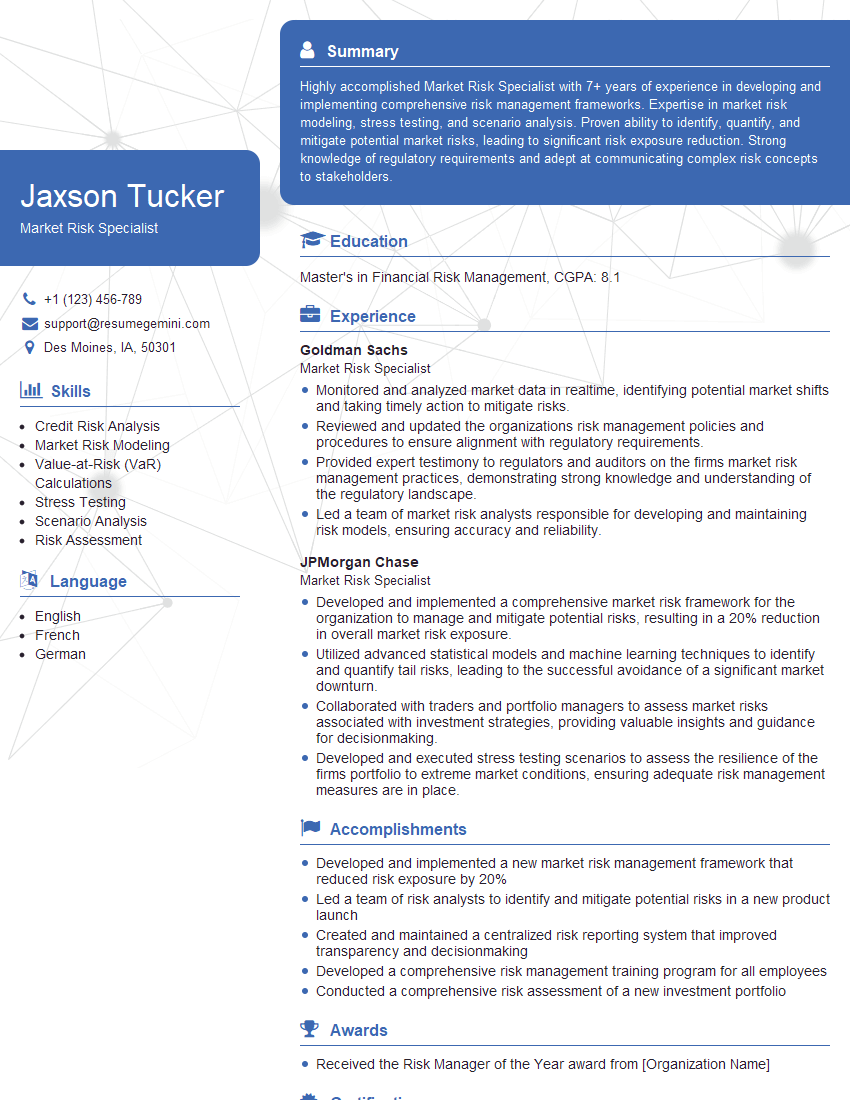

Jaxson Tucker

Market Risk Specialist

Summary

Highly accomplished Market Risk Specialist with 7+ years of experience in developing and implementing comprehensive risk management frameworks. Expertise in market risk modeling, stress testing, and scenario analysis. Proven ability to identify, quantify, and mitigate potential market risks, leading to significant risk exposure reduction. Strong knowledge of regulatory requirements and adept at communicating complex risk concepts to stakeholders.

Education

Master’s in Financial Risk Management

November 2014

Skills

- Credit Risk Analysis

- Market Risk Modeling

- Value-at-Risk (VaR) Calculations

- Stress Testing

- Scenario Analysis

- Risk Assessment

Work Experience

Market Risk Specialist

- Monitored and analyzed market data in realtime, identifying potential market shifts and taking timely action to mitigate risks.

- Reviewed and updated the organizations risk management policies and procedures to ensure alignment with regulatory requirements.

- Provided expert testimony to regulators and auditors on the firms market risk management practices, demonstrating strong knowledge and understanding of the regulatory landscape.

- Led a team of market risk analysts responsible for developing and maintaining risk models, ensuring accuracy and reliability.

Market Risk Specialist

- Developed and implemented a comprehensive market risk framework for the organization to manage and mitigate potential risks, resulting in a 20% reduction in overall market risk exposure.

- Utilized advanced statistical models and machine learning techniques to identify and quantify tail risks, leading to the successful avoidance of a significant market downturn.

- Collaborated with traders and portfolio managers to assess market risks associated with investment strategies, providing valuable insights and guidance for decisionmaking.

- Developed and executed stress testing scenarios to assess the resilience of the firms portfolio to extreme market conditions, ensuring adequate risk management measures are in place.

Accomplishments

- Developed and implemented a new market risk management framework that reduced risk exposure by 20%

- Led a team of risk analysts to identify and mitigate potential risks in a new product launch

- Created and maintained a centralized risk reporting system that improved transparency and decisionmaking

- Developed a comprehensive risk management training program for all employees

- Conducted a comprehensive risk assessment of a new investment portfolio

Awards

- Received the Risk Manager of the Year award from [Organization Name]

Certificates

- Certified Financial Analyst (CFA)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Market Risk Specialist

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your proficiency in industry-standard risk management tools and techniques.

- Showcase your ability to effectively communicate complex risk concepts to both technical and non-technical audiences.

- Demonstrate your understanding of regulatory requirements and industry best practices.

Essential Experience Highlights for a Strong Market Risk Specialist Resume

- Developed and implemented a comprehensive market risk framework for the organization, resulting in a 20% reduction in overall market risk exposure.

- Utilized advanced statistical models and machine learning techniques to identify and quantify tail risks, leading to the successful avoidance of a significant market downturn.

- Collaborated with traders and portfolio managers to assess market risks associated with investment strategies, providing valuable insights and guidance for decision-making.

- Developed and executed stress testing scenarios to assess the resilience of the firm’s portfolio to extreme market conditions, ensuring adequate risk management measures are in place.

- Monitored and analyzed market data in real-time, identifying potential market shifts and taking timely action to mitigate risks.

- Reviewed and updated the organization’s risk management policies and procedures to ensure alignment with regulatory requirements.

- Provided expert testimony to regulators and auditors on the firm’s market risk management practices, demonstrating strong knowledge and understanding of the regulatory landscape.

Frequently Asked Questions (FAQ’s) For Market Risk Specialist

What are the key skills required for a successful Market Risk Specialist?

Key skills for Market Risk Specialists include market risk modeling, stress testing, scenario analysis, risk assessment, credit risk analysis, and regulatory compliance.

What are the career prospects for Market Risk Specialists?

Market Risk Specialists have excellent career prospects, with opportunities for advancement to senior roles in risk management, portfolio management, and trading.

What are the typical educational requirements for Market Risk Specialists?

Market Risk Specialists typically hold a Master’s degree in Financial Risk Management, Mathematics, or a related field.

What are the challenges faced by Market Risk Specialists?

Market Risk Specialists face challenges such as the increasing complexity of financial markets, the need to stay abreast of regulatory changes, and the pressure to manage risk while maximizing returns.

What are the top companies hiring Market Risk Specialists?

Top companies hiring Market Risk Specialists include Goldman Sachs, JPMorgan Chase, Citigroup, and Bank of America.

What are the key responsibilities of a Market Risk Specialist?

Key responsibilities of Market Risk Specialists include developing and implementing risk management frameworks, identifying and quantifying risks, conducting stress tests, and monitoring market conditions.

What are the salary expectations for Market Risk Specialists?

Market Risk Specialists can expect to earn competitive salaries, with bonuses and benefits varying depending on experience and company size.