Are you a seasoned Medical Insurance Claims Processor seeking a new career path? Discover our professionally built Medical Insurance Claims Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

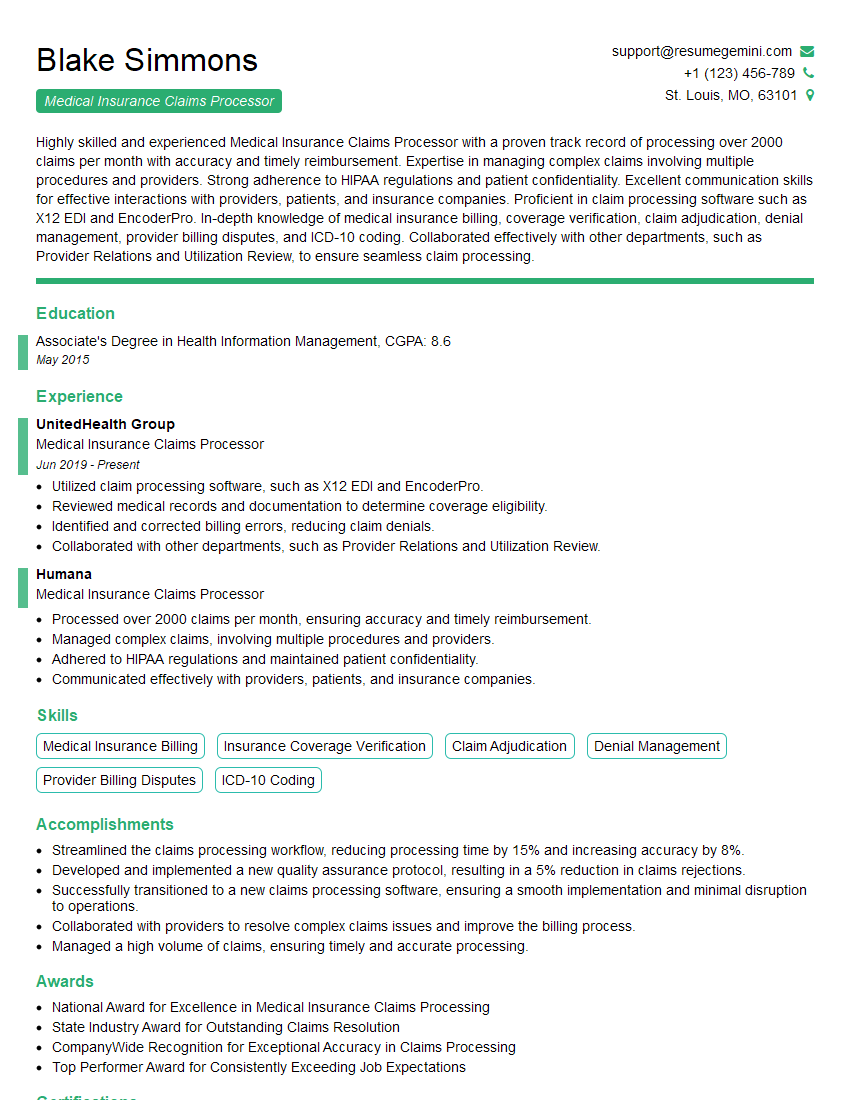

Blake Simmons

Medical Insurance Claims Processor

Summary

Highly skilled and experienced Medical Insurance Claims Processor with a proven track record of processing over 2000 claims per month with accuracy and timely reimbursement. Expertise in managing complex claims involving multiple procedures and providers. Strong adherence to HIPAA regulations and patient confidentiality. Excellent communication skills for effective interactions with providers, patients, and insurance companies. Proficient in claim processing software such as X12 EDI and EncoderPro. In-depth knowledge of medical insurance billing, coverage verification, claim adjudication, denial management, provider billing disputes, and ICD-10 coding. Collaborated effectively with other departments, such as Provider Relations and Utilization Review, to ensure seamless claim processing.

Education

Associate’s Degree in Health Information Management

May 2015

Skills

- Medical Insurance Billing

- Insurance Coverage Verification

- Claim Adjudication

- Denial Management

- Provider Billing Disputes

- ICD-10 Coding

Work Experience

Medical Insurance Claims Processor

- Utilized claim processing software, such as X12 EDI and EncoderPro.

- Reviewed medical records and documentation to determine coverage eligibility.

- Identified and corrected billing errors, reducing claim denials.

- Collaborated with other departments, such as Provider Relations and Utilization Review.

Medical Insurance Claims Processor

- Processed over 2000 claims per month, ensuring accuracy and timely reimbursement.

- Managed complex claims, involving multiple procedures and providers.

- Adhered to HIPAA regulations and maintained patient confidentiality.

- Communicated effectively with providers, patients, and insurance companies.

Accomplishments

- Streamlined the claims processing workflow, reducing processing time by 15% and increasing accuracy by 8%.

- Developed and implemented a new quality assurance protocol, resulting in a 5% reduction in claims rejections.

- Successfully transitioned to a new claims processing software, ensuring a smooth implementation and minimal disruption to operations.

- Collaborated with providers to resolve complex claims issues and improve the billing process.

- Managed a high volume of claims, ensuring timely and accurate processing.

Awards

- National Award for Excellence in Medical Insurance Claims Processing

- State Industry Award for Outstanding Claims Resolution

- CompanyWide Recognition for Exceptional Accuracy in Claims Processing

- Top Performer Award for Consistently Exceeding Job Expectations

Certificates

- Certified Professional Medical Coder (CPC)

- Certified Medical Insurance Specialist (CMIS)

- Certified Health Insurance Claims Processor (CHICP)

- Certified Medical Reimbursement Specialist (CMRS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Medical Insurance Claims Processor

- Highlight your experience and expertise in medical insurance claims processing, emphasizing your ability to handle complex claims efficiently.

- Demonstrate your proficiency in medical insurance billing, coverage verification, claim adjudication, and denial management.

- Emphasize your strong communication and interpersonal skills, as effective interaction with providers, patients, and insurance companies is crucial.

- Showcase your knowledge of claim processing software and your ability to utilize it to improve efficiency and accuracy.

- Quantify your accomplishments whenever possible and provide specific examples of how you have contributed to the success of previous organizations.

Essential Experience Highlights for a Strong Medical Insurance Claims Processor Resume

- Process medical insurance claims accurately and efficiently, ensuring timely reimbursement.

- Manage complex claims involving multiple procedures, providers, and insurance policies.

- Adhere to HIPAA regulations and maintain patient confidentiality in all aspects of claim processing.

- Communicate effectively with providers, patients, and insurance companies to resolve issues and answer inquiries.

- Utilize claim processing software, such as X12 EDI and EncoderPro, to facilitate efficient claim processing.

- Review medical records and documentation to determine coverage eligibility and identify billing errors.

- Collaborate with other departments, such as Provider Relations and Utilization Review, to ensure smooth claim processing and address any discrepancies.

- Stay updated on changes in medical insurance regulations and industry best practices.

Frequently Asked Questions (FAQ’s) For Medical Insurance Claims Processor

What are the key skills required to be a successful Medical Insurance Claims Processor?

Key skills for a Medical Insurance Claims Processor include medical insurance billing, coverage verification, claim adjudication, denial management, provider billing disputes, ICD-10 coding, and proficiency in claim processing software.

What is the average salary for a Medical Insurance Claims Processor?

The average salary for a Medical Insurance Claims Processor can vary depending on experience, location, and employer. According to Indeed, the average salary in the United States is around $45,000 per year.

What are the career advancement opportunities for a Medical Insurance Claims Processor?

Medical Insurance Claims Processors can advance their careers by becoming Claims Examiners, Claims Supervisors, or Managers. With additional education and experience, they can also pursue roles in medical insurance underwriting or policy analysis.

What are the educational requirements to become a Medical Insurance Claims Processor?

Most Medical Insurance Claims Processors have an associate’s degree in health information management or a related field. Some employers may also accept candidates with relevant work experience and on-the-job training.

What are the key challenges faced by Medical Insurance Claims Processors?

Medical Insurance Claims Processors often face challenges such as dealing with complex claims, staying updated on regulatory changes, and working under strict deadlines. They must also be able to handle the emotional aspects of dealing with patients and families.

What are the most important qualities of a successful Medical Insurance Claims Processor?

Successful Medical Insurance Claims Processors are typically detail-oriented, organized, and have excellent communication skills. They are also able to work independently and as part of a team, and are committed to providing excellent customer service.