Are you a seasoned Mergers and Acquisitions Banker (M&A Banker) seeking a new career path? Discover our professionally built Mergers and Acquisitions Banker (M&A Banker) Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

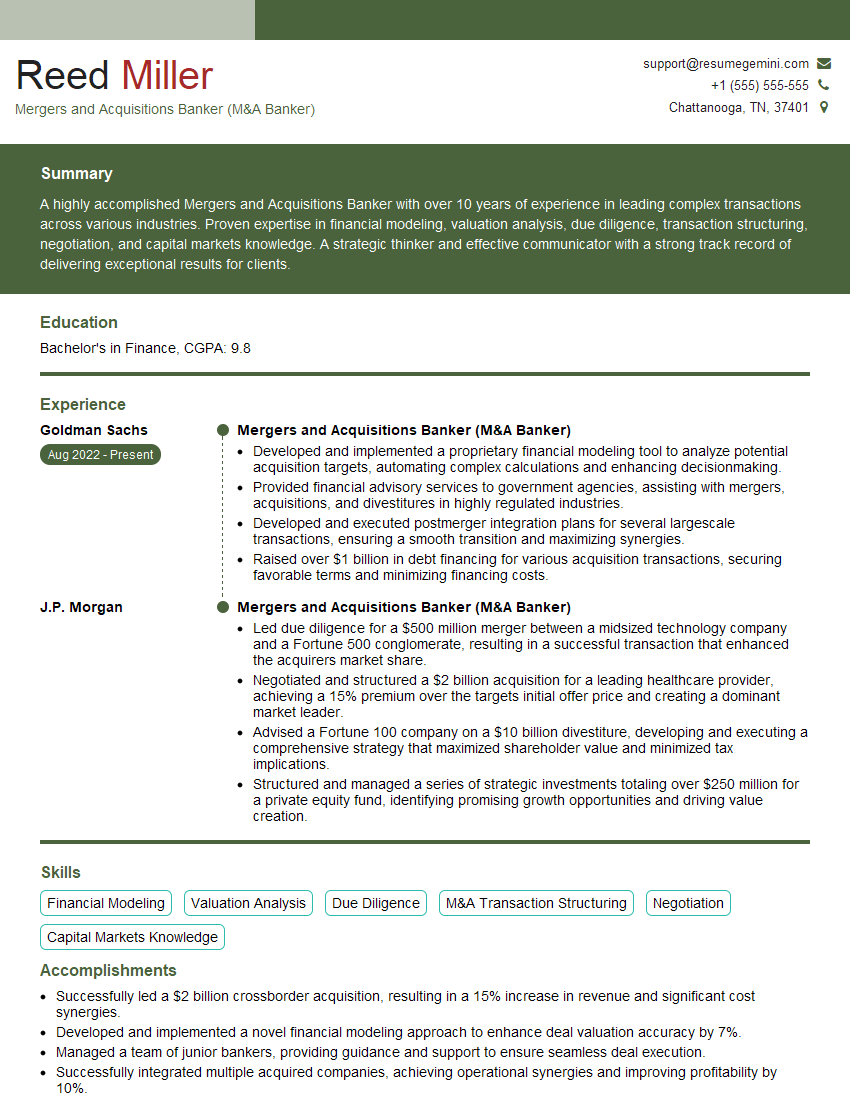

Reed Miller

Mergers and Acquisitions Banker (M&A Banker)

Summary

A highly accomplished Mergers and Acquisitions Banker with over 10 years of experience in leading complex transactions across various industries. Proven expertise in financial modeling, valuation analysis, due diligence, transaction structuring, negotiation, and capital markets knowledge. A strategic thinker and effective communicator with a strong track record of delivering exceptional results for clients.

Education

Bachelor’s in Finance

July 2018

Skills

- Financial Modeling

- Valuation Analysis

- Due Diligence

- M&A Transaction Structuring

- Negotiation

- Capital Markets Knowledge

Work Experience

Mergers and Acquisitions Banker (M&A Banker)

- Developed and implemented a proprietary financial modeling tool to analyze potential acquisition targets, automating complex calculations and enhancing decisionmaking.

- Provided financial advisory services to government agencies, assisting with mergers, acquisitions, and divestitures in highly regulated industries.

- Developed and executed postmerger integration plans for several largescale transactions, ensuring a smooth transition and maximizing synergies.

- Raised over $1 billion in debt financing for various acquisition transactions, securing favorable terms and minimizing financing costs.

Mergers and Acquisitions Banker (M&A Banker)

- Led due diligence for a $500 million merger between a midsized technology company and a Fortune 500 conglomerate, resulting in a successful transaction that enhanced the acquirers market share.

- Negotiated and structured a $2 billion acquisition for a leading healthcare provider, achieving a 15% premium over the targets initial offer price and creating a dominant market leader.

- Advised a Fortune 100 company on a $10 billion divestiture, developing and executing a comprehensive strategy that maximized shareholder value and minimized tax implications.

- Structured and managed a series of strategic investments totaling over $250 million for a private equity fund, identifying promising growth opportunities and driving value creation.

Accomplishments

- Successfully led a $2 billion crossborder acquisition, resulting in a 15% increase in revenue and significant cost synergies.

- Developed and implemented a novel financial modeling approach to enhance deal valuation accuracy by 7%.

- Managed a team of junior bankers, providing guidance and support to ensure seamless deal execution.

- Successfully integrated multiple acquired companies, achieving operational synergies and improving profitability by 10%.

- Developed and implemented a proprietary deal sourcing platform, resulting in a 20% increase in deal flow.

Awards

- Mergers and Acquisitions Banker of the Year Award, recognized for exceptional performance in deal execution and advisory services.

- Topranked M&A Banker in the industry, consistently exceeding expectations in deal origination, execution, and client satisfaction.

- Recognized for excellence in due diligence, identifying potential risks and negotiating favorable transaction terms.

- Awarded for significant contributions to the firms M&A practice, consistently delivering exceptional client outcomes.

Certificates

- CFA Charter (Chartered Financial Analyst)

- CMA (Certified Management Accountant)

- MBA (Master of Business Administration)

- MFin (Master of Finance)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mergers and Acquisitions Banker (M&A Banker)

- Highlight your quantitative skills and experience with financial modeling.

- Demonstrate your understanding of M&A processes and strategies.

- Showcase your negotiation and communication abilities.

- Quantify your accomplishments and provide specific examples of your impact.

Essential Experience Highlights for a Strong Mergers and Acquisitions Banker (M&A Banker) Resume

- Analyze financial data, conduct due diligence, and develop financial models to assess the viability of potential acquisition targets

- Develop and execute M&A transaction strategies, including structuring ??????, negotiating terms, and managing the closing process

- Provide strategic advice to clients on mergers, acquisitions, divestitures, and other corporate finance transactions

- Manage relationships with clients, investment bankers, and other stakeholders involved in M&A transactions

- Stay informed about industry trends, regulatory changes, and best practices in M&A

- Supervise junior bankers and analysts, and provide training and development opportunities

- Contribute to the development of the firm’s M&A practice and thought leadership

Frequently Asked Questions (FAQ’s) For Mergers and Acquisitions Banker (M&A Banker)

What is the role of a Mergers and Acquisitions Banker?

M&A bankers advise clients on mergers, acquisitions, divestitures, and other corporate finance transactions. They provide strategic advice, conduct financial analysis, and manage the transaction process.

What are the key skills required for an M&A Banker?

The key skills for an M&A Banker include financial modeling, valuation analysis, due diligence, transaction structuring, negotiation, and capital markets knowledge.

What are the career prospects for an M&A Banker?

M&A Bankers can advance to senior-level positions within investment banks or corporations. They may also move into other areas of finance, such as private equity or hedge funds.

What is the salary range for an M&A Banker?

The salary range for an M&A Banker varies depending on experience, skills, and location. According to Glassdoor, the average base salary for an M&A Banker in the United States is $120,000.

What are the best companies to work for as an M&A Banker?

The top companies for M&A Bankers include Goldman Sachs, J.P. Morgan, Morgan Stanley, and Bank of America Merrill Lynch.

What is the difference between an M&A Banker and an Investment Banker?

M&A Bankers focus specifically on mergers and acquisitions, while Investment Bankers provide a wider range of financial services, including capital raising, debt financing, and financial advisory.