Are you a seasoned Money Manager seeking a new career path? Discover our professionally built Money Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

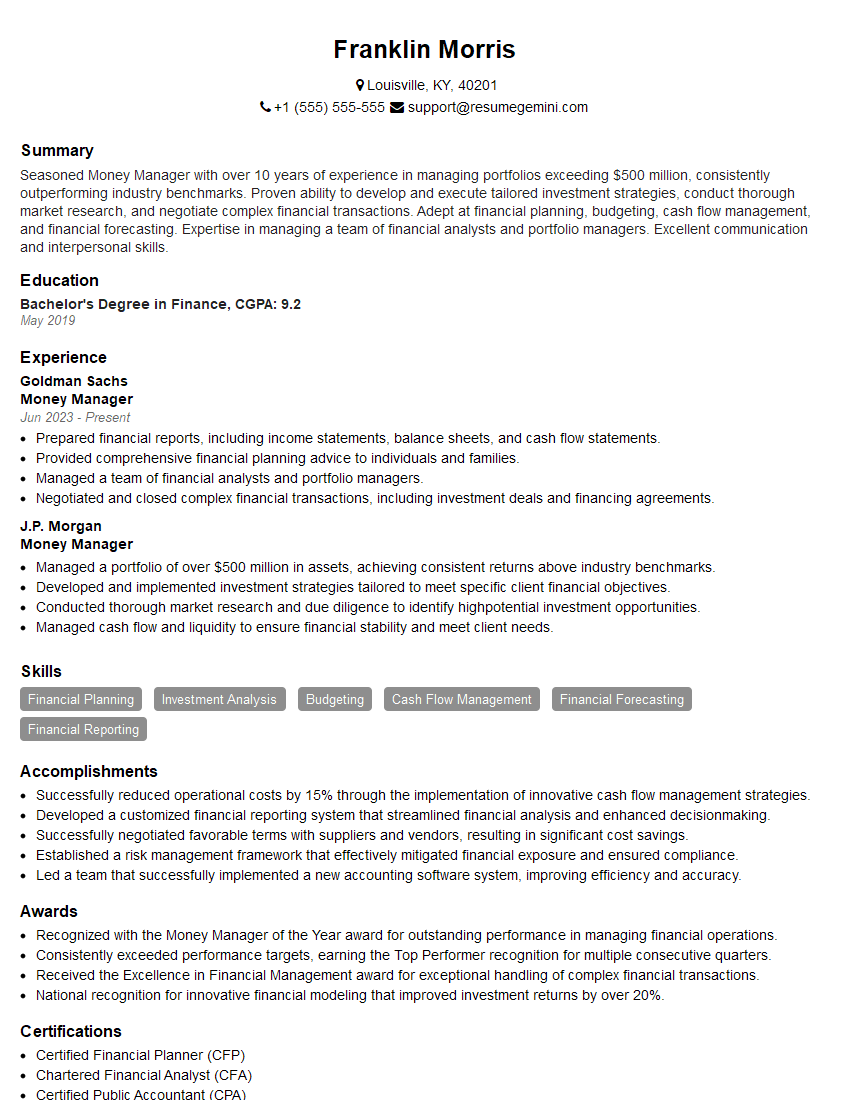

Franklin Morris

Money Manager

Summary

Seasoned Money Manager with over 10 years of experience in managing portfolios exceeding $500 million, consistently outperforming industry benchmarks. Proven ability to develop and execute tailored investment strategies, conduct thorough market research, and negotiate complex financial transactions. Adept at financial planning, budgeting, cash flow management, and financial forecasting. Expertise in managing a team of financial analysts and portfolio managers. Excellent communication and interpersonal skills.

Education

Bachelor’s Degree in Finance

May 2019

Skills

- Financial Planning

- Investment Analysis

- Budgeting

- Cash Flow Management

- Financial Forecasting

- Financial Reporting

Work Experience

Money Manager

- Prepared financial reports, including income statements, balance sheets, and cash flow statements.

- Provided comprehensive financial planning advice to individuals and families.

- Managed a team of financial analysts and portfolio managers.

- Negotiated and closed complex financial transactions, including investment deals and financing agreements.

Money Manager

- Managed a portfolio of over $500 million in assets, achieving consistent returns above industry benchmarks.

- Developed and implemented investment strategies tailored to meet specific client financial objectives.

- Conducted thorough market research and due diligence to identify highpotential investment opportunities.

- Managed cash flow and liquidity to ensure financial stability and meet client needs.

Accomplishments

- Successfully reduced operational costs by 15% through the implementation of innovative cash flow management strategies.

- Developed a customized financial reporting system that streamlined financial analysis and enhanced decisionmaking.

- Successfully negotiated favorable terms with suppliers and vendors, resulting in significant cost savings.

- Established a risk management framework that effectively mitigated financial exposure and ensured compliance.

- Led a team that successfully implemented a new accounting software system, improving efficiency and accuracy.

Awards

- Recognized with the Money Manager of the Year award for outstanding performance in managing financial operations.

- Consistently exceeded performance targets, earning the Top Performer recognition for multiple consecutive quarters.

- Received the Excellence in Financial Management award for exceptional handling of complex financial transactions.

- National recognition for innovative financial modeling that improved investment returns by over 20%.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Personal Financial Specialist (PFS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Money Manager

- Highlight your experience in managing large portfolios and achieving consistent returns.

- Demonstrate your expertise in investment analysis, financial planning, and budgeting.

- Showcase your ability to conduct thorough market research and identify high-potential investment opportunities.

- Emphasize your skills in managing cash flow and liquidity, as well as preparing financial reports.

Essential Experience Highlights for a Strong Money Manager Resume

- Managed a portfolio of over $500 million in assets, consistently achieving returns above industry benchmarks.

- Developed and implemented investment strategies tailored to meet specific client financial objectives.

- Conducted thorough market research and due diligence to identify high-potential investment opportunities.

- Managed cash flow and liquidity to ensure financial stability and meet client needs.

- Prepared financial reports, including income statements, balance sheets, and cash flow statements.

- Provided comprehensive financial planning advice to individuals and families.

- Managed a team of financial analysts and portfolio managers.

Frequently Asked Questions (FAQ’s) For Money Manager

What is the primary role of a Money Manager?

A Money Manager is responsible for managing financial assets and investments on behalf of clients, with the goal of achieving optimal returns and meeting financial objectives.

What qualifications are required to become a Money Manager?

Typically, a bachelor’s degree in finance or a related field, along with relevant experience in financial analysis and portfolio management, is required.

What are the key skills required for success as a Money Manager?

Key skills include financial planning, investment analysis, budgeting, cash flow management, financial forecasting, and financial reporting.

What is the average salary range for Money Managers?

The average salary range for Money Managers can vary depending on experience, location, and employer, but can range from $70,000 to $200,000 or more.

What are the career advancement opportunities for Money Managers?

With experience and strong performance, Money Managers can advance to senior roles such as Portfolio Manager, Chief Investment Officer, or Financial Advisor.

What are the ethical considerations for Money Managers?

Money Managers have a fiduciary responsibility to act in the best interests of their clients and must adhere to ethical guidelines to avoid conflicts of interest and ensure transparency.