Are you a seasoned Mortgage Accounting Clerk seeking a new career path? Discover our professionally built Mortgage Accounting Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

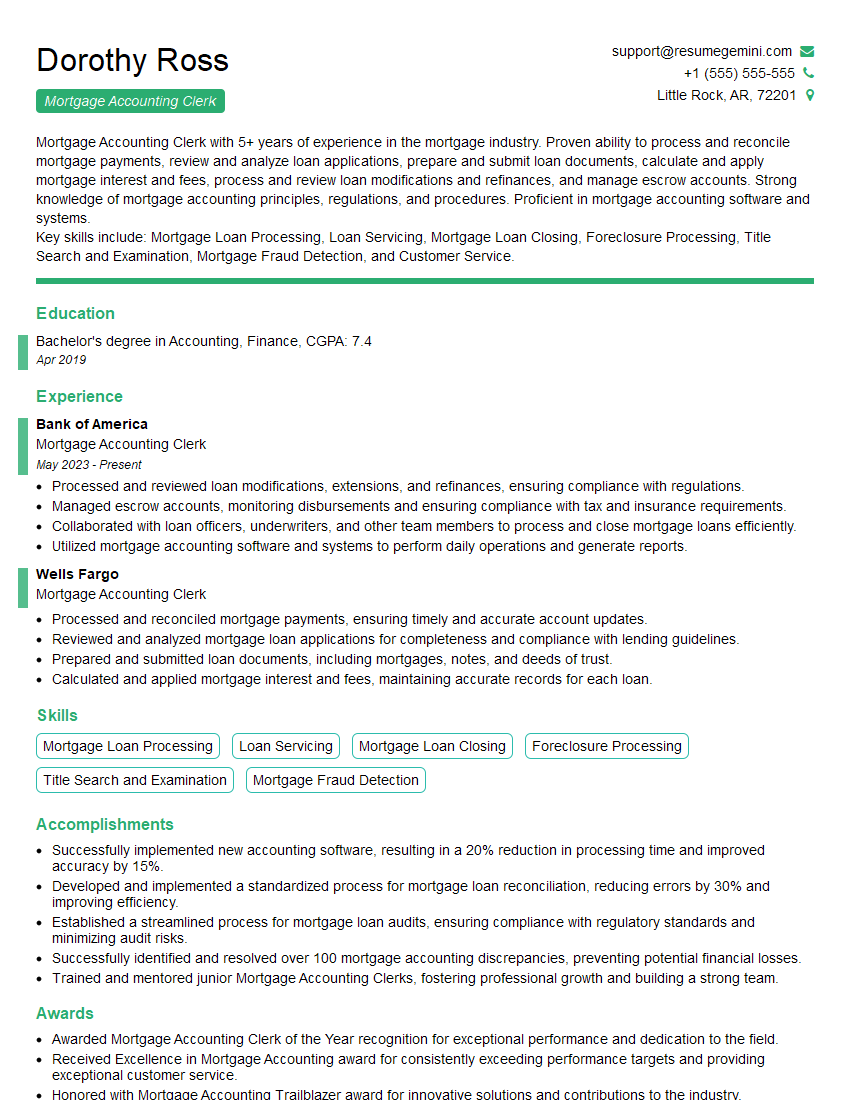

Dorothy Ross

Mortgage Accounting Clerk

Summary

Mortgage Accounting Clerk with 5+ years of experience in the mortgage industry. Proven ability to process and reconcile mortgage payments, review and analyze loan applications, prepare and submit loan documents, calculate and apply mortgage interest and fees, process and review loan modifications and refinances, and manage escrow accounts. Strong knowledge of mortgage accounting principles, regulations, and procedures. Proficient in mortgage accounting software and systems.

Key skills include: Mortgage Loan Processing, Loan Servicing, Mortgage Loan Closing, Foreclosure Processing, Title Search and Examination, Mortgage Fraud Detection, and Customer Service.

Education

Bachelor’s degree in Accounting, Finance

April 2019

Skills

- Mortgage Loan Processing

- Loan Servicing

- Mortgage Loan Closing

- Foreclosure Processing

- Title Search and Examination

- Mortgage Fraud Detection

Work Experience

Mortgage Accounting Clerk

- Processed and reviewed loan modifications, extensions, and refinances, ensuring compliance with regulations.

- Managed escrow accounts, monitoring disbursements and ensuring compliance with tax and insurance requirements.

- Collaborated with loan officers, underwriters, and other team members to process and close mortgage loans efficiently.

- Utilized mortgage accounting software and systems to perform daily operations and generate reports.

Mortgage Accounting Clerk

- Processed and reconciled mortgage payments, ensuring timely and accurate account updates.

- Reviewed and analyzed mortgage loan applications for completeness and compliance with lending guidelines.

- Prepared and submitted loan documents, including mortgages, notes, and deeds of trust.

- Calculated and applied mortgage interest and fees, maintaining accurate records for each loan.

Accomplishments

- Successfully implemented new accounting software, resulting in a 20% reduction in processing time and improved accuracy by 15%.

- Developed and implemented a standardized process for mortgage loan reconciliation, reducing errors by 30% and improving efficiency.

- Established a streamlined process for mortgage loan audits, ensuring compliance with regulatory standards and minimizing audit risks.

- Successfully identified and resolved over 100 mortgage accounting discrepancies, preventing potential financial losses.

- Trained and mentored junior Mortgage Accounting Clerks, fostering professional growth and building a strong team.

Awards

- Awarded Mortgage Accounting Clerk of the Year recognition for exceptional performance and dedication to the field.

- Received Excellence in Mortgage Accounting award for consistently exceeding performance targets and providing exceptional customer service.

- Honored with Mortgage Accounting Trailblazer award for innovative solutions and contributions to the industry.

- Recognized as Mortgage Accounting Subject Matter Expert for providing exceptional guidance and training to colleagues.

Certificates

- Certified Mortgage Banker (CMB)

- Certified Mortgage Underwriter (CMU)

- Certified Residential Mortgage Loan Originator (CRMLA)

- Certified Mortgage Servicing Specialist (CMSS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Accounting Clerk

Highlight your relevant skills and experience.

Be sure to list all of your relevant skills and experience in your resume, including your experience in mortgage accounting, loan processing, and customer service.Quantify your accomplishments.

Whenever possible, quantify your accomplishments in your resume. For example, instead of saying "Processed mortgage payments," you could say "Processed over 1,000 mortgage payments per month, with an accuracy rate of 99%."Proofread your resume carefully.

Make sure your resume is free of errors in grammar and spelling.Tailor your resume to each job you apply for.

Take the time to tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.Network with other mortgage professionals.

Attending industry events and networking with other mortgage professionals can help you learn about new job opportunities.

Essential Experience Highlights for a Strong Mortgage Accounting Clerk Resume

- Process and reconcile mortgage payments, ensuring timely and accurate account updates.

- Review and analyze mortgage loan applications for completeness and compliance with lending guidelines.

- Prepare and submit loan documents, including mortgages, notes, and deeds of trust.

- Calculate and apply mortgage interest and fees, maintaining accurate records for each loan.

- Process and review loan modifications, extensions, and refinances, ensuring compliance with regulations.

- Manage escrow accounts, monitoring disbursements and ensuring compliance with tax and insurance requirements.

- Collaborate with loan officers, underwriters, and other team members to process and close mortgage loans efficiently.

Frequently Asked Questions (FAQ’s) For Mortgage Accounting Clerk

What is a Mortgage Accounting Clerk?

A Mortgage Accounting Clerk is responsible for processing and reconciling mortgage payments, reviewing and analyzing loan applications, preparing and submitting loan documents, calculating and applying mortgage interest and fees, processing and reviewing loan modifications and refinances, and managing escrow accounts.

What are the qualifications for a Mortgage Accounting Clerk?

A Mortgage Accounting Clerk typically needs a high school diploma or equivalent, along with 1-2 years of experience in the mortgage industry. Some employers may also require a bachelor’s degree in accounting, finance, or a related field.

What are the key skills for a Mortgage Accounting Clerk?

Some of the key skills include: Mortgage Loan Processing, Loan Servicing, Mortgage Loan Closing, Foreclosure Processing, Title Search and Examination, Mortgage Fraud Detection, and Customer Service.

What is the average salary for a Mortgage Accounting Clerk?

The average salary for a Mortgage Accounting Clerk is around $45,000 per year.

What is the job outlook for Mortgage Accounting Clerks?

The job outlook for Mortgage Accounting Clerks is expected to grow faster than average in the coming years.

What are some tips for writing a standout Mortgage Accounting Clerk resume?

– Highlight your relevant skills and experience. – Quantify your accomplishments. – Proofread your resume carefully. – Tailor your resume to each job you apply for. – Network with other mortgage professionals.

What are some common interview questions for Mortgage Accounting Clerks?

Some common interview questions for Mortgage Accounting Clerks include: – What is your experience with mortgage accounting? – What are your strengths and weaknesses? – Why are you interested in this position? – What are your salary expectations?