Are you a seasoned Mortgage Broker seeking a new career path? Discover our professionally built Mortgage Broker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

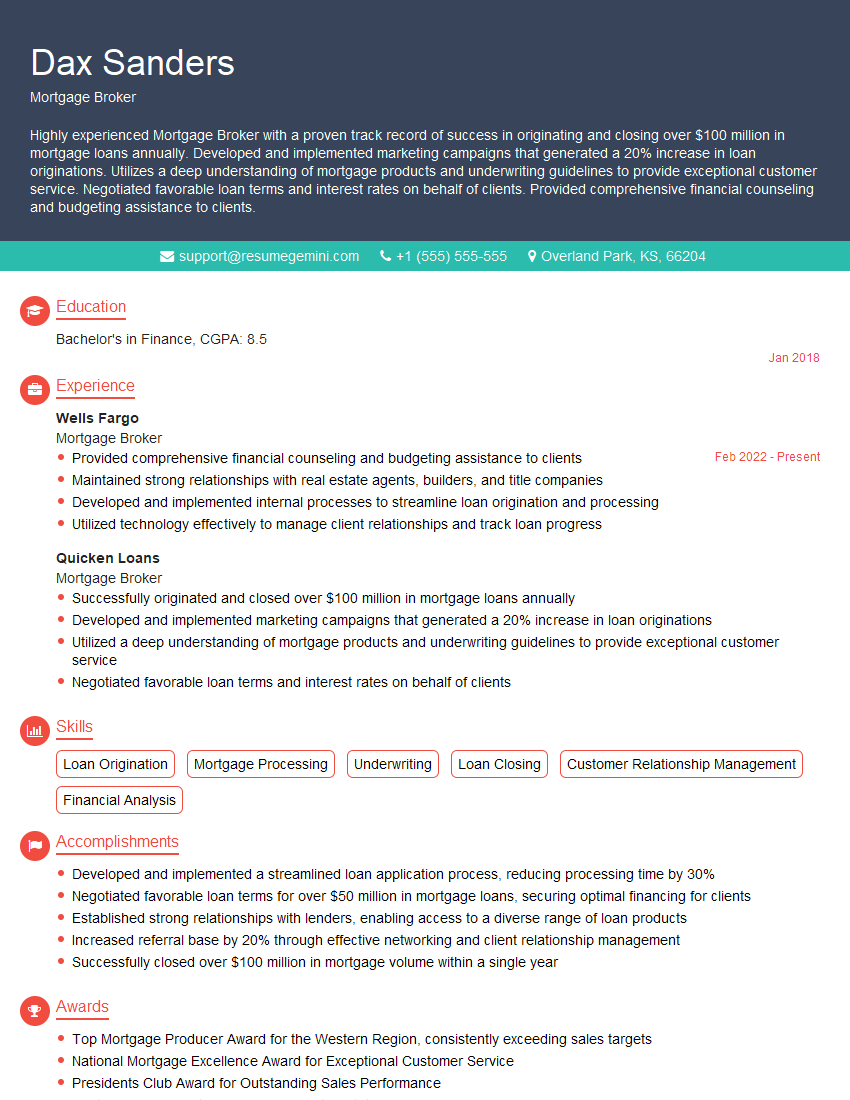

Dax Sanders

Mortgage Broker

Summary

Highly experienced Mortgage Broker with a proven track record of success in originating and closing over $100 million in mortgage loans annually. Developed and implemented marketing campaigns that generated a 20% increase in loan originations. Utilizes a deep understanding of mortgage products and underwriting guidelines to provide exceptional customer service. Negotiated favorable loan terms and interest rates on behalf of clients. Provided comprehensive financial counseling and budgeting assistance to clients.

Education

Bachelor’s in Finance

January 2018

Skills

- Loan Origination

- Mortgage Processing

- Underwriting

- Loan Closing

- Customer Relationship Management

- Financial Analysis

Work Experience

Mortgage Broker

- Provided comprehensive financial counseling and budgeting assistance to clients

- Maintained strong relationships with real estate agents, builders, and title companies

- Developed and implemented internal processes to streamline loan origination and processing

- Utilized technology effectively to manage client relationships and track loan progress

Mortgage Broker

- Successfully originated and closed over $100 million in mortgage loans annually

- Developed and implemented marketing campaigns that generated a 20% increase in loan originations

- Utilized a deep understanding of mortgage products and underwriting guidelines to provide exceptional customer service

- Negotiated favorable loan terms and interest rates on behalf of clients

Accomplishments

- Developed and implemented a streamlined loan application process, reducing processing time by 30%

- Negotiated favorable loan terms for over $50 million in mortgage loans, securing optimal financing for clients

- Established strong relationships with lenders, enabling access to a diverse range of loan products

- Increased referral base by 20% through effective networking and client relationship management

- Successfully closed over $100 million in mortgage volume within a single year

Awards

- Top Mortgage Producer Award for the Western Region, consistently exceeding sales targets

- National Mortgage Excellence Award for Exceptional Customer Service

- Presidents Club Award for Outstanding Sales Performance

- Mortgage Broker of the Year Award for the State of California

Certificates

- Certified Mortgage Planning Specialist (CMPS)

- Certified Mortgage Loan Originator (CMLU)

- Certified Mortgage Underwriter (CMU)

- Certified Residential Mortgage Underwriter (CRMU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Broker

- Highlight your experience and accomplishments in mortgage lending.

- Use keywords throughout your resume to improve its visibility to potential employers.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work.

- Proofread your resume carefully for errors in grammar and spelling.

- Tailor your resume to each job you apply for, highlighting the skills and experiences that are most relevant to the position.

Essential Experience Highlights for a Strong Mortgage Broker Resume

- Originate and close mortgage loans

- Develop and implement marketing campaigns

- Provide exceptional customer service

- Negotiate favorable loan terms and interest rates

- Provide comprehensive financial counseling

- Maintain strong relationships with real estate agents, builders, and title companies

- Streamline loan origination and processing

Frequently Asked Questions (FAQ’s) For Mortgage Broker

What is a Mortgage Broker?

A mortgage broker is a professional who helps borrowers obtain financing for the purchase or refinancing of a home. Mortgage brokers work with a variety of lenders to find the best loan for their clients, and they typically charge a fee for their services.

What are the benefits of using a Mortgage Broker?

There are many benefits to using a mortgage broker, including: – Access to a wide range of lenders and loan products – Personalized advice and guidance throughout the loan process – Negotiating power to get you the best possible loan terms – Convenience and time savings

How do I choose a Mortgage Broker?

When choosing a mortgage broker, it is important to consider the following factors: – Experience and qualifications – Reputation and references – Fees and services offered – Communication style and availability

What are the steps involved in getting a mortgage?

The steps involved in getting a mortgage typically include: – Getting pre-approved for a loan – Finding a home and making an offer – Applying for a loan – Closing on the loan

What are the different types of mortgage loans?

There are many different types of mortgage loans available, including: – Fixed-rate mortgages – Adjustable-rate mortgages – FHA loans – VA loans – Jumbo loans

How much does it cost to get a mortgage?

The cost of getting a mortgage varies depending on a number of factors, including the loan amount, the loan term, the interest rate, and the lender’s fees.