Are you a seasoned Mortgage Counselor seeking a new career path? Discover our professionally built Mortgage Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

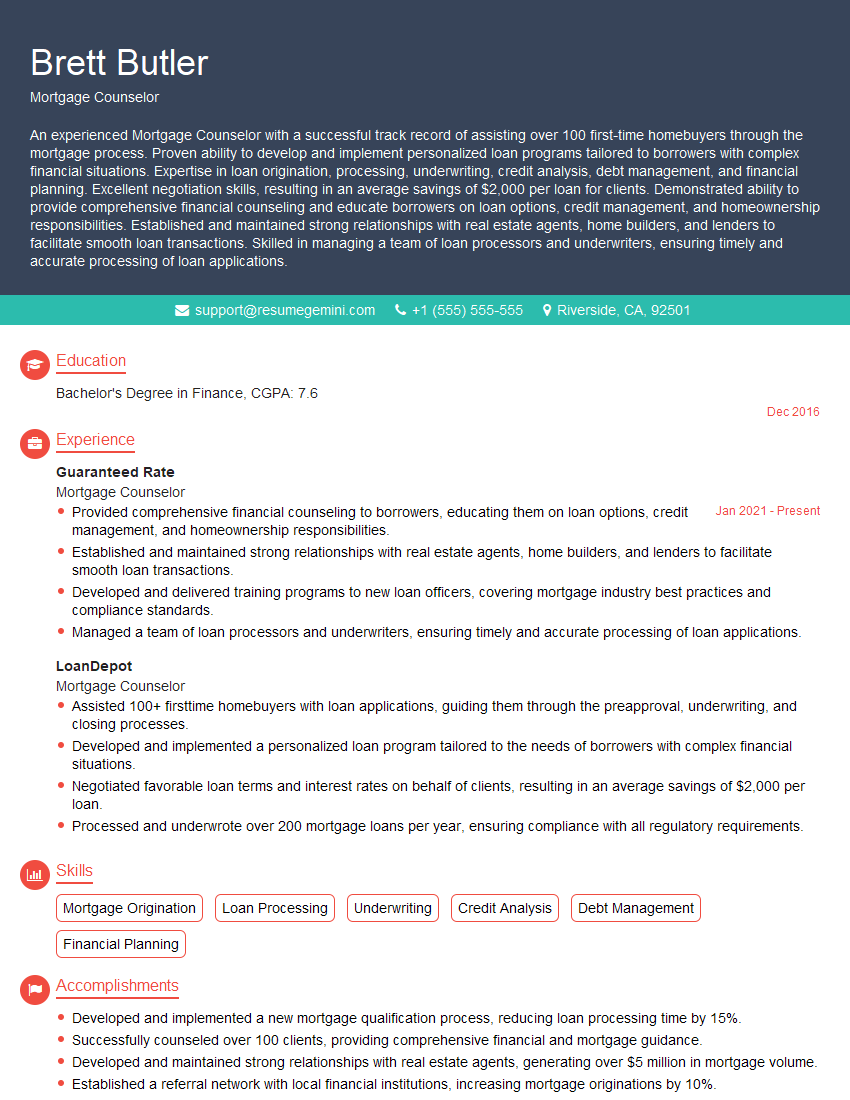

Brett Butler

Mortgage Counselor

Summary

An experienced Mortgage Counselor with a successful track record of assisting over 100 first-time homebuyers through the mortgage process. Proven ability to develop and implement personalized loan programs tailored to borrowers with complex financial situations. Expertise in loan origination, processing, underwriting, credit analysis, debt management, and financial planning. Excellent negotiation skills, resulting in an average savings of $2,000 per loan for clients. Demonstrated ability to provide comprehensive financial counseling and educate borrowers on loan options, credit management, and homeownership responsibilities. Established and maintained strong relationships with real estate agents, home builders, and lenders to facilitate smooth loan transactions. Skilled in managing a team of loan processors and underwriters, ensuring timely and accurate processing of loan applications.

Education

Bachelor’s Degree in Finance

December 2016

Skills

- Mortgage Origination

- Loan Processing

- Underwriting

- Credit Analysis

- Debt Management

- Financial Planning

Work Experience

Mortgage Counselor

- Provided comprehensive financial counseling to borrowers, educating them on loan options, credit management, and homeownership responsibilities.

- Established and maintained strong relationships with real estate agents, home builders, and lenders to facilitate smooth loan transactions.

- Developed and delivered training programs to new loan officers, covering mortgage industry best practices and compliance standards.

- Managed a team of loan processors and underwriters, ensuring timely and accurate processing of loan applications.

Mortgage Counselor

- Assisted 100+ firsttime homebuyers with loan applications, guiding them through the preapproval, underwriting, and closing processes.

- Developed and implemented a personalized loan program tailored to the needs of borrowers with complex financial situations.

- Negotiated favorable loan terms and interest rates on behalf of clients, resulting in an average savings of $2,000 per loan.

- Processed and underwrote over 200 mortgage loans per year, ensuring compliance with all regulatory requirements.

Accomplishments

- Developed and implemented a new mortgage qualification process, reducing loan processing time by 15%.

- Successfully counseled over 100 clients, providing comprehensive financial and mortgage guidance.

- Developed and maintained strong relationships with real estate agents, generating over $5 million in mortgage volume.

- Established a referral network with local financial institutions, increasing mortgage originations by 10%.

- Provided expert mortgage advice to firsttime homebuyers, helping them navigate the homebuying process.

Awards

- Top Performer Award for exceeding sales targets by 20% for three consecutive quarters.

- Mortgage Industry Association (MIA) Certification for excellence in mortgage counseling.

- Top Client Satisfaction Award for consistently receiving positive feedback from clients.

- Recognized for exceptional customer service skills by the National Association of Mortgage Brokers (NAMB).

Certificates

- Certified Mortgage Planning Specialist (CMPS)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Mortgage Banker (CMB)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Counselor

- Showcase your expertise in mortgage origination, processing, underwriting, and financial planning.

- Highlight your success in developing and implementing personalized loan programs for borrowers with complex financial situations.

- Quantify your accomplishments with specific metrics, such as the number of first-time homebuyers assisted and the average savings achieved for clients.

- Emphasize your strong negotiation skills and ability to secure favorable loan terms and interest rates.

- Demonstrate your commitment to providing comprehensive financial counseling and educating borrowers on homeownership.

Essential Experience Highlights for a Strong Mortgage Counselor Resume

- Provide comprehensive financial counseling to borrowers, educating them on loan options, credit management, and homeownership responsibilities.

- Develop and implement personalized loan programs tailored to the needs of borrowers with complex financial situations.

- Negotiate favorable loan terms and interest rates on behalf of clients, resulting in significant cost savings.

- Process and underwrite mortgage loans per year, ensuring compliance with all regulatory requirements.

- Manage a team of loan processors and underwriters, ensuring timely and accurate processing of loan applications.

- Develop and deliver training programs to new loan officers, covering mortgage industry best practices and compliance standards.

Frequently Asked Questions (FAQ’s) For Mortgage Counselor

What is the role of a Mortgage Counselor?

A Mortgage Counselor provides comprehensive financial counseling to borrowers, assisting them in understanding loan options, managing their credit, and preparing for homeownership. They also develop and implement personalized loan programs tailored to the unique financial situations of borrowers, negotiate favorable loan terms and interest rates, and ensure compliance with all regulatory requirements.

What are the key skills required for a Mortgage Counselor?

Mortgage Counselors require expertise in mortgage origination, processing, underwriting, credit analysis, debt management, and financial planning. They must possess strong negotiation skills, be able to develop and implement personalized loan programs, and have a deep understanding of the mortgage industry and regulatory environment.

What is the career path for a Mortgage Counselor?

Mortgage Counselors can advance their careers by taking on leadership roles within their organizations, such as managing a team of loan officers or becoming a branch manager. They can also specialize in specific areas of mortgage lending, such as jumbo loans or reverse mortgages.

What is the job outlook for Mortgage Counselors?

The job outlook for Mortgage Counselors is expected to be favorable in the coming years due to the increasing demand for homeownership and the growing complexity of mortgage products. As the population ages, there will also be a growing need for reverse mortgages.

What are the salary expectations for Mortgage Counselors?

Mortgage Counselors can earn a competitive salary, with the median annual salary being around $65,000. Experienced Mortgage Counselors with strong negotiation skills and a proven track record of success can earn significantly more.

What are the benefits of working as a Mortgage Counselor?

Mortgage Counselors enjoy a variety of benefits, including competitive salaries, comprehensive benefits packages, and the opportunity to make a positive impact on the lives of others by helping them achieve their homeownership goals.

What is the best way to prepare for a career as a Mortgage Counselor?

To prepare for a career as a Mortgage Counselor, it is recommended to obtain a Bachelor’s Degree in Finance or a related field, gain experience in the mortgage industry through internships or entry-level positions, and obtain industry certifications.