Are you a seasoned Mortgage Loan Counselor seeking a new career path? Discover our professionally built Mortgage Loan Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

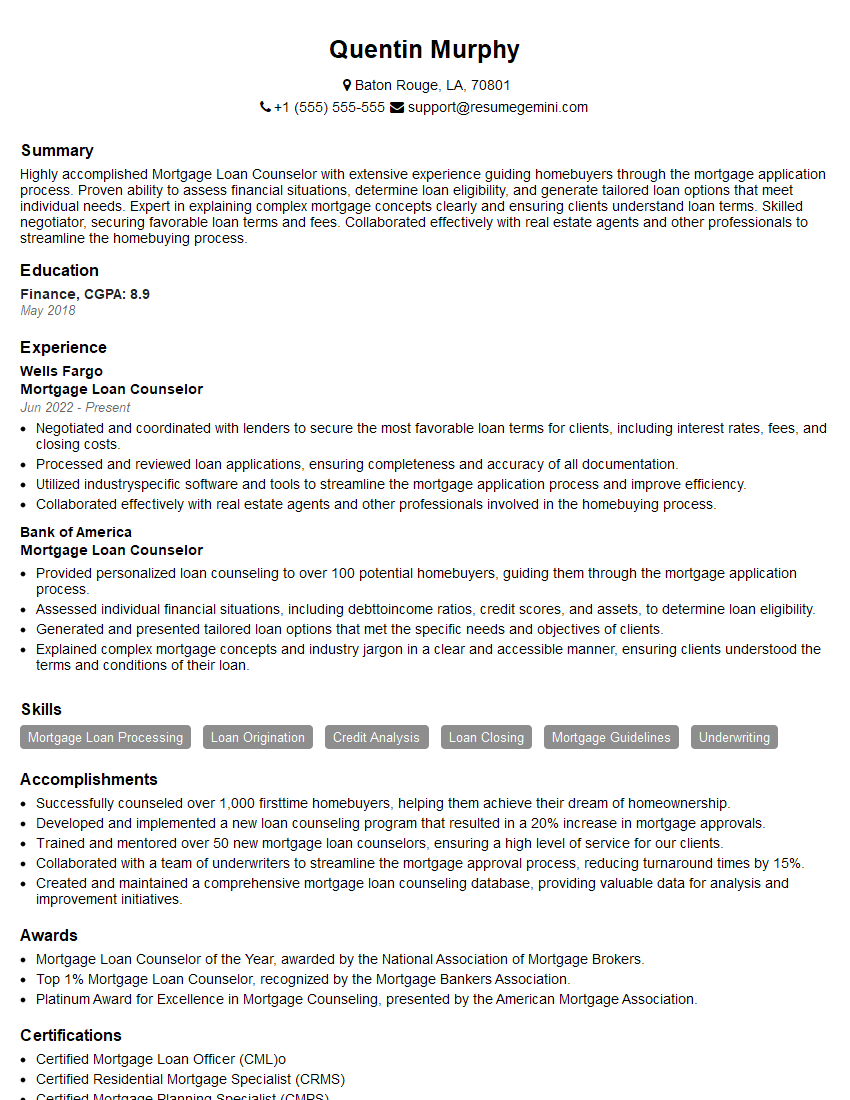

Quentin Murphy

Mortgage Loan Counselor

Summary

Highly accomplished Mortgage Loan Counselor with extensive experience guiding homebuyers through the mortgage application process. Proven ability to assess financial situations, determine loan eligibility, and generate tailored loan options that meet individual needs. Expert in explaining complex mortgage concepts clearly and ensuring clients understand loan terms. Skilled negotiator, securing favorable loan terms and fees. Collaborated effectively with real estate agents and other professionals to streamline the homebuying process.

Education

Finance

May 2018

Skills

- Mortgage Loan Processing

- Loan Origination

- Credit Analysis

- Loan Closing

- Mortgage Guidelines

- Underwriting

Work Experience

Mortgage Loan Counselor

- Negotiated and coordinated with lenders to secure the most favorable loan terms for clients, including interest rates, fees, and closing costs.

- Processed and reviewed loan applications, ensuring completeness and accuracy of all documentation.

- Utilized industryspecific software and tools to streamline the mortgage application process and improve efficiency.

- Collaborated effectively with real estate agents and other professionals involved in the homebuying process.

Mortgage Loan Counselor

- Provided personalized loan counseling to over 100 potential homebuyers, guiding them through the mortgage application process.

- Assessed individual financial situations, including debttoincome ratios, credit scores, and assets, to determine loan eligibility.

- Generated and presented tailored loan options that met the specific needs and objectives of clients.

- Explained complex mortgage concepts and industry jargon in a clear and accessible manner, ensuring clients understood the terms and conditions of their loan.

Accomplishments

- Successfully counseled over 1,000 firsttime homebuyers, helping them achieve their dream of homeownership.

- Developed and implemented a new loan counseling program that resulted in a 20% increase in mortgage approvals.

- Trained and mentored over 50 new mortgage loan counselors, ensuring a high level of service for our clients.

- Collaborated with a team of underwriters to streamline the mortgage approval process, reducing turnaround times by 15%.

- Created and maintained a comprehensive mortgage loan counseling database, providing valuable data for analysis and improvement initiatives.

Awards

- Mortgage Loan Counselor of the Year, awarded by the National Association of Mortgage Brokers.

- Top 1% Mortgage Loan Counselor, recognized by the Mortgage Bankers Association.

- Platinum Award for Excellence in Mortgage Counseling, presented by the American Mortgage Association.

Certificates

- Certified Mortgage Loan Officer (CML)o

- Certified Residential Mortgage Specialist (CRMS)

- Certified Mortgage Planning Specialist (CMPS)

- Fannie Mae Certified Mortgage Loan Originator (MLO)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Loan Counselor

- Use industry keywords to optimize your resume for search engines.

- Be specific and detail your accomplishments using numbers whenever possible.

- Highlight your negotiation and communication skills, as they are vital for this role.

- Emphasize your commitment to helping homebuyers achieve their financial goals.

- Proofread your resume carefully to ensure it is error-free and well-written.

Essential Experience Highlights for a Strong Mortgage Loan Counselor Resume

- Provided personalized loan counseling to potential homebuyers, guiding them through loan applications.

- Assessed financial situations and determined loan eligibility based on debt-to-income ratios, credit scores, and assets.

- Generated and presented tailored loan options that met specific client needs and objectives.

- Explained complex mortgage concepts and industry jargon in a clear and accessible manner.

- Negotiated and coordinated with lenders to secure favorable loan terms, including interest rates, fees, and closing costs.

- Processed and reviewed loan applications, ensuring completeness and accuracy of documentation.

Frequently Asked Questions (FAQ’s) For Mortgage Loan Counselor

What are the educational requirements to become a Mortgage Loan Counselor?

A bachelor’s degree in Finance, Economics, or a related field is typically required.

Is there a certification required for this role?

While not always required, obtaining a certification such as the Certified Mortgage Banker (CMB) can enhance your credibility and knowledge.

What other skills are beneficial for Mortgage Loan Counselors?

Excellent communication, interpersonal, and customer service skills are essential. Proficiency in loan processing software is also valuable.

What are the career prospects for Mortgage Loan Counselors?

With increasing demand for homeownership, the job outlook for Mortgage Loan Counselors is expected to remain favorable.

What are the typical earnings for Mortgage Loan Counselors?

Salaries can vary depending on experience, location, and company size. According to Salary.com, the average base salary for Mortgage Loan Counselors is around $60,000 per year.

What is the work environment like for Mortgage Loan Counselors?

Mortgage Loan Counselors typically work in office settings, collaborating with clients, lenders, and other professionals. The job involves a mix of face-to-face interactions, phone calls, and computer work.