Are you a seasoned Mortgage Loan Processing Clerk seeking a new career path? Discover our professionally built Mortgage Loan Processing Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

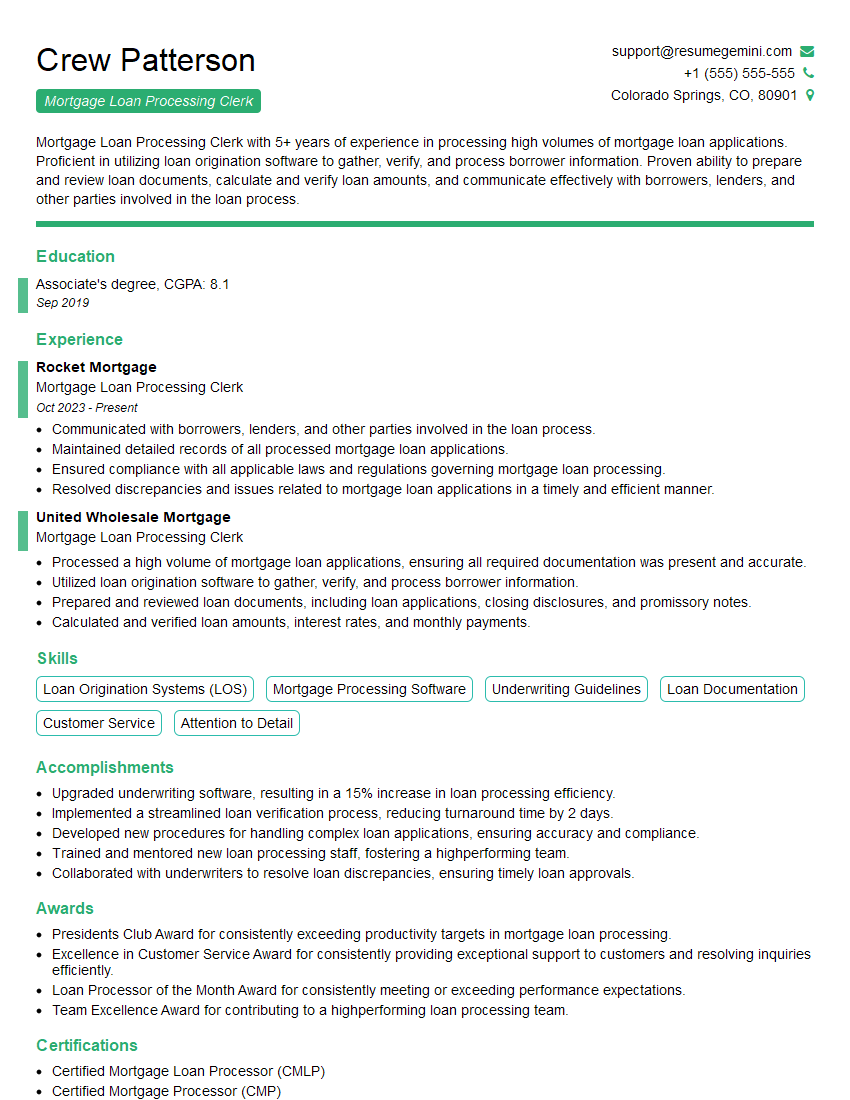

Crew Patterson

Mortgage Loan Processing Clerk

Summary

Mortgage Loan Processing Clerk with 5+ years of experience in processing high volumes of mortgage loan applications. Proficient in utilizing loan origination software to gather, verify, and process borrower information. Proven ability to prepare and review loan documents, calculate and verify loan amounts, and communicate effectively with borrowers, lenders, and other parties involved in the loan process.

Education

Associate’s degree

September 2019

Skills

- Loan Origination Systems (LOS)

- Mortgage Processing Software

- Underwriting Guidelines

- Loan Documentation

- Customer Service

- Attention to Detail

Work Experience

Mortgage Loan Processing Clerk

- Communicated with borrowers, lenders, and other parties involved in the loan process.

- Maintained detailed records of all processed mortgage loan applications.

- Ensured compliance with all applicable laws and regulations governing mortgage loan processing.

- Resolved discrepancies and issues related to mortgage loan applications in a timely and efficient manner.

Mortgage Loan Processing Clerk

- Processed a high volume of mortgage loan applications, ensuring all required documentation was present and accurate.

- Utilized loan origination software to gather, verify, and process borrower information.

- Prepared and reviewed loan documents, including loan applications, closing disclosures, and promissory notes.

- Calculated and verified loan amounts, interest rates, and monthly payments.

Accomplishments

- Upgraded underwriting software, resulting in a 15% increase in loan processing efficiency.

- Implemented a streamlined loan verification process, reducing turnaround time by 2 days.

- Developed new procedures for handling complex loan applications, ensuring accuracy and compliance.

- Trained and mentored new loan processing staff, fostering a highperforming team.

- Collaborated with underwriters to resolve loan discrepancies, ensuring timely loan approvals.

Awards

- Presidents Club Award for consistently exceeding productivity targets in mortgage loan processing.

- Excellence in Customer Service Award for consistently providing exceptional support to customers and resolving inquiries efficiently.

- Loan Processor of the Month Award for consistently meeting or exceeding performance expectations.

- Team Excellence Award for contributing to a highperforming loan processing team.

Certificates

- Certified Mortgage Loan Processor (CMLP)

- Certified Mortgage Processor (CMP)

- Mortgage Loan Originator (MLO)

- Certified Mortgage Underwriter (CMU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Loan Processing Clerk

- Highlight your experience and skills in mortgage loan processing.

- Use strong action verbs to describe your accomplishments.

- Proofread your resume carefully for any errors.

- Tailor your resume to the specific job you are applying for.

- Consider including a cover letter that highlights your interest in the position and how your skills and experience align with the company’s needs.

Essential Experience Highlights for a Strong Mortgage Loan Processing Clerk Resume

- Processed a high volume of mortgage loan applications, ensuring all required documentation was present and accurate.

- Utilized loan origination software to gather, verify, and process borrower information.

- Prepared and reviewed loan documents, including loan applications, closing disclosures, and promissory notes.

- Calculated and verified loan amounts, interest rates, and monthly payments.

- Communicated with borrowers, lenders, and other parties involved in the loan process.

- Maintained detailed records of all processed mortgage loan applications.

- Ensured compliance with all applicable laws and regulations governing mortgage loan processing.

Frequently Asked Questions (FAQ’s) For Mortgage Loan Processing Clerk

What is the job description of a Mortgage Loan Processing Clerk?

A Mortgage Loan Processing Clerk is responsible for processing mortgage loan applications, ensuring that all required documentation is present and accurate, and preparing and reviewing loan documents.

What are the qualifications for a Mortgage Loan Processing Clerk?

A Mortgage Loan Processing Clerk typically requires an associate’s degree in a related field, such as business or finance, and 2-3 years of experience in mortgage loan processing.

What are the key skills for a Mortgage Loan Processing Clerk?

Key skills for a Mortgage Loan Processing Clerk include attention to detail, strong communication skills, and proficiency in mortgage loan processing software.

What is the career outlook for a Mortgage Loan Processing Clerk?

The career outlook for a Mortgage Loan Processing Clerk is expected to grow faster than average in the coming years due to the increasing demand for mortgages.

What is the average salary for a Mortgage Loan Processing Clerk?

The average salary for a Mortgage Loan Processing Clerk varies depending on experience and location, but it is typically around $45,000 per year.

What are the benefits of being a Mortgage Loan Processing Clerk?

Benefits of being a Mortgage Loan Processing Clerk include a stable career, opportunities for advancement, and the satisfaction of helping people achieve their homeownership goals.