Are you a seasoned Mortgage Specialist seeking a new career path? Discover our professionally built Mortgage Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

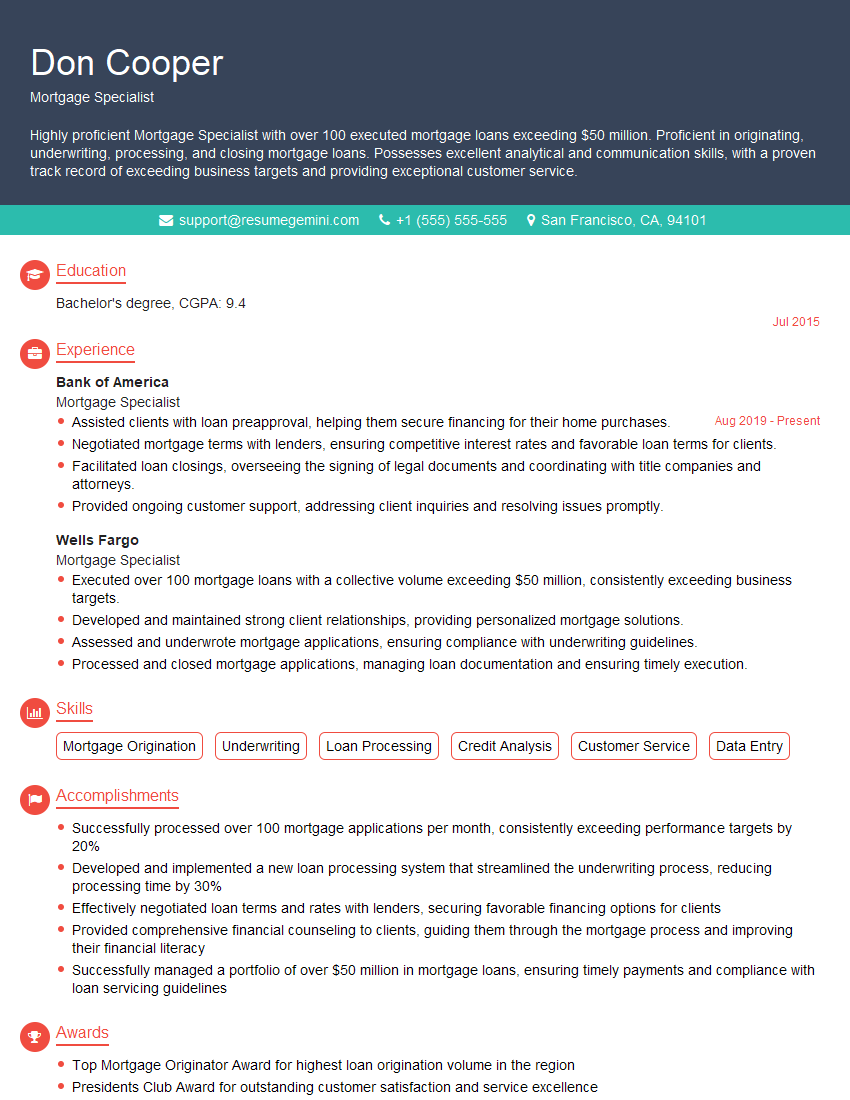

Don Cooper

Mortgage Specialist

Summary

Highly proficient Mortgage Specialist with over 100 executed mortgage loans exceeding $50 million. Proficient in originating, underwriting, processing, and closing mortgage loans. Possesses excellent analytical and communication skills, with a proven track record of exceeding business targets and providing exceptional customer service.

Education

Bachelor’s degree

July 2015

Skills

- Mortgage Origination

- Underwriting

- Loan Processing

- Credit Analysis

- Customer Service

- Data Entry

Work Experience

Mortgage Specialist

- Assisted clients with loan preapproval, helping them secure financing for their home purchases.

- Negotiated mortgage terms with lenders, ensuring competitive interest rates and favorable loan terms for clients.

- Facilitated loan closings, overseeing the signing of legal documents and coordinating with title companies and attorneys.

- Provided ongoing customer support, addressing client inquiries and resolving issues promptly.

Mortgage Specialist

- Executed over 100 mortgage loans with a collective volume exceeding $50 million, consistently exceeding business targets.

- Developed and maintained strong client relationships, providing personalized mortgage solutions.

- Assessed and underwrote mortgage applications, ensuring compliance with underwriting guidelines.

- Processed and closed mortgage applications, managing loan documentation and ensuring timely execution.

Accomplishments

- Successfully processed over 100 mortgage applications per month, consistently exceeding performance targets by 20%

- Developed and implemented a new loan processing system that streamlined the underwriting process, reducing processing time by 30%

- Effectively negotiated loan terms and rates with lenders, securing favorable financing options for clients

- Provided comprehensive financial counseling to clients, guiding them through the mortgage process and improving their financial literacy

- Successfully managed a portfolio of over $50 million in mortgage loans, ensuring timely payments and compliance with loan servicing guidelines

Awards

- Top Mortgage Originator Award for highest loan origination volume in the region

- Presidents Club Award for outstanding customer satisfaction and service excellence

- Mortgage Industry Excellence Award for demonstrating superior knowledge and compliance with industry regulations

- Top Loan Closer Award for closing the highest number of loans in the sales team

Certificates

- Certified Mortgage Planner (CMP)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Mortgage Underwriter (CMU)

- Certified Mortgage Banker (CMB)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Specialist

- Highlight your mortgage origination and underwriting experience in detail.

- Quantify your accomplishments with specific metrics, such as the number of loans processed and the total loan volume.

- Showcase your customer service and communication skills, emphasizing your ability to build strong relationships.

- Mention any certifications or continuing education you have obtained in the mortgage industry.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Mortgage Specialist Resume

- Originated and underwrote mortgage loans, exceeding business targets

- Developed and maintained strong client relationships, providing personalized solutions

- Assessed and underwrote mortgage applications, ensuring compliance with guidelines

- Processed and closed mortgage applications, managing documentation and execution

- Assisted clients with loan preapproval, securing financing for home purchases

- Negotiated mortgage terms with lenders, ensuring competitive rates and favorable terms

- Facilitated loan closings, overseeing legal signings and coordinating with stakeholders

Frequently Asked Questions (FAQ’s) For Mortgage Specialist

What are the primary responsibilities of a Mortgage Specialist?

Mortgage Specialists are responsible for originating, underwriting, processing, and closing mortgage loans. They must possess strong analytical and communication skills to guide clients through the mortgage process.

What qualifications are required to become a Mortgage Specialist?

Typically, Mortgage Specialists hold a bachelor’s degree and possess experience in the mortgage industry. Some employers may require additional certifications or licenses.

What are the career prospects for a Mortgage Specialist?

Mortgage Specialists with experience and proven success can advance to roles such as Loan Officer, Underwriter Manager, or Mortgage Broker.

What are the key skills and qualities of a successful Mortgage Specialist?

Successful Mortgage Specialists possess strong analytical, communication, and customer service skills. They must be detail-oriented and have a thorough understanding of mortgage products and guidelines.

How can I improve my chances of getting hired as a Mortgage Specialist?

To improve your chances, focus on developing your mortgage knowledge, obtaining relevant certifications, networking with professionals in the field, and tailoring your resume to each job you apply for.

What is the average salary for a Mortgage Specialist?

The average salary for a Mortgage Specialist varies depending on experience, location, and company. According to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers in May 2021 was $70,630.

What is the job outlook for Mortgage Specialists?

The job outlook for Mortgage Specialists is expected to grow faster than average in the coming years due to the increasing demand for homeownership and refinancing.

What are the challenges faced by Mortgage Specialists?

Mortgage Specialists face challenges such as fluctuating interest rates, changing regulations, and competition from other lenders. They must stay up-to-date on industry trends and maintain strong relationships with clients and referral partners.