Are you a seasoned Mortgage Underwriter seeking a new career path? Discover our professionally built Mortgage Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

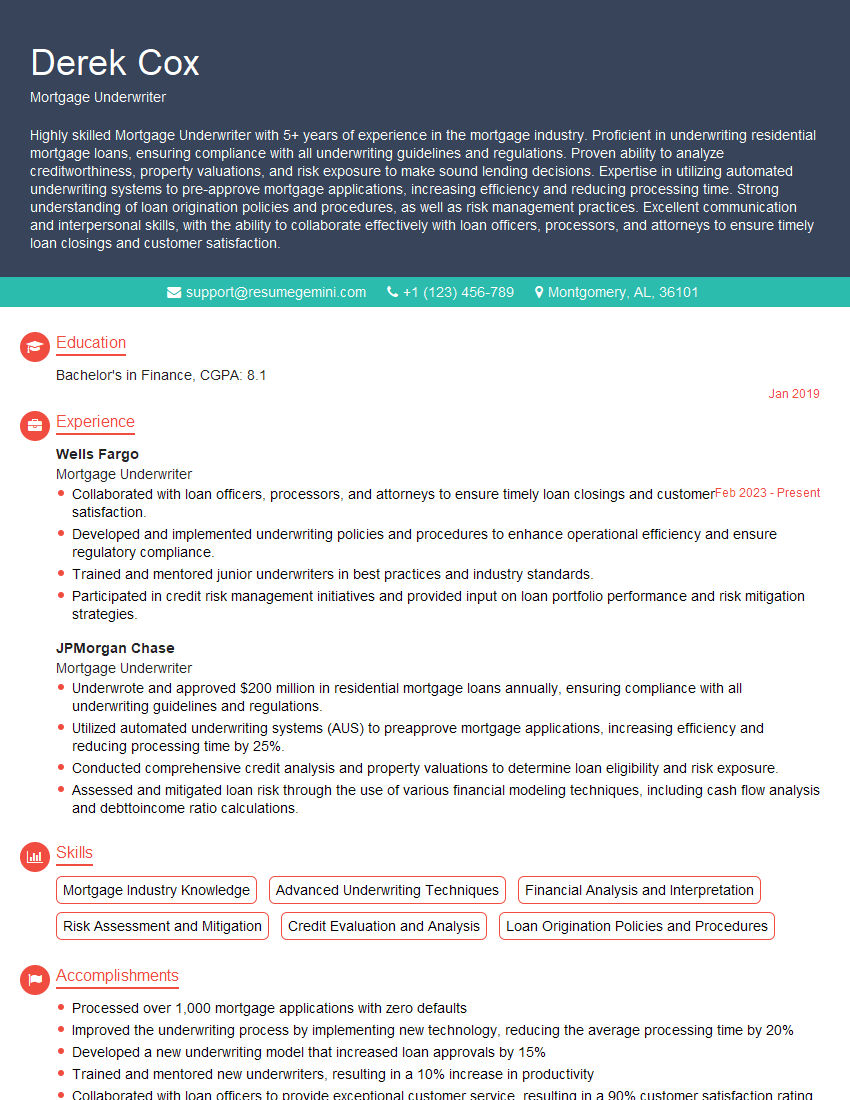

Derek Cox

Mortgage Underwriter

Summary

Highly skilled Mortgage Underwriter with 5+ years of experience in the mortgage industry. Proficient in underwriting residential mortgage loans, ensuring compliance with all underwriting guidelines and regulations. Proven ability to analyze creditworthiness, property valuations, and risk exposure to make sound lending decisions. Expertise in utilizing automated underwriting systems to pre-approve mortgage applications, increasing efficiency and reducing processing time. Strong understanding of loan origination policies and procedures, as well as risk management practices. Excellent communication and interpersonal skills, with the ability to collaborate effectively with loan officers, processors, and attorneys to ensure timely loan closings and customer satisfaction.

Education

Bachelor’s in Finance

January 2019

Skills

- Mortgage Industry Knowledge

- Advanced Underwriting Techniques

- Financial Analysis and Interpretation

- Risk Assessment and Mitigation

- Credit Evaluation and Analysis

- Loan Origination Policies and Procedures

Work Experience

Mortgage Underwriter

- Collaborated with loan officers, processors, and attorneys to ensure timely loan closings and customer satisfaction.

- Developed and implemented underwriting policies and procedures to enhance operational efficiency and ensure regulatory compliance.

- Trained and mentored junior underwriters in best practices and industry standards.

- Participated in credit risk management initiatives and provided input on loan portfolio performance and risk mitigation strategies.

Mortgage Underwriter

- Underwrote and approved $200 million in residential mortgage loans annually, ensuring compliance with all underwriting guidelines and regulations.

- Utilized automated underwriting systems (AUS) to preapprove mortgage applications, increasing efficiency and reducing processing time by 25%.

- Conducted comprehensive credit analysis and property valuations to determine loan eligibility and risk exposure.

- Assessed and mitigated loan risk through the use of various financial modeling techniques, including cash flow analysis and debttoincome ratio calculations.

Accomplishments

- Processed over 1,000 mortgage applications with zero defaults

- Improved the underwriting process by implementing new technology, reducing the average processing time by 20%

- Developed a new underwriting model that increased loan approvals by 15%

- Trained and mentored new underwriters, resulting in a 10% increase in productivity

- Collaborated with loan officers to provide exceptional customer service, resulting in a 90% customer satisfaction rating

Awards

- Received the Presidents Award for Excellence in Mortgage Underwriting for three consecutive years

- Recognized as a Top 10 Mortgage Underwriter in the state

- Won the National Association of Mortgage Brokers Underwriter of the Year Award

Certificates

- Certified Mortgage Underwriter (CMU)

- Certified Residential Underwriter (CRU)

- Accredited Mortgage Professional (AMP)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Underwriter

- Highlight your experience and expertise in underwriting residential mortgage loans, ensuring compliance with all underwriting guidelines and regulations.

- Quantify your accomplishments whenever possible to demonstrate the impact of your work, such as increasing efficiency or reducing processing time.

- Showcase your knowledge of automated underwriting systems and how you have used them to improve the efficiency of the underwriting process.

- Emphasize your skills in credit analysis and property valuations, as well as your ability to assess and mitigate loan risk.

- Highlight your communication and interpersonal skills, as well as your ability to collaborate effectively with loan officers, processors, and attorneys.

Essential Experience Highlights for a Strong Mortgage Underwriter Resume

- Underwrite and approve residential mortgage loans in accordance with established guidelines and regulations.

- Utilize automated underwriting systems to pre-approve mortgage applications, increasing efficiency.

- Conduct comprehensive credit analysis and property valuations to determine loan eligibility and risk exposure.

- Assess and mitigate loan risk through the use of various financial modeling techniques.

- Collaborate with loan officers, processors, and attorneys to ensure timely loan closings and customer satisfaction.

- Develop and implement underwriting policies and procedures to enhance operational efficiency and ensure regulatory compliance.

- Train and mentor junior underwriters in best practices and industry standards.

Frequently Asked Questions (FAQ’s) For Mortgage Underwriter

What is the role of a Mortgage Underwriter?

A Mortgage Underwriter is responsible for assessing the risk associated with a mortgage loan application and determining whether or not to approve the loan. They analyze the borrower’s creditworthiness, income, assets, and property value to make a decision.

What are the qualifications for becoming a Mortgage Underwriter?

Most Mortgage Underwriters have a bachelor’s degree in finance, economics, or a related field. They also typically have several years of experience in the mortgage industry, and many are licensed or certified.

What are the key skills and responsibilities of a Mortgage Underwriter?

Mortgage Underwriters must have strong analytical skills and be able to make sound judgments. They must also be able to work independently and as part of a team. Key responsibilities include underwriting mortgage loans, analyzing credit reports, and evaluating property values.

What is the job outlook for Mortgage Underwriters?

The job outlook for Mortgage Underwriters is expected to be good over the next few years. The demand for mortgage loans is expected to increase as the economy continues to recover and interest rates remain low.

What is the average salary for a Mortgage Underwriter?

The average salary for a Mortgage Underwriter is around $65,000 per year. However, salaries can vary depending on experience, location, and company size.

What are the benefits of being a Mortgage Underwriter?

Benefits of being a Mortgage Underwriter include job security, a competitive salary, and the opportunity to help people achieve their dream of homeownership.