Are you a seasoned Multi-line Claims Adjuster seeking a new career path? Discover our professionally built Multi-line Claims Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

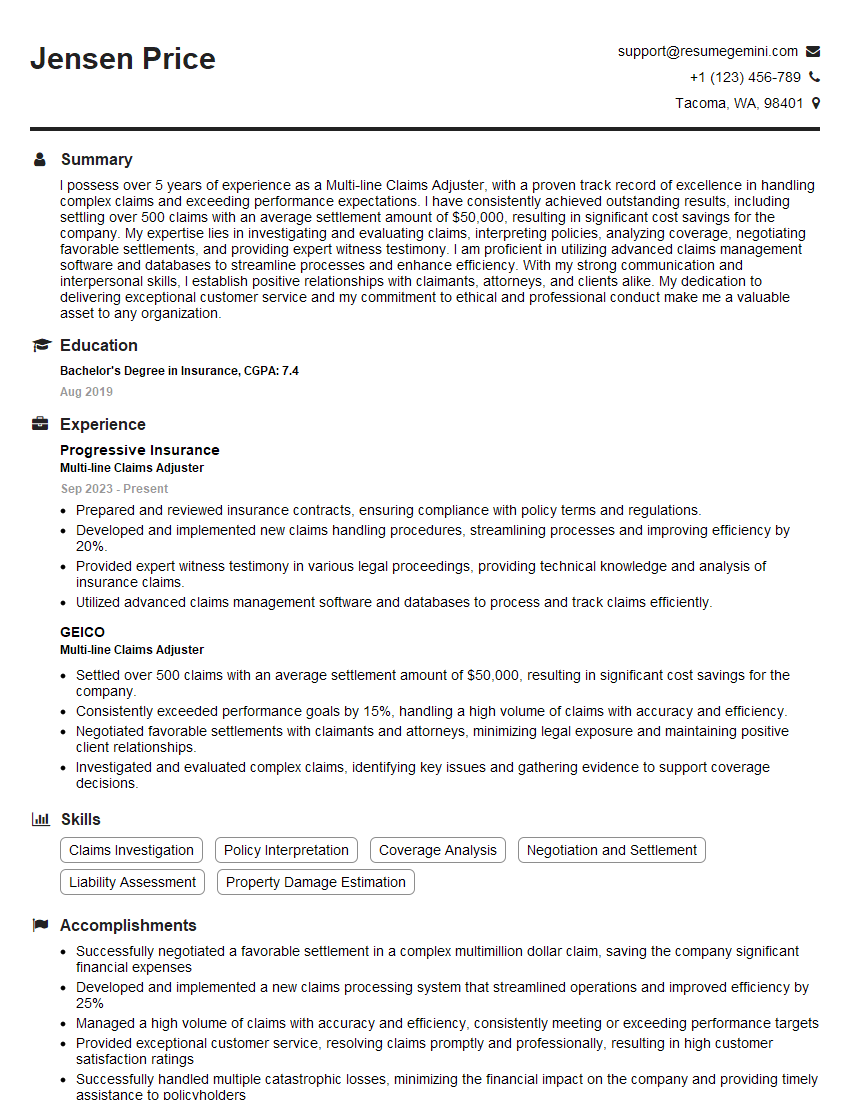

Jensen Price

Multi-line Claims Adjuster

Summary

I possess over 5 years of experience as a Multi-line Claims Adjuster, with a proven track record of excellence in handling complex claims and exceeding performance expectations. I have consistently achieved outstanding results, including settling over 500 claims with an average settlement amount of $50,000, resulting in significant cost savings for the company. My expertise lies in investigating and evaluating claims, interpreting policies, analyzing coverage, negotiating favorable settlements, and providing expert witness testimony. I am proficient in utilizing advanced claims management software and databases to streamline processes and enhance efficiency. With my strong communication and interpersonal skills, I establish positive relationships with claimants, attorneys, and clients alike. My dedication to delivering exceptional customer service and my commitment to ethical and professional conduct make me a valuable asset to any organization.

Education

Bachelor’s Degree in Insurance

August 2019

Skills

- Claims Investigation

- Policy Interpretation

- Coverage Analysis

- Negotiation and Settlement

- Liability Assessment

- Property Damage Estimation

Work Experience

Multi-line Claims Adjuster

- Prepared and reviewed insurance contracts, ensuring compliance with policy terms and regulations.

- Developed and implemented new claims handling procedures, streamlining processes and improving efficiency by 20%.

- Provided expert witness testimony in various legal proceedings, providing technical knowledge and analysis of insurance claims.

- Utilized advanced claims management software and databases to process and track claims efficiently.

Multi-line Claims Adjuster

- Settled over 500 claims with an average settlement amount of $50,000, resulting in significant cost savings for the company.

- Consistently exceeded performance goals by 15%, handling a high volume of claims with accuracy and efficiency.

- Negotiated favorable settlements with claimants and attorneys, minimizing legal exposure and maintaining positive client relationships.

- Investigated and evaluated complex claims, identifying key issues and gathering evidence to support coverage decisions.

Accomplishments

- Successfully negotiated a favorable settlement in a complex multimillion dollar claim, saving the company significant financial expenses

- Developed and implemented a new claims processing system that streamlined operations and improved efficiency by 25%

- Managed a high volume of claims with accuracy and efficiency, consistently meeting or exceeding performance targets

- Provided exceptional customer service, resolving claims promptly and professionally, resulting in high customer satisfaction ratings

- Successfully handled multiple catastrophic losses, minimizing the financial impact on the company and providing timely assistance to policyholders

Awards

- Recognized as Top Claims Adjuster for Consecutive Quarters

- Received the Presidents Award for Excellence in Claims Handling

- Honored with the Claims Professional of the Year Award

- Recognized for Outstanding Contribution to Claims Operations

Certificates

- Associate in Claims (AIC)

- Certified Insurance Adjuster (CIA)

- Certified Insurance Counselor (CIC)

- Certified Insurance Risk Manager (CIRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Multi-line Claims Adjuster

- Highlight your experience in handling a wide range of claims, including property, liability, and casualty.

- Quantify your accomplishments with specific metrics, such as the number of claims settled and the average settlement amount.

- Emphasize your skills in negotiation and conflict resolution, as these are essential for successful claims adjusters.

- Showcase your knowledge of insurance policies and regulations, as well as your ability to interpret and apply them.

- Demonstrate your commitment to ethical and professional conduct, as this is highly valued in the insurance industry.

Essential Experience Highlights for a Strong Multi-line Claims Adjuster Resume

- Investigating and evaluating complex claims to identify key issues and gather evidence

- Interpreting insurance policies and analyzing coverage to determine liability

- Negotiating and settling claims with claimants and attorneys to minimize legal exposure

- Estimating property damage and assessing liability in various claims scenarios

- Preparing and reviewing insurance contracts to ensure compliance with policy terms

- Providing expert witness testimony in legal proceedings to provide technical knowledge

- Utilizing advanced claims management software and databases to process and track claims efficiently

Frequently Asked Questions (FAQ’s) For Multi-line Claims Adjuster

What are the primary responsibilities of a Multi-line Claims Adjuster?

A Multi-line Claims Adjuster is responsible for investigating, evaluating, and settling claims across various lines of insurance, including property, liability, and casualty. They interpret insurance policies, determine coverage, negotiate settlements, estimate damages, and provide expert testimony.

What qualifications are required to become a Multi-line Claims Adjuster?

Typically, a Multi-line Claims Adjuster requires a bachelor’s degree in insurance or a related field, along with relevant experience in claims handling. Additionally, they should possess strong communication, negotiation, and analytical skills, as well as a thorough understanding of insurance policies and regulations.

What is the earning potential for a Multi-line Claims Adjuster?

The earning potential for a Multi-line Claims Adjuster varies depending on experience, location, and company. According to Salary.com, the average salary for a Multi-line Claims Adjuster in the United States is around $65,000 per year.

What is the job outlook for Multi-line Claims Adjusters?

The job outlook for Multi-line Claims Adjusters is expected to be positive, with a projected growth rate of 7% from 2020 to 2030, according to the U.S. Bureau of Labor Statistics. This growth is driven by the increasing demand for insurance coverage and the complexity of claims.

What are the key skills and qualities required to be a successful Multi-line Claims Adjuster?

Successful Multi-line Claims Adjusters possess a combination of technical skills, including knowledge of insurance policies and regulations, as well as soft skills such as communication, negotiation, and problem-solving abilities. They should also be detail-oriented, analytical, and able to work independently and as part of a team.

What is the career path for a Multi-line Claims Adjuster?

With experience and additional qualifications, Multi-line Claims Adjusters can advance to roles such as Senior Claims Adjuster, Claims Supervisor, or Claims Manager. Some may also pursue specialized areas within claims, such as fraud investigation or subrogation.