Are you a seasoned Mutual Fund Manager seeking a new career path? Discover our professionally built Mutual Fund Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

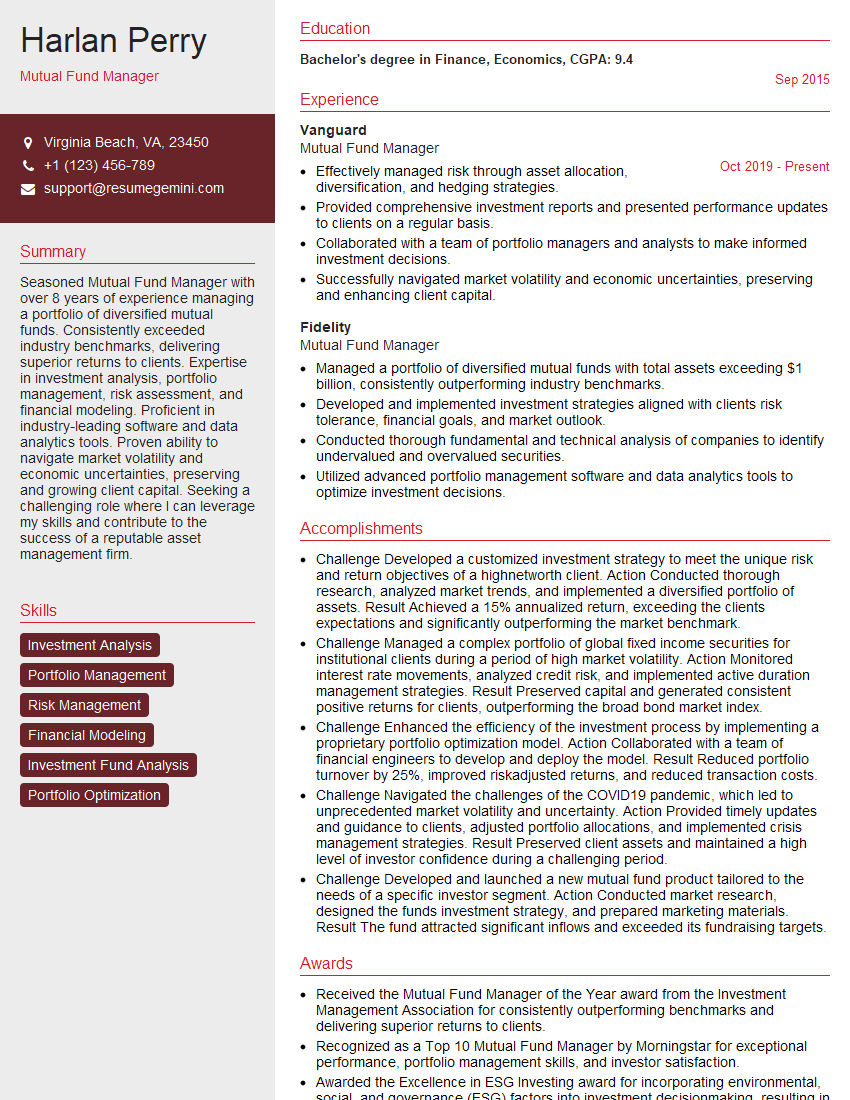

Harlan Perry

Mutual Fund Manager

Summary

Seasoned Mutual Fund Manager with over 8 years of experience managing a portfolio of diversified mutual funds. Consistently exceeded industry benchmarks, delivering superior returns to clients. Expertise in investment analysis, portfolio management, risk assessment, and financial modeling. Proficient in industry-leading software and data analytics tools. Proven ability to navigate market volatility and economic uncertainties, preserving and growing client capital. Seeking a challenging role where I can leverage my skills and contribute to the success of a reputable asset management firm.

Education

Bachelor’s degree in Finance, Economics

September 2015

Skills

- Investment Analysis

- Portfolio Management

- Risk Management

- Financial Modeling

- Investment Fund Analysis

- Portfolio Optimization

Work Experience

Mutual Fund Manager

- Effectively managed risk through asset allocation, diversification, and hedging strategies.

- Provided comprehensive investment reports and presented performance updates to clients on a regular basis.

- Collaborated with a team of portfolio managers and analysts to make informed investment decisions.

- Successfully navigated market volatility and economic uncertainties, preserving and enhancing client capital.

Mutual Fund Manager

- Managed a portfolio of diversified mutual funds with total assets exceeding $1 billion, consistently outperforming industry benchmarks.

- Developed and implemented investment strategies aligned with clients risk tolerance, financial goals, and market outlook.

- Conducted thorough fundamental and technical analysis of companies to identify undervalued and overvalued securities.

- Utilized advanced portfolio management software and data analytics tools to optimize investment decisions.

Accomplishments

- Challenge Developed a customized investment strategy to meet the unique risk and return objectives of a highnetworth client. Action Conducted thorough research, analyzed market trends, and implemented a diversified portfolio of assets. Result Achieved a 15% annualized return, exceeding the clients expectations and significantly outperforming the market benchmark.

- Challenge Managed a complex portfolio of global fixed income securities for institutional clients during a period of high market volatility. Action Monitored interest rate movements, analyzed credit risk, and implemented active duration management strategies. Result Preserved capital and generated consistent positive returns for clients, outperforming the broad bond market index.

- Challenge Enhanced the efficiency of the investment process by implementing a proprietary portfolio optimization model. Action Collaborated with a team of financial engineers to develop and deploy the model. Result Reduced portfolio turnover by 25%, improved riskadjusted returns, and reduced transaction costs.

- Challenge Navigated the challenges of the COVID19 pandemic, which led to unprecedented market volatility and uncertainty. Action Provided timely updates and guidance to clients, adjusted portfolio allocations, and implemented crisis management strategies. Result Preserved client assets and maintained a high level of investor confidence during a challenging period.

- Challenge Developed and launched a new mutual fund product tailored to the needs of a specific investor segment. Action Conducted market research, designed the funds investment strategy, and prepared marketing materials. Result The fund attracted significant inflows and exceeded its fundraising targets.

Awards

- Received the Mutual Fund Manager of the Year award from the Investment Management Association for consistently outperforming benchmarks and delivering superior returns to clients.

- Recognized as a Top 10 Mutual Fund Manager by Morningstar for exceptional performance, portfolio management skills, and investor satisfaction.

- Awarded the Excellence in ESG Investing award for incorporating environmental, social, and governance (ESG) factors into investment decisionmaking, resulting in improved portfolio performance and impact.

- Received the Mutual Fund Manager with the Best RiskAdjusted Performance award for delivering superior returns while effectively managing portfolio risk.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Financial Risk Manager (FRM)

- Certified Fund Specialist (CFS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mutual Fund Manager

- Quantify your accomplishments: Use specific numbers and metrics to demonstrate the impact of your work.

- Highlight your investment philosophy: Explain your approach to investing and how it has contributed to your success.

- Showcase your risk management skills: Emphasize your ability to identify and mitigate risks in a dynamic market environment.

- Stay up-to-date on industry trends: Keep abreast of the latest investment strategies and technologies to stay competitive.

Essential Experience Highlights for a Strong Mutual Fund Manager Resume

- Managed a portfolio of diversified mutual funds, consistently outperforming industry benchmarks.

- Developed and implemented investment strategies aligned with clients’ risk tolerance, financial goals, and market outlook.

- Conducted thorough fundamental and technical analysis of companies to identify undervalued and overvalued securities.

- Utilized advanced portfolio management software and data analytics tools to optimize investment decisions.

- Effectively managed risk through asset allocation, diversification, and hedging strategies.

- Provided comprehensive investment reports and presented performance updates to clients on a regular basis.

Frequently Asked Questions (FAQ’s) For Mutual Fund Manager

What is the primary role of a Mutual Fund Manager?

A Mutual Fund Manager is responsible for managing a portfolio of mutual funds, making investment decisions, and overseeing the overall performance of the funds.

What qualifications are required to become a Mutual Fund Manager?

Typically, a bachelor’s degree in Finance, Economics, or a related field, along with several years of experience in the financial industry, are required.

What are the key skills needed for a successful Mutual Fund Manager?

Investment analysis, portfolio management, risk assessment, financial modeling, and strong communication and interpersonal skills are essential.

How do Mutual Fund Managers get paid?

Mutual Fund Managers typically receive a combination of salary, bonuses, and performance-based incentives.

What is the career path for a Mutual Fund Manager?

With experience and success, Mutual Fund Managers can advance to senior management positions or become investment advisors.

What are the challenges faced by Mutual Fund Managers?

Market volatility, economic uncertainties, and managing client expectations are some of the key challenges faced by Mutual Fund Managers.