Are you a seasoned Natural Gas Basis Trader seeking a new career path? Discover our professionally built Natural Gas Basis Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

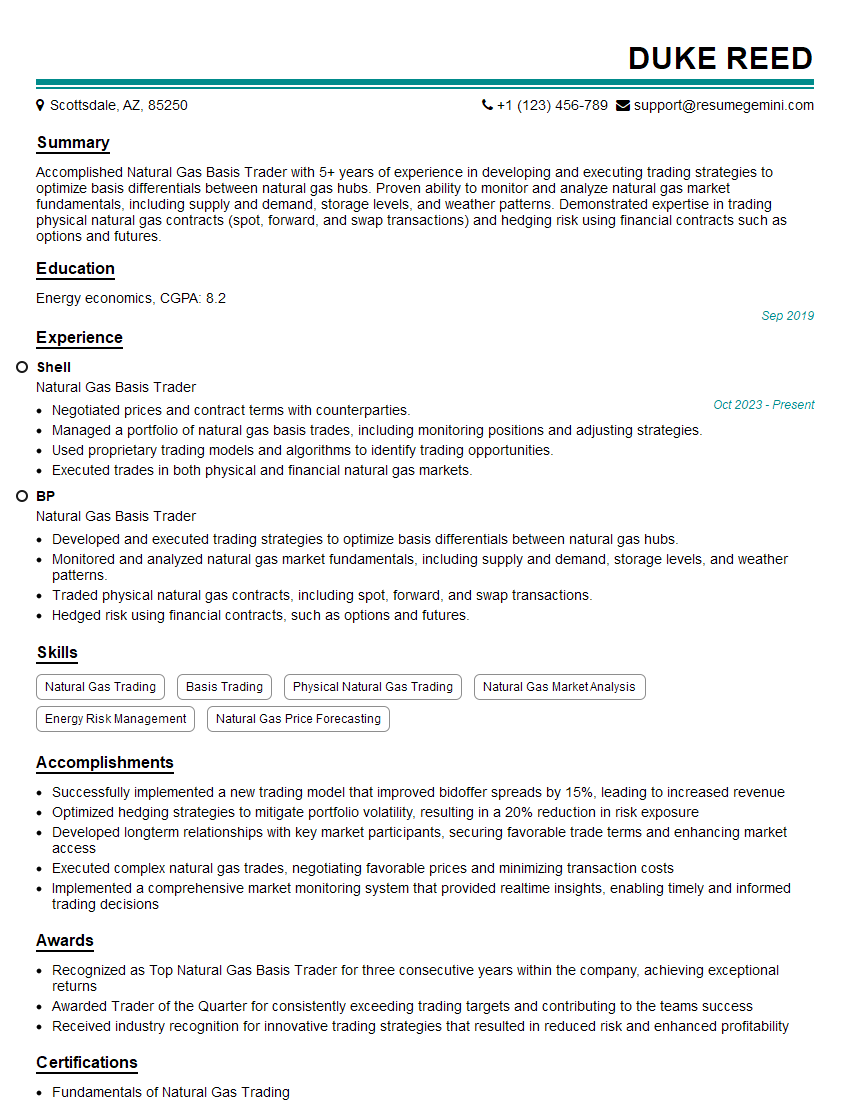

Duke Reed

Natural Gas Basis Trader

Summary

Accomplished Natural Gas Basis Trader with 5+ years of experience in developing and executing trading strategies to optimize basis differentials between natural gas hubs. Proven ability to monitor and analyze natural gas market fundamentals, including supply and demand, storage levels, and weather patterns. Demonstrated expertise in trading physical natural gas contracts (spot, forward, and swap transactions) and hedging risk using financial contracts such as options and futures.

Education

Energy economics

September 2019

Skills

- Natural Gas Trading

- Basis Trading

- Physical Natural Gas Trading

- Natural Gas Market Analysis

- Energy Risk Management

- Natural Gas Price Forecasting

Work Experience

Natural Gas Basis Trader

- Negotiated prices and contract terms with counterparties.

- Managed a portfolio of natural gas basis trades, including monitoring positions and adjusting strategies.

- Used proprietary trading models and algorithms to identify trading opportunities.

- Executed trades in both physical and financial natural gas markets.

Natural Gas Basis Trader

- Developed and executed trading strategies to optimize basis differentials between natural gas hubs.

- Monitored and analyzed natural gas market fundamentals, including supply and demand, storage levels, and weather patterns.

- Traded physical natural gas contracts, including spot, forward, and swap transactions.

- Hedged risk using financial contracts, such as options and futures.

Accomplishments

- Successfully implemented a new trading model that improved bidoffer spreads by 15%, leading to increased revenue

- Optimized hedging strategies to mitigate portfolio volatility, resulting in a 20% reduction in risk exposure

- Developed longterm relationships with key market participants, securing favorable trade terms and enhancing market access

- Executed complex natural gas trades, negotiating favorable prices and minimizing transaction costs

- Implemented a comprehensive market monitoring system that provided realtime insights, enabling timely and informed trading decisions

Awards

- Recognized as Top Natural Gas Basis Trader for three consecutive years within the company, achieving exceptional returns

- Awarded Trader of the Quarter for consistently exceeding trading targets and contributing to the teams success

- Received industry recognition for innovative trading strategies that resulted in reduced risk and enhanced profitability

Certificates

- Fundamentals of Natural Gas Trading

- Natural Gas Trading Strategies and Risk Management

- Energy Risk Professional (ERP)

- Certified Energy Trader (CET)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Natural Gas Basis Trader

- Quantify your accomplishments. Use specific numbers and metrics to demonstrate the impact of your work.

- Highlight your knowledge of natural gas markets. This industry-specific expertise is highly sought after.

- Showcase your analytical and problem-solving skills. The ability to interpret data and make sound decisions is crucial.

- Emphasize your communication and negotiation skills. You’ll be working with a variety of stakeholders, so these skills are essential.

Essential Experience Highlights for a Strong Natural Gas Basis Trader Resume

- Developed and executed trading strategies to optimize basis differentials between natural gas hubs.

- Monitored and analyzed natural gas market fundamentals, including supply and demand, storage levels, and weather patterns.

- Traded physical natural gas contracts, including spot, forward, and swap transactions.

- Hedged risk using financial contracts, such as options and futures.

- Negotiated prices and contract terms with counterparties.

- Managed a portfolio of natural gas basis trades, including monitoring positions and adjusting strategies.

- Used proprietary trading models and algorithms to identify trading opportunities.

Frequently Asked Questions (FAQ’s) For Natural Gas Basis Trader

What is the role of a Natural Gas Basis Trader?

A Natural Gas Basis Trader develops and executes trading strategies to optimize basis differentials between natural gas hubs. They analyze market fundamentals, trade physical and financial contracts, and manage risk to maximize profitability.

What skills are required to be a Natural Gas Basis Trader?

Strong analytical and problem-solving skills, knowledge of natural gas markets, experience in trading physical and financial contracts, and excellent communication and negotiation skills are essential.

What is the career path for a Natural Gas Basis Trader?

With experience and success, Natural Gas Basis Traders can advance to roles such as Portfolio Manager, Risk Manager, or Trading Manager.

What is the job outlook for Natural Gas Basis Traders?

The job outlook is expected to be good as the demand for natural gas continues to grow.

What is the salary range for Natural Gas Basis Traders?

The salary range can vary depending on experience, skills, and company size, but typically ranges from $100,000 to $200,000 per year.

What is the work environment for Natural Gas Basis Traders?

Natural Gas Basis Traders typically work in fast-paced, high-pressure trading environments.