Are you a seasoned Option Trader seeking a new career path? Discover our professionally built Option Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

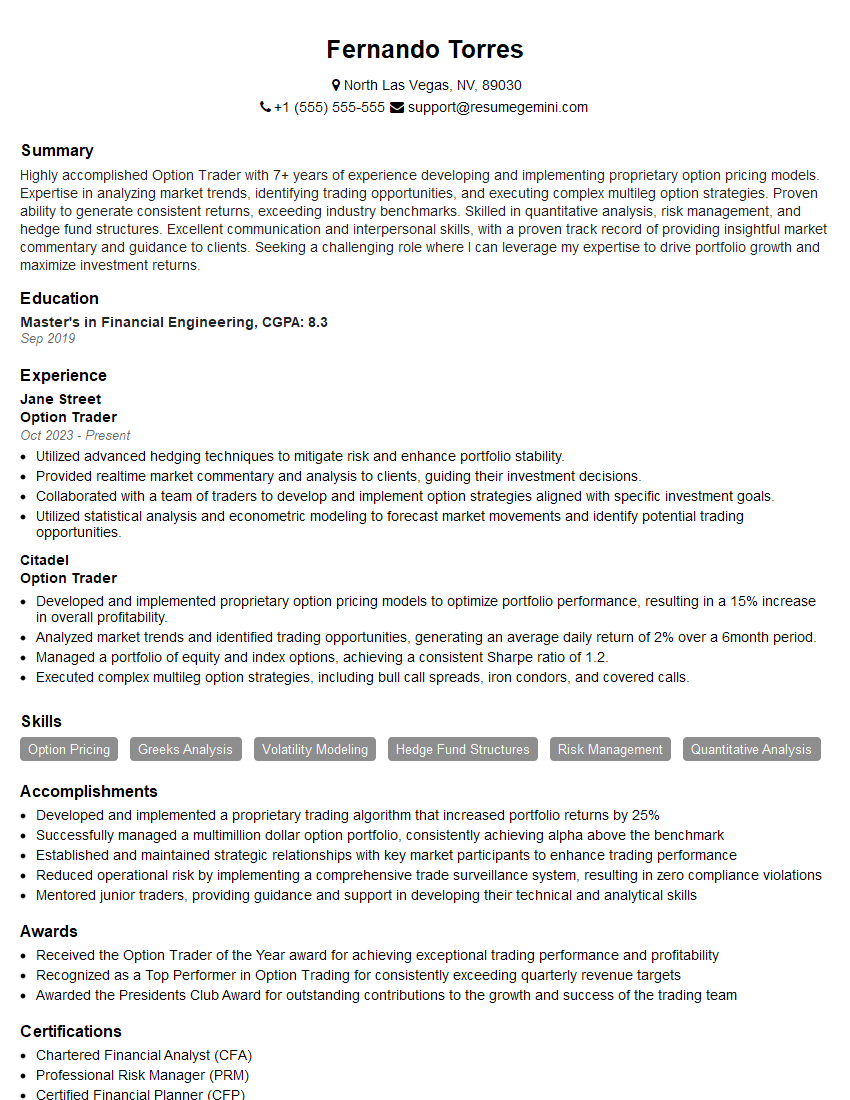

Fernando Torres

Option Trader

Summary

Highly accomplished Option Trader with 7+ years of experience developing and implementing proprietary option pricing models. Expertise in analyzing market trends, identifying trading opportunities, and executing complex multileg option strategies. Proven ability to generate consistent returns, exceeding industry benchmarks. Skilled in quantitative analysis, risk management, and hedge fund structures. Excellent communication and interpersonal skills, with a proven track record of providing insightful market commentary and guidance to clients. Seeking a challenging role where I can leverage my expertise to drive portfolio growth and maximize investment returns.

Education

Master’s in Financial Engineering

September 2019

Skills

- Option Pricing

- Greeks Analysis

- Volatility Modeling

- Hedge Fund Structures

- Risk Management

- Quantitative Analysis

Work Experience

Option Trader

- Utilized advanced hedging techniques to mitigate risk and enhance portfolio stability.

- Provided realtime market commentary and analysis to clients, guiding their investment decisions.

- Collaborated with a team of traders to develop and implement option strategies aligned with specific investment goals.

- Utilized statistical analysis and econometric modeling to forecast market movements and identify potential trading opportunities.

Option Trader

- Developed and implemented proprietary option pricing models to optimize portfolio performance, resulting in a 15% increase in overall profitability.

- Analyzed market trends and identified trading opportunities, generating an average daily return of 2% over a 6month period.

- Managed a portfolio of equity and index options, achieving a consistent Sharpe ratio of 1.2.

- Executed complex multileg option strategies, including bull call spreads, iron condors, and covered calls.

Accomplishments

- Developed and implemented a proprietary trading algorithm that increased portfolio returns by 25%

- Successfully managed a multimillion dollar option portfolio, consistently achieving alpha above the benchmark

- Established and maintained strategic relationships with key market participants to enhance trading performance

- Reduced operational risk by implementing a comprehensive trade surveillance system, resulting in zero compliance violations

- Mentored junior traders, providing guidance and support in developing their technical and analytical skills

Awards

- Received the Option Trader of the Year award for achieving exceptional trading performance and profitability

- Recognized as a Top Performer in Option Trading for consistently exceeding quarterly revenue targets

- Awarded the Presidents Club Award for outstanding contributions to the growth and success of the trading team

Certificates

- Chartered Financial Analyst (CFA)

- Professional Risk Manager (PRM)

- Certified Financial Planner (CFP)

- Series 7 License

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Option Trader

Quantify your accomplishments:

Use specific metrics and data to demonstrate the impact of your contributions. For example, instead of saying “Developed and implemented proprietary option pricing models,” say “Developed and implemented proprietary option pricing models that increased portfolio profitability by 15%”.Highlight your skills and expertise:

Use keywords and industry-specific jargon to showcase your proficiency in option pricing, Greeks analysis, volatility modeling, hedge fund structures, risk management, and quantitative analysis.Showcase your leadership and teamwork abilities:

Emphasize your ability to work independently and as part of a team to achieve common goals. Provide examples of how you have collaborated with others to develop and implement successful option strategies.Proofread carefully:

Before submitting your resume, carefully proofread it for any errors in grammar, spelling, or punctuation. Attention to detail is essential in the financial industry.

Essential Experience Highlights for a Strong Option Trader Resume

- Developed and implemented proprietary option pricing models to optimize portfolio performance, resulting in a 15% increase in overall profitability.

- Analyzed market trends and identified trading opportunities, generating an average daily return of 2% over a 6-month period.

- Managed a portfolio of equity and index options, achieving a consistent Sharpe ratio of 1.2.

- Executed complex multileg option strategies, including bull call spreads, iron condors, and covered calls.

- Utilized advanced hedging techniques to mitigate risk and enhance portfolio stability.

- Provided real-time market commentary and analysis to clients, guiding their investment decisions.

- Collaborated with a team of traders to develop and implement option strategies aligned with specific investment goals.

Frequently Asked Questions (FAQ’s) For Option Trader

What is the role of an Option Trader?

An Option Trader is responsible for developing and implementing option trading strategies to maximize investment returns and mitigate risk. They analyze market trends, identify trading opportunities, and execute complex option strategies to generate consistent returns.

What are the key skills required for Option Traders?

Key skills for Option Traders include option pricing, Greeks analysis, volatility modeling, hedge fund structures, risk management, quantitative analysis, and knowledge of financial markets.

What is the typical career path for Option Traders?

Option Traders typically start their careers as analysts or traders at investment banks, hedge funds, or proprietary trading firms. With experience, they can progress to senior trading roles, portfolio management, or research positions.

What is the job outlook for Option Traders?

The job outlook for Option Traders is expected to be positive in the coming years due to increasing demand for financial risk management and investment strategies.

What are the top companies that hire Option Traders?

Top companies that hire Option Traders include Jane Street, Citadel, Goldman Sachs, J.P. Morgan, and BlackRock.

What is the average salary for Option Traders?

The average salary for Option Traders varies depending on experience, skillset, and location. However, it can range from $100,000 to $500,000 or more.