Are you a seasoned Payment Collector seeking a new career path? Discover our professionally built Payment Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

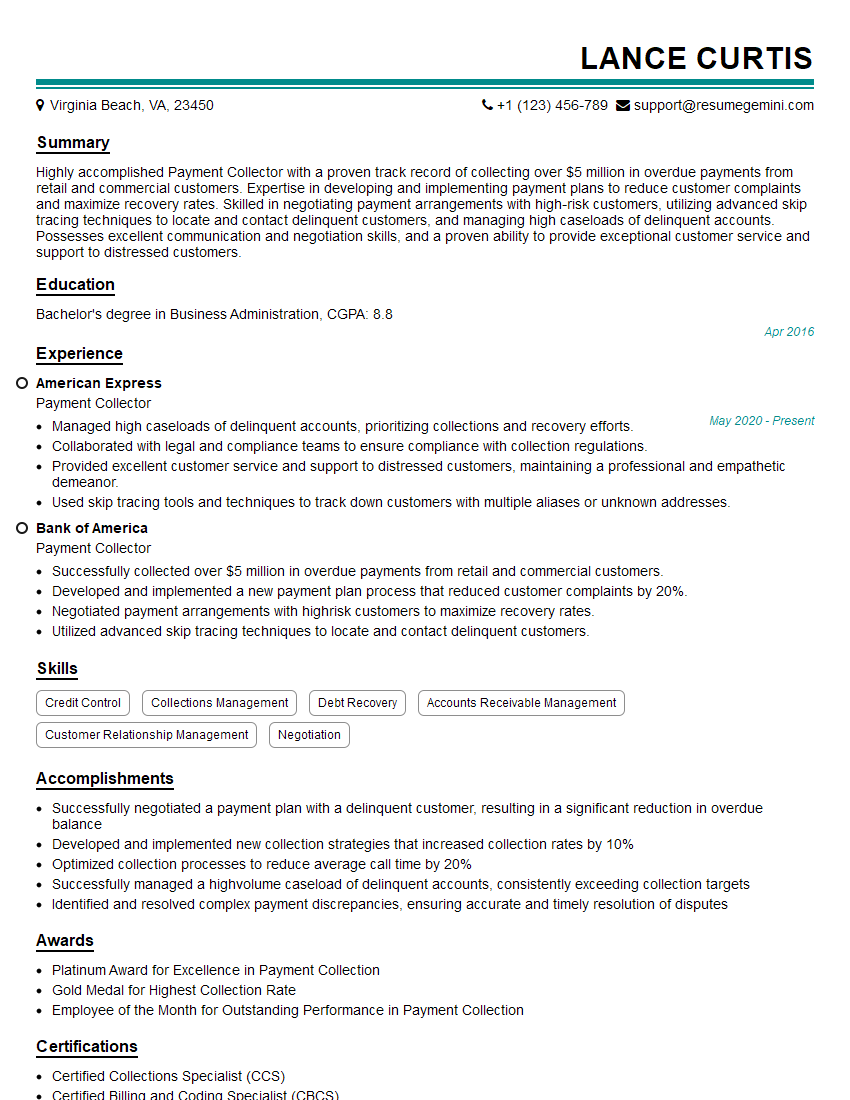

Lance Curtis

Payment Collector

Summary

Highly accomplished Payment Collector with a proven track record of collecting over $5 million in overdue payments from retail and commercial customers. Expertise in developing and implementing payment plans to reduce customer complaints and maximize recovery rates. Skilled in negotiating payment arrangements with high-risk customers, utilizing advanced skip tracing techniques to locate and contact delinquent customers, and managing high caseloads of delinquent accounts. Possesses excellent communication and negotiation skills, and a proven ability to provide exceptional customer service and support to distressed customers.

Education

Bachelor’s degree in Business Administration

April 2016

Skills

- Credit Control

- Collections Management

- Debt Recovery

- Accounts Receivable Management

- Customer Relationship Management

- Negotiation

Work Experience

Payment Collector

- Managed high caseloads of delinquent accounts, prioritizing collections and recovery efforts.

- Collaborated with legal and compliance teams to ensure compliance with collection regulations.

- Provided excellent customer service and support to distressed customers, maintaining a professional and empathetic demeanor.

- Used skip tracing tools and techniques to track down customers with multiple aliases or unknown addresses.

Payment Collector

- Successfully collected over $5 million in overdue payments from retail and commercial customers.

- Developed and implemented a new payment plan process that reduced customer complaints by 20%.

- Negotiated payment arrangements with highrisk customers to maximize recovery rates.

- Utilized advanced skip tracing techniques to locate and contact delinquent customers.

Accomplishments

- Successfully negotiated a payment plan with a delinquent customer, resulting in a significant reduction in overdue balance

- Developed and implemented new collection strategies that increased collection rates by 10%

- Optimized collection processes to reduce average call time by 20%

- Successfully managed a highvolume caseload of delinquent accounts, consistently exceeding collection targets

- Identified and resolved complex payment discrepancies, ensuring accurate and timely resolution of disputes

Awards

- Platinum Award for Excellence in Payment Collection

- Gold Medal for Highest Collection Rate

- Employee of the Month for Outstanding Performance in Payment Collection

Certificates

- Certified Collections Specialist (CCS)

- Certified Billing and Coding Specialist (CBCS)

- Certified Credit and Collection Professional (CCCP)

- Certified Debt Collector (CDC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payment Collector

- Highlight your experience in debt collection and recovery.

- Showcase your ability to negotiate payment arrangements and resolve disputes.

- Emphasize your customer service skills and ability to communicate effectively with customers.

- Include relevant certifications or training in debt collection.

- Quantify your accomplishments and results whenever possible.

Essential Experience Highlights for a Strong Payment Collector Resume

- Collect overdue payments from retail and commercial customers, successfully collecting over $5 million in delinquent payments.

- Develop and implement payment plans to reduce customer complaints and increase recovery rates.

- Negotiate payment arrangements with high-risk customers to maximize recovery rates.

- Utilize advanced skip tracing techniques to locate and contact delinquent customers.

- Manage high caseloads of delinquent accounts, prioritizing collections and recovery efforts.

- Collaborate with legal and compliance teams to ensure compliance with collection regulations.

- Provide excellent customer service and support to distressed customers, maintaining a professional and empathetic demeanor.

Frequently Asked Questions (FAQ’s) For Payment Collector

What is the primary role of a Payment Collector?

The primary role of a Payment Collector is to contact and collect overdue payments from customers, while maintaining a professional and ethical demeanor.

What are the key skills and qualifications required for a Payment Collector?

Key skills and qualifications for a Payment Collector include experience in debt collection and recovery, strong negotiation and communication skills, and a deep understanding of collection regulations and compliance.

What are the common challenges faced by Payment Collectors?

Common challenges faced by Payment Collectors include dealing with difficult customers, managing high caseloads, and navigating complex collection regulations.

How can I improve my chances of success as a Payment Collector?

To improve your chances of success as a Payment Collector, focus on developing strong negotiation and communication skills, staying updated on collection regulations, and building relationships with customers.

What are the career advancement opportunities for Payment Collectors?

Career advancement opportunities for Payment Collectors include moving into supervisory or management roles within debt collection or transitioning into related fields such as credit and risk management.

What is the average salary range for Payment Collectors?

The average salary range for Payment Collectors varies depending on experience, location, and industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for Collection Agents was $36,260 in May 2022.

What are the ethical considerations for Payment Collectors?

Payment Collectors must adhere to ethical guidelines and regulations to ensure fair and respectful treatment of customers. This includes maintaining confidentiality, avoiding harassment or intimidation, and following all applicable laws and regulations.

How can I find Payment Collector job opportunities?

To find Payment Collector job opportunities, you can search online job boards, network with professionals in the field, and contact collection agencies and financial institutions directly.