Are you a seasoned Payroll Associate seeking a new career path? Discover our professionally built Payroll Associate Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

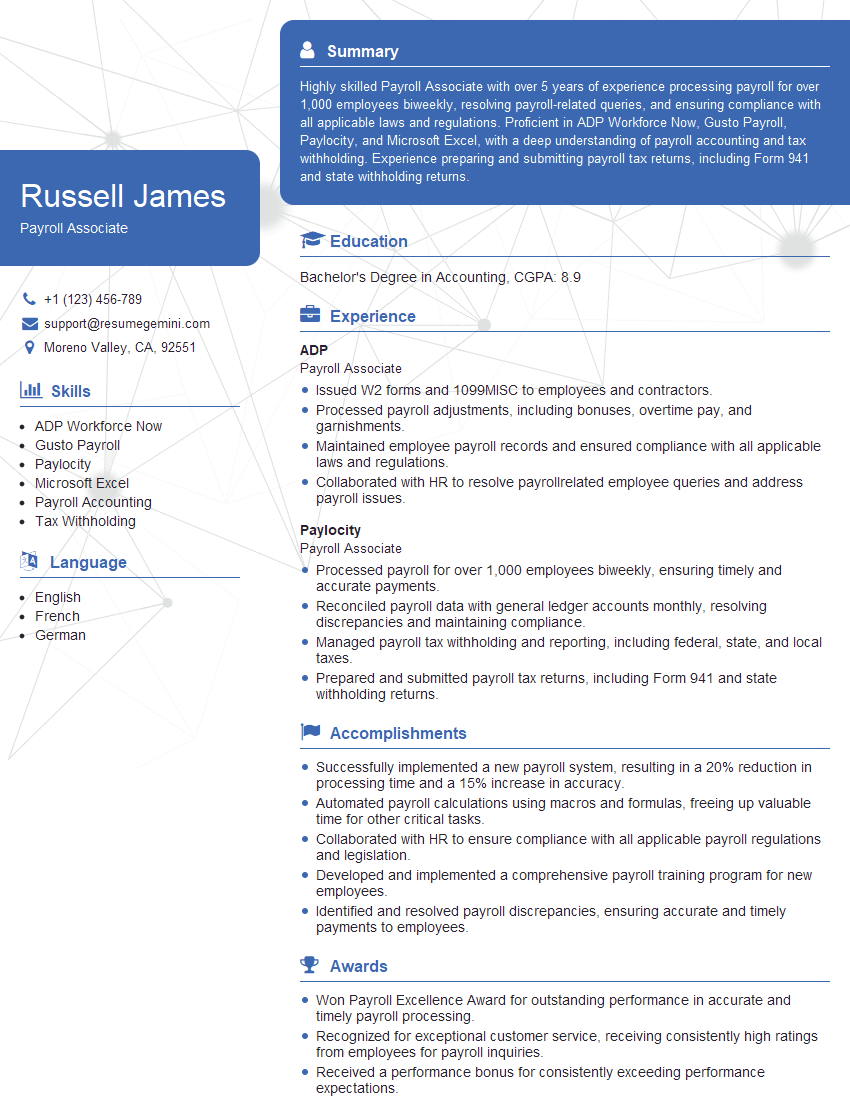

Russell James

Payroll Associate

Summary

Highly skilled Payroll Associate with over 5 years of experience processing payroll for over 1,000 employees biweekly, resolving payroll-related queries, and ensuring compliance with all applicable laws and regulations. Proficient in ADP Workforce Now, Gusto Payroll, Paylocity, and Microsoft Excel, with a deep understanding of payroll accounting and tax withholding. Experience preparing and submitting payroll tax returns, including Form 941 and state withholding returns.

Education

Bachelor’s Degree in Accounting

October 2017

Skills

- ADP Workforce Now

- Gusto Payroll

- Paylocity

- Microsoft Excel

- Payroll Accounting

- Tax Withholding

Work Experience

Payroll Associate

- Issued W2 forms and 1099MISC to employees and contractors.

- Processed payroll adjustments, including bonuses, overtime pay, and garnishments.

- Maintained employee payroll records and ensured compliance with all applicable laws and regulations.

- Collaborated with HR to resolve payrollrelated employee queries and address payroll issues.

Payroll Associate

- Processed payroll for over 1,000 employees biweekly, ensuring timely and accurate payments.

- Reconciled payroll data with general ledger accounts monthly, resolving discrepancies and maintaining compliance.

- Managed payroll tax withholding and reporting, including federal, state, and local taxes.

- Prepared and submitted payroll tax returns, including Form 941 and state withholding returns.

Accomplishments

- Successfully implemented a new payroll system, resulting in a 20% reduction in processing time and a 15% increase in accuracy.

- Automated payroll calculations using macros and formulas, freeing up valuable time for other critical tasks.

- Collaborated with HR to ensure compliance with all applicable payroll regulations and legislation.

- Developed and implemented a comprehensive payroll training program for new employees.

- Identified and resolved payroll discrepancies, ensuring accurate and timely payments to employees.

Awards

- Won Payroll Excellence Award for outstanding performance in accurate and timely payroll processing.

- Recognized for exceptional customer service, receiving consistently high ratings from employees for payroll inquiries.

- Received a performance bonus for consistently exceeding performance expectations.

- Recognized for innovative use of technology to improve payroll efficiency.

Certificates

- Certified Payroll Professional (CPP)

- American Payroll Association (APA)

- National Payroll Reporting Consortium (NPRC)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Associate

- Highlight your proficiency in payroll software and your understanding of payroll accounting and tax withholding.

- Provide specific examples of your experience managing payroll for a large number of employees.

- Quantify your accomplishments whenever possible, such as the number of payroll errors you resolved or the amount of money you saved the company through payroll optimization.

- Proofread your resume carefully for any errors. A well-written resume will make you stand out from other candidates.

Essential Experience Highlights for a Strong Payroll Associate Resume

- Processed payroll for over 1,000 employees biweekly, ensuring timely and accurate payments.

- Reconciled payroll data with general ledger accounts monthly, resolving discrepancies and maintaining compliance.

- Managed payroll tax withholding and reporting, including federal, state, and local taxes.

- Prepared and submitted payroll tax returns, including Form 941 and state withholding returns.

- Issued W2 forms and 1099MISC to employees and contractors.

- Processed payroll adjustments, including bonuses, overtime pay, and garnishments.

- Maintained employee payroll records and ensured compliance with all applicable laws and regulations.

Frequently Asked Questions (FAQ’s) For Payroll Associate

What is the role of a Payroll Associate?

A Payroll Associate is responsible for processing payroll, managing payroll tax withholding and reporting, and ensuring compliance with all applicable laws and regulations.

What skills are required to be a Payroll Associate?

Payroll Associates should have a strong understanding of payroll accounting and tax withholding, as well as proficiency in payroll software.

What is the career path for a Payroll Associate?

Payroll Associates can advance to roles such as Payroll Manager, Payroll Supervisor, or Human Resources Manager.

What is the average salary for a Payroll Associate?

The average salary for a Payroll Associate is around $55,000 per year.

What are the benefits of working as a Payroll Associate?

Payroll Associates enjoy a stable career with good benefits and the opportunity to make a real difference in the lives of employees.

What are the challenges of working as a Payroll Associate?

Payroll Associates can face challenges such as strict deadlines, complex regulations, and the need to maintain accuracy and confidentiality.