Are you a seasoned Payroll Clerk seeking a new career path? Discover our professionally built Payroll Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

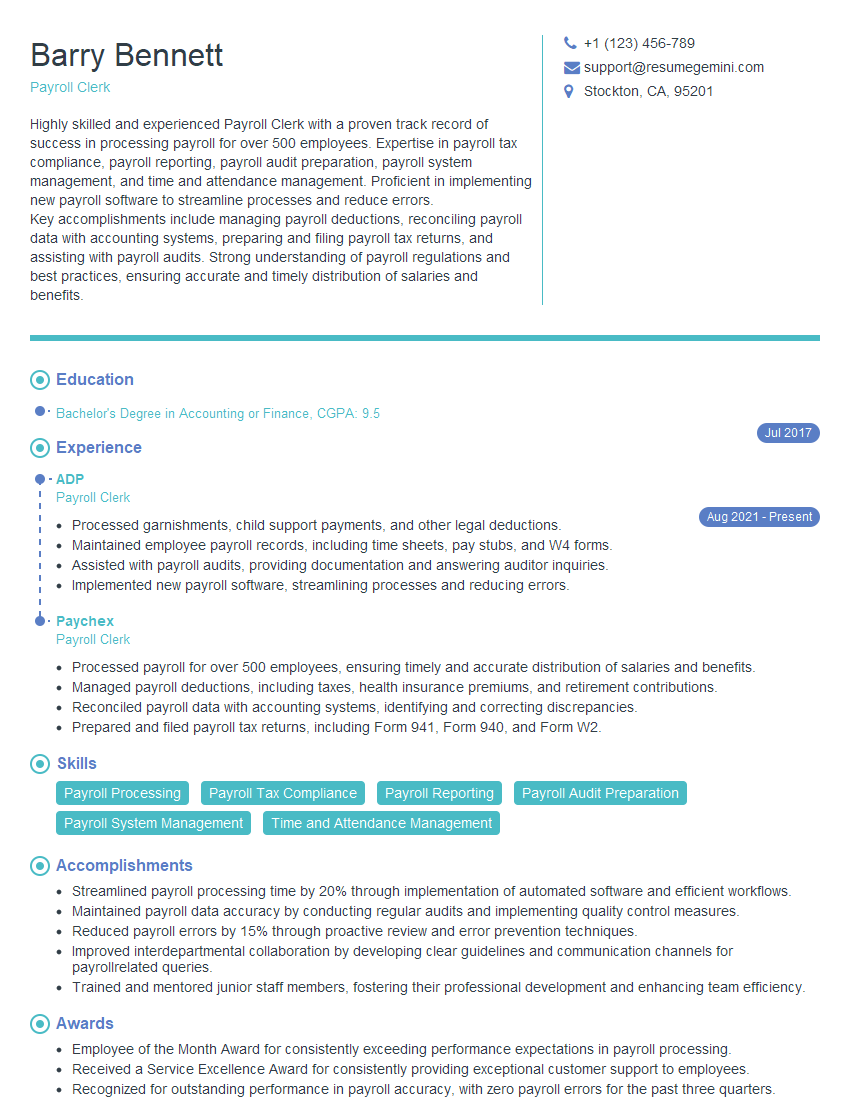

Barry Bennett

Payroll Clerk

Summary

Highly skilled and experienced Payroll Clerk with a proven track record of success in processing payroll for over 500 employees. Expertise in payroll tax compliance, payroll reporting, payroll audit preparation, payroll system management, and time and attendance management. Proficient in implementing new payroll software to streamline processes and reduce errors.

Key accomplishments include managing payroll deductions, reconciling payroll data with accounting systems, preparing and filing payroll tax returns, and assisting with payroll audits. Strong understanding of payroll regulations and best practices, ensuring accurate and timely distribution of salaries and benefits.

Education

Bachelor’s Degree in Accounting or Finance

July 2017

Skills

- Payroll Processing

- Payroll Tax Compliance

- Payroll Reporting

- Payroll Audit Preparation

- Payroll System Management

- Time and Attendance Management

Work Experience

Payroll Clerk

- Processed garnishments, child support payments, and other legal deductions.

- Maintained employee payroll records, including time sheets, pay stubs, and W4 forms.

- Assisted with payroll audits, providing documentation and answering auditor inquiries.

- Implemented new payroll software, streamlining processes and reducing errors.

Payroll Clerk

- Processed payroll for over 500 employees, ensuring timely and accurate distribution of salaries and benefits.

- Managed payroll deductions, including taxes, health insurance premiums, and retirement contributions.

- Reconciled payroll data with accounting systems, identifying and correcting discrepancies.

- Prepared and filed payroll tax returns, including Form 941, Form 940, and Form W2.

Accomplishments

- Streamlined payroll processing time by 20% through implementation of automated software and efficient workflows.

- Maintained payroll data accuracy by conducting regular audits and implementing quality control measures.

- Reduced payroll errors by 15% through proactive review and error prevention techniques.

- Improved interdepartmental collaboration by developing clear guidelines and communication channels for payrollrelated queries.

- Trained and mentored junior staff members, fostering their professional development and enhancing team efficiency.

Awards

- Employee of the Month Award for consistently exceeding performance expectations in payroll processing.

- Received a Service Excellence Award for consistently providing exceptional customer support to employees.

- Recognized for outstanding performance in payroll accuracy, with zero payroll errors for the past three quarters.

- Certified Payroll Professional (CPP) certification, demonstrating a high level of proficiency in payroll processing.

Certificates

- Certified Payroll Professional (CPP)

- Fundamental Payroll Certification (FPC)

- American Payroll Association (APA) Membership

- National Payroll Reporting Consortium (NPRC) Membership

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Clerk

- Highlight your experience in payroll processing and tax compliance. Quantify your accomplishments with specific numbers and metrics whenever possible.

- Demonstrate your proficiency in payroll software and systems. Mention any certifications or training you have received.

- Showcase your attention to detail and accuracy. Payroll clerks are responsible for handling sensitive financial information, so emphasizing your ability to work accurately is crucial.

- Emphasize your communication and interpersonal skills. Payroll clerks often interact with employees and other departments, so highlighting your ability to communicate effectively is important.

Essential Experience Highlights for a Strong Payroll Clerk Resume

- Process payroll for a large number of employees, ensuring timely and accurate distribution of salaries and benefits

- Manage payroll deductions, including taxes, health insurance premiums, and retirement contributions

- Reconcile payroll data with accounting systems, identifying and correcting discrepancies

- Prepare and file payroll tax returns, including Form 941, Form 940, and Form W2

- Process garnishments, child support payments, and other legal deductions

- Maintain employee payroll records, including time sheets, pay stubs, and W4 forms

- Assist with payroll audits, providing documentation and answering auditor inquiries

Frequently Asked Questions (FAQ’s) For Payroll Clerk

What are the key responsibilities of a Payroll Clerk?

Payroll Clerks are responsible for processing payroll, managing payroll deductions, reconciling payroll data, preparing and filing payroll tax returns, and maintaining employee payroll records.

What qualifications are required to become a Payroll Clerk?

Most Payroll Clerks have a high school diploma or equivalent, but some employers may prefer candidates with a bachelor’s degree in accounting or finance.

What are the career prospects for a Payroll Clerk?

Payroll Clerks can advance to positions such as Payroll Manager, Human Resources Manager, or Accountant.

What is the average salary for a Payroll Clerk?

The average salary for a Payroll Clerk is around $45,000 per year.

What are the benefits of working as a Payroll Clerk?

Payroll Clerks enjoy a stable job with regular hours and benefits such as health insurance, paid time off, and retirement plans.

What are the challenges of working as a Payroll Clerk?

Payroll Clerks must be able to work accurately and meet deadlines. They must also be able to handle confidential information and interact with employees and other departments.

What are the most important skills for a Payroll Clerk?

The most important skills for a Payroll Clerk are attention to detail, accuracy, communication skills, and proficiency in payroll software and systems.

What is the job outlook for Payroll Clerks?

The job outlook for Payroll Clerks is expected to grow in the coming years due to the increasing complexity of payroll regulations.