Are you a seasoned Payroll Examiner seeking a new career path? Discover our professionally built Payroll Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

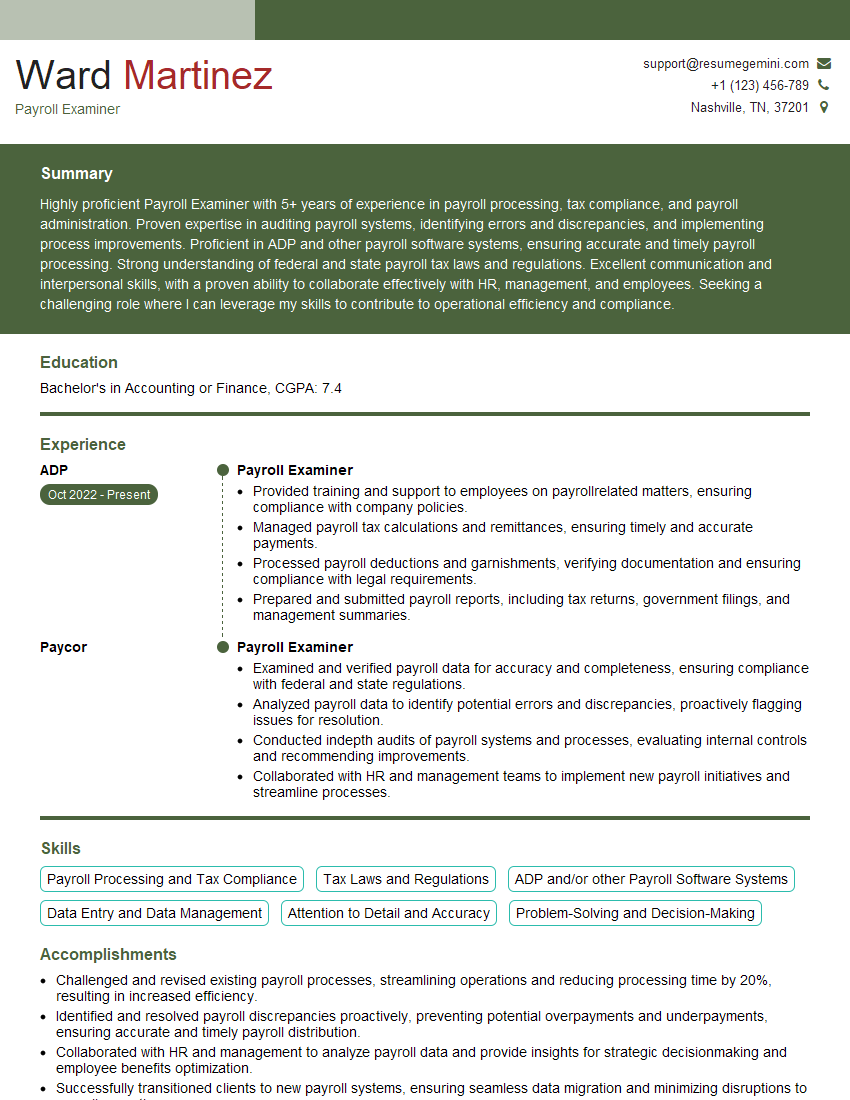

Ward Martinez

Payroll Examiner

Summary

Highly proficient Payroll Examiner with 5+ years of experience in payroll processing, tax compliance, and payroll administration. Proven expertise in auditing payroll systems, identifying errors and discrepancies, and implementing process improvements. Proficient in ADP and other payroll software systems, ensuring accurate and timely payroll processing. Strong understanding of federal and state payroll tax laws and regulations. Excellent communication and interpersonal skills, with a proven ability to collaborate effectively with HR, management, and employees. Seeking a challenging role where I can leverage my skills to contribute to operational efficiency and compliance.

Education

Bachelor’s in Accounting or Finance

September 2018

Skills

- Payroll Processing and Tax Compliance

- Tax Laws and Regulations

- ADP and/or other Payroll Software Systems

- Data Entry and Data Management

- Attention to Detail and Accuracy

- Problem-Solving and Decision-Making

Work Experience

Payroll Examiner

- Provided training and support to employees on payrollrelated matters, ensuring compliance with company policies.

- Managed payroll tax calculations and remittances, ensuring timely and accurate payments.

- Processed payroll deductions and garnishments, verifying documentation and ensuring compliance with legal requirements.

- Prepared and submitted payroll reports, including tax returns, government filings, and management summaries.

Payroll Examiner

- Examined and verified payroll data for accuracy and completeness, ensuring compliance with federal and state regulations.

- Analyzed payroll data to identify potential errors and discrepancies, proactively flagging issues for resolution.

- Conducted indepth audits of payroll systems and processes, evaluating internal controls and recommending improvements.

- Collaborated with HR and management teams to implement new payroll initiatives and streamline processes.

Accomplishments

- Challenged and revised existing payroll processes, streamlining operations and reducing processing time by 20%, resulting in increased efficiency.

- Identified and resolved payroll discrepancies proactively, preventing potential overpayments and underpayments, ensuring accurate and timely payroll distribution.

- Collaborated with HR and management to analyze payroll data and provide insights for strategic decisionmaking and employee benefits optimization.

- Successfully transitioned clients to new payroll systems, ensuring seamless data migration and minimizing disruptions to payroll operations.

- Participated in industry training and certification programs to enhance knowledge and stay abreast of the latest payroll industry trends and regulations.

Awards

- Received the Payroll Accuracy Excellence Award for maintaining an exceptional payroll accuracy rate consistently exceeding 99.9%.

- Awarded the Payroll Compliance Champion Award for successfully implementing and adhering to complex payroll regulations, ensuring compliance with all applicable laws and guidelines.

- Honored with the Payroll Excellence Award for consistently exceeding performance standards, delivering highquality payroll services that met all client expectations.

- Received the Payroll Innovation Award for developing a novel payroll auditing tool that significantly improved the accuracy and efficiency of payroll reviews.

Certificates

- Certified Payroll Professional (CPP)

- American Payroll Association (APA)

- Certified Payroll Examiner (CPE)

- Intuit Certified ProAdvisor

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Examiner

- Highlight your proficiency in payroll processing and tax compliance, as these are key responsibilities of a Payroll Examiner.

- Showcase your experience in auditing payroll systems and identifying errors, as this demonstrates your attention to detail and analytical skills.

- Emphasize your ability to implement process improvements, as this highlights your problem-solving and efficiency-oriented mindset.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

Essential Experience Highlights for a Strong Payroll Examiner Resume

- Examined and verified payroll data for accuracy and completeness, ensuring compliance with federal and state regulations.

- Analyzed payroll data to identify potential errors and discrepancies, proactively flagging issues for resolution.

- Conducted in-depth audits of payroll systems and processes, evaluating internal controls and recommending improvements.

- Collaborated with HR and management teams to implement new payroll initiatives and streamline processes.

- Provided training and support to employees on payroll-related matters, ensuring compliance with company policies.

- Managed payroll tax calculations and remittances, ensuring timely and accurate payments.

Frequently Asked Questions (FAQ’s) For Payroll Examiner

What are the primary responsibilities of a Payroll Examiner?

The primary responsibilities of a Payroll Examiner include examining and verifying payroll data for accuracy and completeness, analyzing payroll data to identify potential errors and discrepancies, conducting in-depth audits of payroll systems and processes, collaborating with HR and management teams to implement new payroll initiatives and streamline processes, and providing training and support to employees on payroll-related matters.

What qualifications are typically required to become a Payroll Examiner?

The minimum qualification to become a Payroll Examiner is usually a high school diploma or equivalent, but most employers prefer candidates with a bachelor’s degree in accounting, finance, or a related field.

What skills are essential for a successful Payroll Examiner?

Essential skills for a successful Payroll Examiner include strong analytical and problem-solving abilities, proficiency in Microsoft Office Suite and payroll software systems, excellent attention to detail and accuracy, and effective communication and interpersonal skills.

What is the average salary range for a Payroll Examiner?

The average salary range for a Payroll Examiner varies depending on experience, location, and company size, but typically falls between $40,000 and $70,000 per year.

What are the career advancement opportunities for a Payroll Examiner?

With experience and additional qualifications, a Payroll Examiner can advance to roles such as Payroll Manager, Payroll Supervisor, or Human Resources Manager.

What are the key challenges faced by Payroll Examiners?

Common challenges faced by Payroll Examiners include staying up-to-date with changing tax laws and regulations, ensuring compliance with payroll-related laws and regulations, and maintaining confidentiality of employee payroll information.