Are you a seasoned Peer Financial Counselor seeking a new career path? Discover our professionally built Peer Financial Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

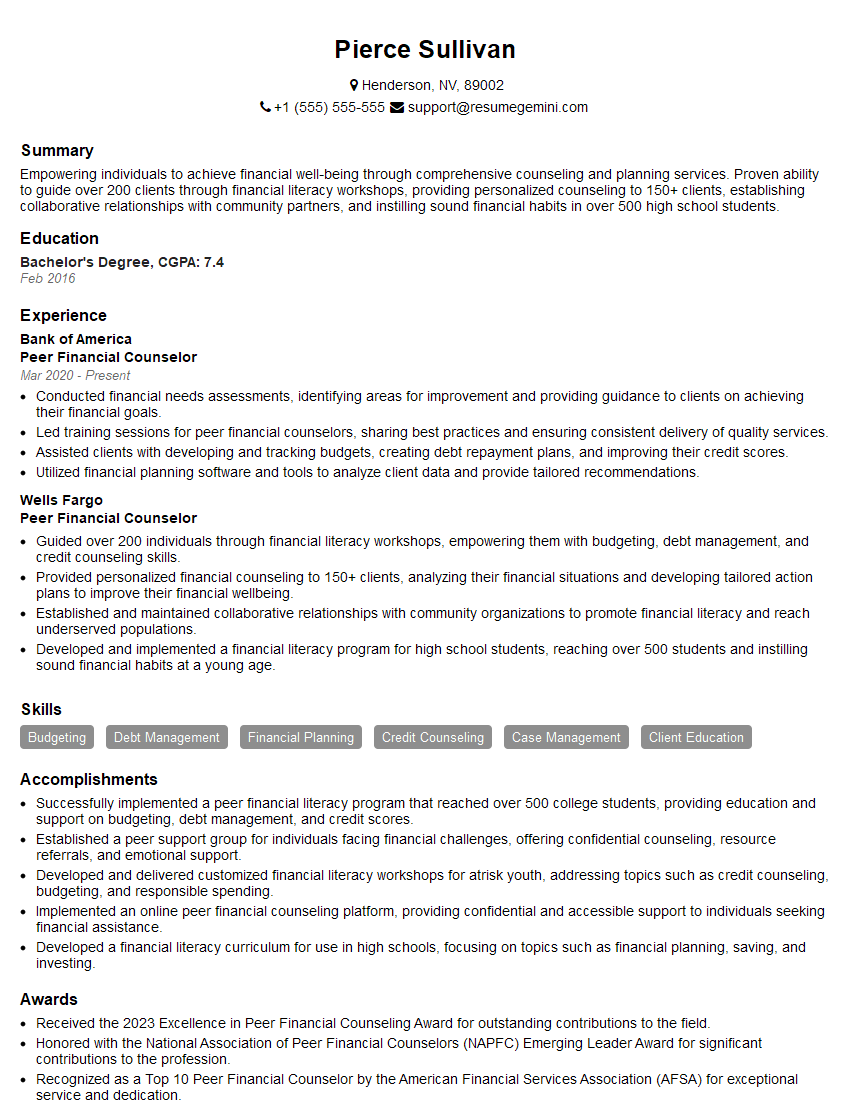

Pierce Sullivan

Peer Financial Counselor

Summary

Empowering individuals to achieve financial well-being through comprehensive counseling and planning services. Proven ability to guide over 200 clients through financial literacy workshops, providing personalized counseling to 150+ clients, establishing collaborative relationships with community partners, and instilling sound financial habits in over 500 high school students.

Education

Bachelor’s Degree

February 2016

Skills

- Budgeting

- Debt Management

- Financial Planning

- Credit Counseling

- Case Management

- Client Education

Work Experience

Peer Financial Counselor

- Conducted financial needs assessments, identifying areas for improvement and providing guidance to clients on achieving their financial goals.

- Led training sessions for peer financial counselors, sharing best practices and ensuring consistent delivery of quality services.

- Assisted clients with developing and tracking budgets, creating debt repayment plans, and improving their credit scores.

- Utilized financial planning software and tools to analyze client data and provide tailored recommendations.

Peer Financial Counselor

- Guided over 200 individuals through financial literacy workshops, empowering them with budgeting, debt management, and credit counseling skills.

- Provided personalized financial counseling to 150+ clients, analyzing their financial situations and developing tailored action plans to improve their financial wellbeing.

- Established and maintained collaborative relationships with community organizations to promote financial literacy and reach underserved populations.

- Developed and implemented a financial literacy program for high school students, reaching over 500 students and instilling sound financial habits at a young age.

Accomplishments

- Successfully implemented a peer financial literacy program that reached over 500 college students, providing education and support on budgeting, debt management, and credit scores.

- Established a peer support group for individuals facing financial challenges, offering confidential counseling, resource referrals, and emotional support.

- Developed and delivered customized financial literacy workshops for atrisk youth, addressing topics such as credit counseling, budgeting, and responsible spending.

- Implemented an online peer financial counseling platform, providing confidential and accessible support to individuals seeking financial assistance.

- Developed a financial literacy curriculum for use in high schools, focusing on topics such as financial planning, saving, and investing.

Awards

- Received the 2023 Excellence in Peer Financial Counseling Award for outstanding contributions to the field.

- Honored with the National Association of Peer Financial Counselors (NAPFC) Emerging Leader Award for significant contributions to the profession.

- Recognized as a Top 10 Peer Financial Counselor by the American Financial Services Association (AFSA) for exceptional service and dedication.

- Awarded the Presidents Volunteer Service Award for contributing over 500 hours of pro bono financial counseling services to the local community.

Certificates

- Certified Financial Counselor (CFC)

- Certified Peer Support Specialist (CPSS)

- National Foundation for Credit Counseling (NFCC) Certified Credit Counselor (CCC)

- Financial Literacy Certification Commission (FLCC) Certified Financial Literacy Educator (CFLE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Peer Financial Counselor

- Highlight your passion for financial empowerment and your ability to connect with clients on a personal level.

- Quantify your accomplishments with specific metrics to demonstrate the impact of your work.

- Showcase your proficiency in financial concepts, counseling techniques, and software tools.

- Include testimonials or letters of recommendation from clients or colleagues to add credibility to your application.

- Consider obtaining industry certifications, such as the Certified Financial Counselor (CFC) or the Personal Finance Counselor (PFC), to enhance your professional standing.

Essential Experience Highlights for a Strong Peer Financial Counselor Resume

- Conduct financial needs assessments to identify areas for improvement and develop tailored action plans.

- Provide financial counseling on budgeting, debt management, credit repair, and financial planning.

- Collaborate with community organizations to promote financial literacy and reach underserved populations.

- Develop and implement financial literacy programs for diverse audiences, including high school students and adults.

- Analyze client data using financial planning software and tools to provide customized recommendations.

- Lead training sessions for peer financial counselors to ensure consistent delivery of quality services.

- Track client progress and provide ongoing support to help them achieve their financial goals.

Frequently Asked Questions (FAQ’s) For Peer Financial Counselor

What is the role of a Peer Financial Counselor?

A Peer Financial Counselor provides financial guidance and support to individuals and families, helping them improve their financial literacy, manage their finances effectively, and achieve their financial goals

What are the qualifications for becoming a Peer Financial Counselor?

Typically, a Bachelor’s Degree in a related field such as finance, social work, or counseling is required. Additional certifications or experience in financial counseling is also beneficial

What skills are essential for a Peer Financial Counselor?

Excellent communication and interpersonal skills, strong financial knowledge, proficiency in financial planning software, and a passion for empowering others to improve their financial well-being

What is the job outlook for Peer Financial Counselors?

The job outlook for Peer Financial Counselors is expected to grow faster than average as the demand for financial literacy and counseling services continues to rise

What are the earning prospects for Peer Financial Counselors?

The earning potential for Peer Financial Counselors can vary depending on their experience, location, and organization. However, salaries generally range from $40,000 to $70,000 annually

What are the challenges faced by Peer Financial Counselors?

Peer Financial Counselors may face challenges related to working with clients from diverse backgrounds and with varying financial situations. They may also encounter emotional situations and ethical dilemmas that require empathy, discretion, and professional judgment

How can I become a successful Peer Financial Counselor?

To become a successful Peer Financial Counselor, it is important to have a strong foundation in financial principles, develop effective counseling skills, build a network of professional contacts, and stay abreast of industry trends and best practices