Are you a seasoned Pension Agent seeking a new career path? Discover our professionally built Pension Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

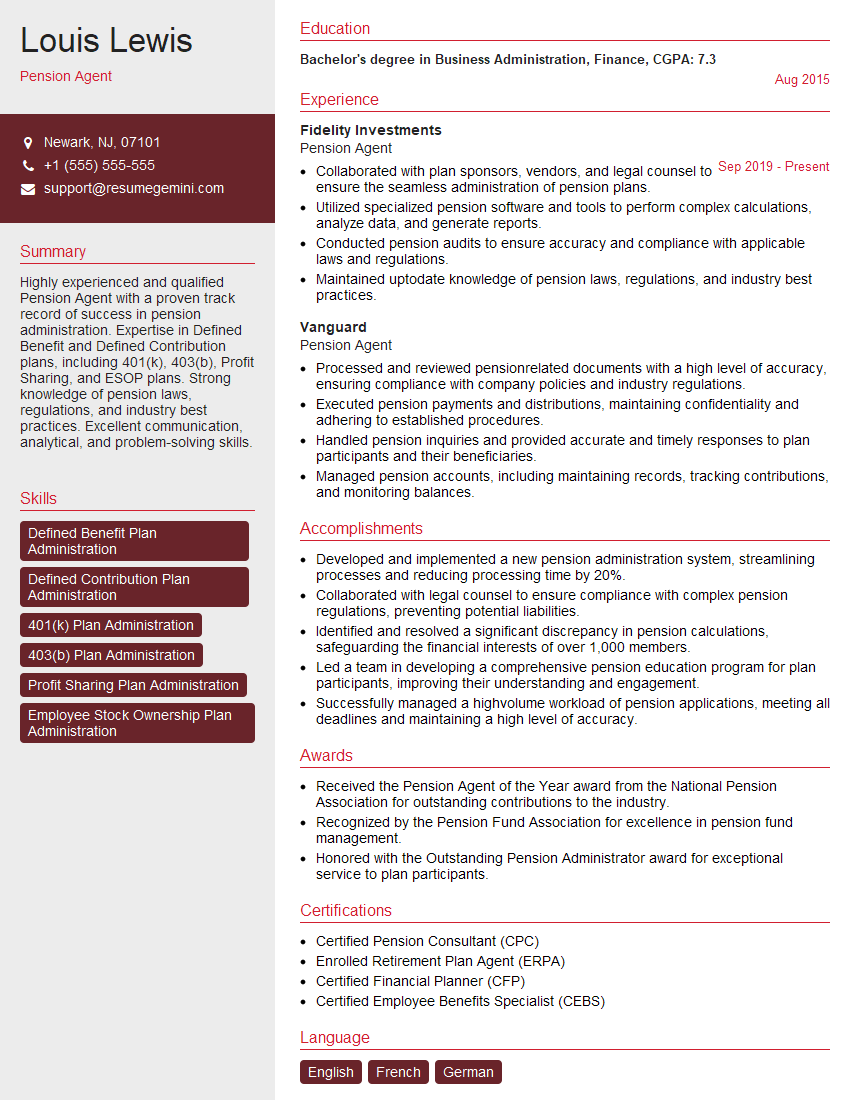

Louis Lewis

Pension Agent

Summary

Highly experienced and qualified Pension Agent with a proven track record of success in pension administration. Expertise in Defined Benefit and Defined Contribution plans, including 401(k), 403(b), Profit Sharing, and ESOP plans. Strong knowledge of pension laws, regulations, and industry best practices. Excellent communication, analytical, and problem-solving skills.

Education

Bachelor’s degree in Business Administration, Finance

August 2015

Skills

- Defined Benefit Plan Administration

- Defined Contribution Plan Administration

- 401(k) Plan Administration

- 403(b) Plan Administration

- Profit Sharing Plan Administration

- Employee Stock Ownership Plan Administration

Work Experience

Pension Agent

- Collaborated with plan sponsors, vendors, and legal counsel to ensure the seamless administration of pension plans.

- Utilized specialized pension software and tools to perform complex calculations, analyze data, and generate reports.

- Conducted pension audits to ensure accuracy and compliance with applicable laws and regulations.

- Maintained uptodate knowledge of pension laws, regulations, and industry best practices.

Pension Agent

- Processed and reviewed pensionrelated documents with a high level of accuracy, ensuring compliance with company policies and industry regulations.

- Executed pension payments and distributions, maintaining confidentiality and adhering to established procedures.

- Handled pension inquiries and provided accurate and timely responses to plan participants and their beneficiaries.

- Managed pension accounts, including maintaining records, tracking contributions, and monitoring balances.

Accomplishments

- Developed and implemented a new pension administration system, streamlining processes and reducing processing time by 20%.

- Collaborated with legal counsel to ensure compliance with complex pension regulations, preventing potential liabilities.

- Identified and resolved a significant discrepancy in pension calculations, safeguarding the financial interests of over 1,000 members.

- Led a team in developing a comprehensive pension education program for plan participants, improving their understanding and engagement.

- Successfully managed a highvolume workload of pension applications, meeting all deadlines and maintaining a high level of accuracy.

Awards

- Received the Pension Agent of the Year award from the National Pension Association for outstanding contributions to the industry.

- Recognized by the Pension Fund Association for excellence in pension fund management.

- Honored with the Outstanding Pension Administrator award for exceptional service to plan participants.

Certificates

- Certified Pension Consultant (CPC)

- Enrolled Retirement Plan Agent (ERPA)

- Certified Financial Planner (CFP)

- Certified Employee Benefits Specialist (CEBS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Pension Agent

- Highlight your experience and expertise in pension administration, specifically in the areas of Defined Benefit and Defined Contribution plans.

- Quantify your accomplishments and results whenever possible. For example, mention the number of pension plans you have administered or the amount of assets you have managed.

- Demonstrate your knowledge of pension laws and regulations. Mention any relevant certifications or training programs you have completed.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Pension Agent Resume

- Processed and reviewed pension-related documents with a high level of accuracy, ensuring compliance with company policies and industry regulations.

- Executed pension payments and distributions, maintaining confidentiality and adhering to established procedures.

- Handled pension inquiries and provided accurate and timely responses to plan participants and their beneficiaries.

- Managed pension accounts, including maintaining records, tracking contributions, and monitoring balances.

- Collaborated with plan sponsors, vendors, and legal counsel to ensure the seamless administration of pension plans.

- Utilized specialized pension software and tools to perform complex calculations, analyze data, and generate reports.

- Conducted pension audits to ensure accuracy and compliance with applicable laws and regulations.

Frequently Asked Questions (FAQ’s) For Pension Agent

What are the key responsibilities of a Pension Agent?

The key responsibilities of a Pension Agent include processing and reviewing pension-related documents, executing pension payments and distributions, handling pension inquiries, managing pension accounts, collaborating with plan sponsors and vendors, utilizing specialized pension software and tools, and conducting pension audits.

What are the educational requirements to become a Pension Agent?

Most Pension Agents have a bachelor’s degree in Business Administration, Finance, or a related field. Some employers may also require candidates to have a pension certification, such as the Certified Pension Consultant (CPC) designation.

What are the career prospects for Pension Agents?

Pension Agents with experience and expertise can advance to more senior positions, such as Pension Manager or Pension Administrator. They may also move into related fields, such as financial planning or investment management.

What are the key skills and qualities of a successful Pension Agent?

Successful Pension Agents have strong analytical, problem-solving, and communication skills. They are also detail-oriented and have a good understanding of pension laws and regulations.

What are the typical working hours for a Pension Agent?

Pension Agents typically work regular business hours, Monday through Friday. However, they may need to work overtime during peak periods, such as during the annual enrollment period.

What is the average salary for a Pension Agent?

The average salary for a Pension Agent varies depending on experience, location, and employer. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for Pension Agents was $73,950 in May 2021.