Are you a seasoned Personal Banker seeking a new career path? Discover our professionally built Personal Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

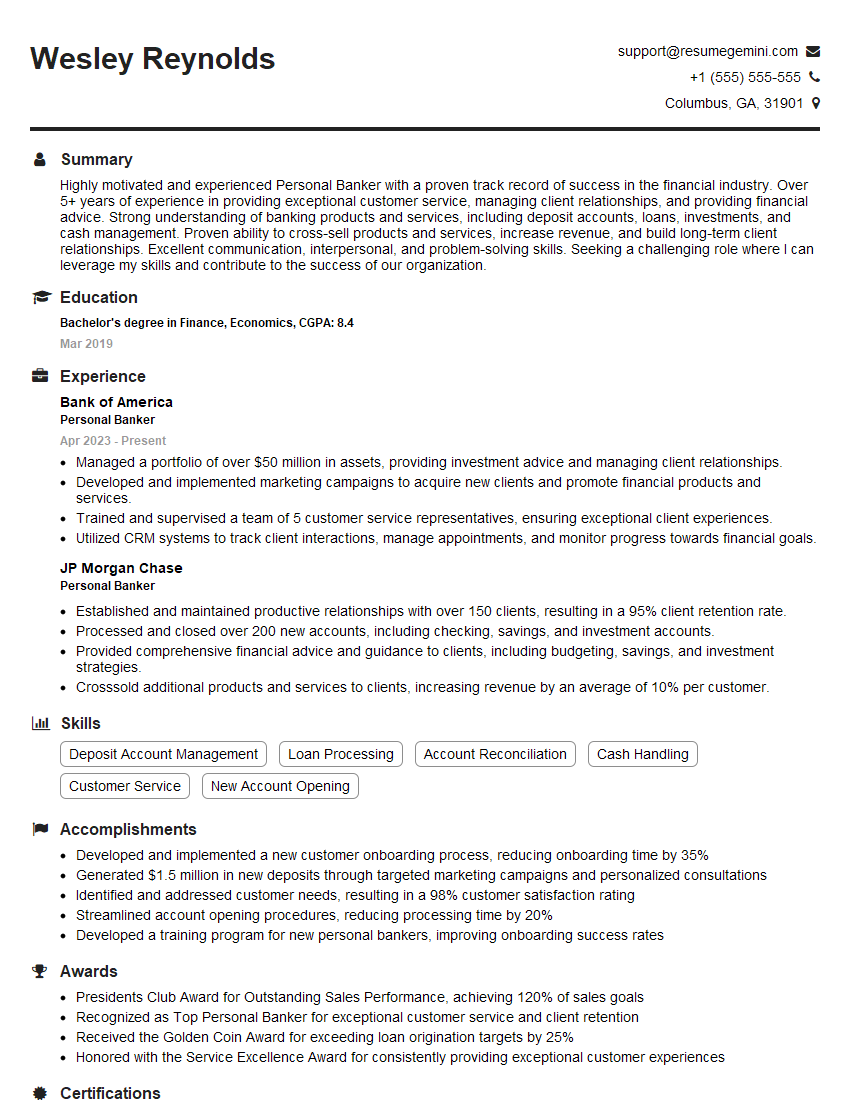

Wesley Reynolds

Personal Banker

Summary

Highly motivated and experienced Personal Banker with a proven track record of success in the financial industry. Over 5+ years of experience in providing exceptional customer service, managing client relationships, and providing financial advice. Strong understanding of banking products and services, including deposit accounts, loans, investments, and cash management. Proven ability to cross-sell products and services, increase revenue, and build long-term client relationships. Excellent communication, interpersonal, and problem-solving skills. Seeking a challenging role where I can leverage my skills and contribute to the success of our organization.

Education

Bachelor’s degree in Finance, Economics

March 2019

Skills

- Deposit Account Management

- Loan Processing

- Account Reconciliation

- Cash Handling

- Customer Service

- New Account Opening

Work Experience

Personal Banker

- Managed a portfolio of over $50 million in assets, providing investment advice and managing client relationships.

- Developed and implemented marketing campaigns to acquire new clients and promote financial products and services.

- Trained and supervised a team of 5 customer service representatives, ensuring exceptional client experiences.

- Utilized CRM systems to track client interactions, manage appointments, and monitor progress towards financial goals.

Personal Banker

- Established and maintained productive relationships with over 150 clients, resulting in a 95% client retention rate.

- Processed and closed over 200 new accounts, including checking, savings, and investment accounts.

- Provided comprehensive financial advice and guidance to clients, including budgeting, savings, and investment strategies.

- Crosssold additional products and services to clients, increasing revenue by an average of 10% per customer.

Accomplishments

- Developed and implemented a new customer onboarding process, reducing onboarding time by 35%

- Generated $1.5 million in new deposits through targeted marketing campaigns and personalized consultations

- Identified and addressed customer needs, resulting in a 98% customer satisfaction rating

- Streamlined account opening procedures, reducing processing time by 20%

- Developed a training program for new personal bankers, improving onboarding success rates

Awards

- Presidents Club Award for Outstanding Sales Performance, achieving 120% of sales goals

- Recognized as Top Personal Banker for exceptional customer service and client retention

- Received the Golden Coin Award for exceeding loan origination targets by 25%

- Honored with the Service Excellence Award for consistently providing exceptional customer experiences

Certificates

- Certified Personal Banker (CPB)

- Certified Financial Planner (CFP)

- Chartered Financial Consultant (ChFC)

- Financial Industry Regulatory Authority (FINRA) Series 7

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Banker

Highlight your customer service skills.

Personal Bankers are responsible for providing exceptional customer service, so be sure to emphasize your skills in this area on your resume.Quantify your accomplishments.

When possible, use numbers to quantify your accomplishments on your resume. This will help potential employers see the impact of your work.Use keywords.

When writing your resume, be sure to use keywords that potential employers will be looking for. This will help your resume get noticed and increase your chances of getting an interview.Proofread your resume carefully.

Before submitting your resume, be sure to proofread it carefully for any errors.Tailor your resume to each job you apply for.

Take the time to tailor your resume to each job you apply for. This will show potential employers that you are genuinely interested in the position and that you have taken the time to learn about their company.

Essential Experience Highlights for a Strong Personal Banker Resume

- Provide exceptional customer service to all clients, ensuring their needs are met and expectations are exceeded.

- Open and manage deposit accounts, including checking, savings, and money market accounts.

- Process and close loan applications, including personal loans, auto loans, and mortgages.

- Provide financial advice and guidance to clients on a range of topics, including budgeting, saving, and investing.

- Cross-sell additional products and services to clients, such as credit cards, insurance, and investment products.

- Manage a portfolio of clients, providing ongoing support and monitoring their financial progress.

- Stay up-to-date on the latest financial products and services to ensure clients receive the best possible advice.

- Work closely with other departments, such as lending and investment services, to provide a seamless experience for clients.

Frequently Asked Questions (FAQ’s) For Personal Banker

What is the role of a Personal Banker?

Personal Bankers are responsible for providing financial advice and guidance to clients, as well as managing their financial accounts. They work with clients to help them achieve their financial goals, such as saving for retirement, buying a home, or paying for college.

What are the qualifications for becoming a Personal Banker?

Most Personal Bankers have a bachelor’s degree in finance, economics, or a related field. They also typically have experience in the financial industry, such as working as a teller or customer service representative.

What are the skills required to be a successful Personal Banker?

Successful Personal Bankers have strong communication and interpersonal skills, as well as a deep understanding of financial products and services. They are also able to build strong relationships with clients and provide them with personalized advice.

What is the career outlook for Personal Bankers?

The career outlook for Personal Bankers is expected to be good over the next few years. As the population ages and the demand for financial advice increases, the need for Personal Bankers will continue to grow.

How can I become a Personal Banker?

There are a few different ways to become a Personal Banker. You can start by getting a bachelor’s degree in finance, economics, or a related field. You can also gain experience in the financial industry by working as a teller or customer service representative. Once you have the necessary qualifications, you can apply for Personal Banker positions at banks and other financial institutions.

What is the average salary for a Personal Banker?

The average salary for a Personal Banker is around $50,000 per year. However, salaries can vary depending on experience, location, and the size of the bank or financial institution.

What are the benefits of working as a Personal Banker?

There are many benefits to working as a Personal Banker, including the opportunity to help people achieve their financial goals, the chance to learn about different financial products and services, and the opportunity to build strong relationships with clients.

What are the challenges of working as a Personal Banker?

There are also some challenges to working as a Personal Banker, such as the need to be able to handle difficult conversations, the pressure to meet sales goals, and the long hours that are often required.