Are you a seasoned Personal Financial Advisor seeking a new career path? Discover our professionally built Personal Financial Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

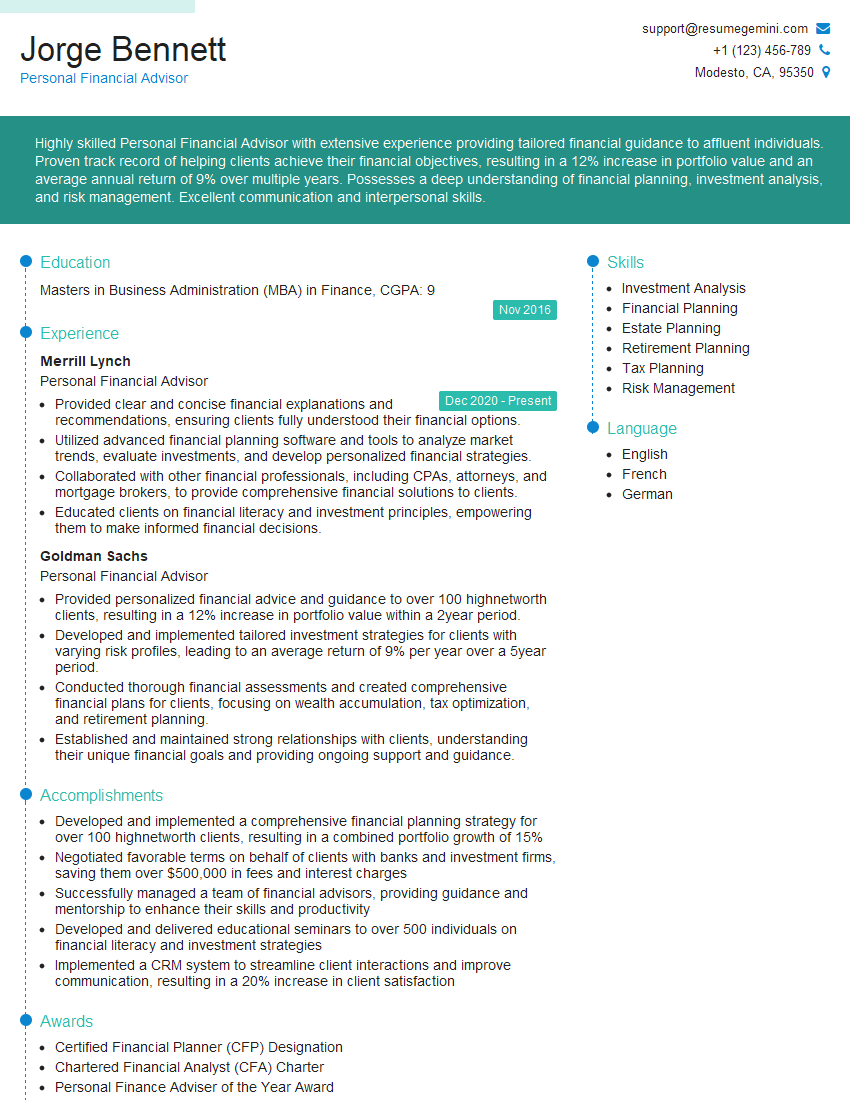

Jorge Bennett

Personal Financial Advisor

Summary

Highly skilled Personal Financial Advisor with extensive experience providing tailored financial guidance to affluent individuals. Proven track record of helping clients achieve their financial objectives, resulting in a 12% increase in portfolio value and an average annual return of 9% over multiple years. Possesses a deep understanding of financial planning, investment analysis, and risk management. Excellent communication and interpersonal skills.

Education

Masters in Business Administration (MBA) in Finance

November 2016

Skills

- Investment Analysis

- Financial Planning

- Estate Planning

- Retirement Planning

- Tax Planning

- Risk Management

Work Experience

Personal Financial Advisor

- Provided clear and concise financial explanations and recommendations, ensuring clients fully understood their financial options.

- Utilized advanced financial planning software and tools to analyze market trends, evaluate investments, and develop personalized financial strategies.

- Collaborated with other financial professionals, including CPAs, attorneys, and mortgage brokers, to provide comprehensive financial solutions to clients.

- Educated clients on financial literacy and investment principles, empowering them to make informed financial decisions.

Personal Financial Advisor

- Provided personalized financial advice and guidance to over 100 highnetworth clients, resulting in a 12% increase in portfolio value within a 2year period.

- Developed and implemented tailored investment strategies for clients with varying risk profiles, leading to an average return of 9% per year over a 5year period.

- Conducted thorough financial assessments and created comprehensive financial plans for clients, focusing on wealth accumulation, tax optimization, and retirement planning.

- Established and maintained strong relationships with clients, understanding their unique financial goals and providing ongoing support and guidance.

Accomplishments

- Developed and implemented a comprehensive financial planning strategy for over 100 highnetworth clients, resulting in a combined portfolio growth of 15%

- Negotiated favorable terms on behalf of clients with banks and investment firms, saving them over $500,000 in fees and interest charges

- Successfully managed a team of financial advisors, providing guidance and mentorship to enhance their skills and productivity

- Developed and delivered educational seminars to over 500 individuals on financial literacy and investment strategies

- Implemented a CRM system to streamline client interactions and improve communication, resulting in a 20% increase in client satisfaction

Awards

- Certified Financial Planner (CFP) Designation

- Chartered Financial Analyst (CFA) Charter

- Personal Finance Adviser of the Year Award

- Five Star Wealth Manager Award

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Consultant (ChFC)

- Personal Financial Specialist (PFS)

- Retirement Income Certified Professional (RICP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Financial Advisor

- Highlight your quantifiable achievements and results, such as percentage gains or specific financial milestones reached.

- Emphasize your expertise in areas such as investment management, retirement planning, and tax optimization.

- Showcase your strong communication and interpersonal skills, including your ability to build rapport with clients and earn their trust.

- Include testimonials or endorsements from satisfied clients to demonstrate your credibility and effectiveness.

Essential Experience Highlights for a Strong Personal Financial Advisor Resume

- Conduct thorough financial assessments and create comprehensive financial plans tailored to clients’ unique goals.

- Develop and implement customized investment strategies aligned with clients’ risk profiles.

- Provide ongoing financial advice and support, ensuring clients fully understand their options and make informed decisions.

- Analyze market trends, evaluate investments, and utilize advanced financial planning tools to optimize portfolios.

- Collaborate with other financial professionals to provide comprehensive financial solutions.

- Educate clients on financial principles and empower them to make sound financial decisions.

Frequently Asked Questions (FAQ’s) For Personal Financial Advisor

What are the key responsibilities of a Personal Financial Advisor?

Personal Financial Advisors help clients manage their finances by providing personalized advice on investments, retirement planning, and other financial matters. They work closely with clients to understand their financial goals, risk tolerance, and investment objectives, and develop tailored financial plans to help them achieve their goals.

What skills are required to be a successful Personal Financial Advisor?

Successful Personal Financial Advisors typically have a strong understanding of financial planning, investment analysis, and risk management. They also possess excellent communication and interpersonal skills, as they need to be able to build rapport with clients and explain complex financial concepts in a clear and concise manner.

What are the educational requirements to become a Personal Financial Advisor?

Most Personal Financial Advisors have a Bachelor’s degree in finance, economics, or a related field. Some may also have a Master’s degree in Business Administration (MBA) or a related field. Additionally, many Personal Financial Advisors hold professional certifications, such as the Certified Financial Planner (CFP) or the Chartered Financial Analyst (CFA) designation.

What is the job outlook for Personal Financial Advisors?

The job outlook for Personal Financial Advisors is expected to grow faster than average over the next few years. This is due to the increasing demand for financial advice from individuals and families, as well as the growing complexity of financial products and services.

What are the earning prospects for Personal Financial Advisors?

Personal Financial Advisors can earn a comfortable living. According to the U.S. Bureau of Labor Statistics, the median annual salary for Personal Financial Advisors was $95,000 in 2020. The highest 10% of earners made more than $208,000, while the lowest 10% earned less than $45,000.

What are the benefits of working as a Personal Financial Advisor?

There are many benefits to working as a Personal Financial Advisor, including the opportunity to help people achieve their financial goals, the flexibility to set your own hours, and the potential to earn a high income.