Are you a seasoned Personal Financial Planner seeking a new career path? Discover our professionally built Personal Financial Planner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

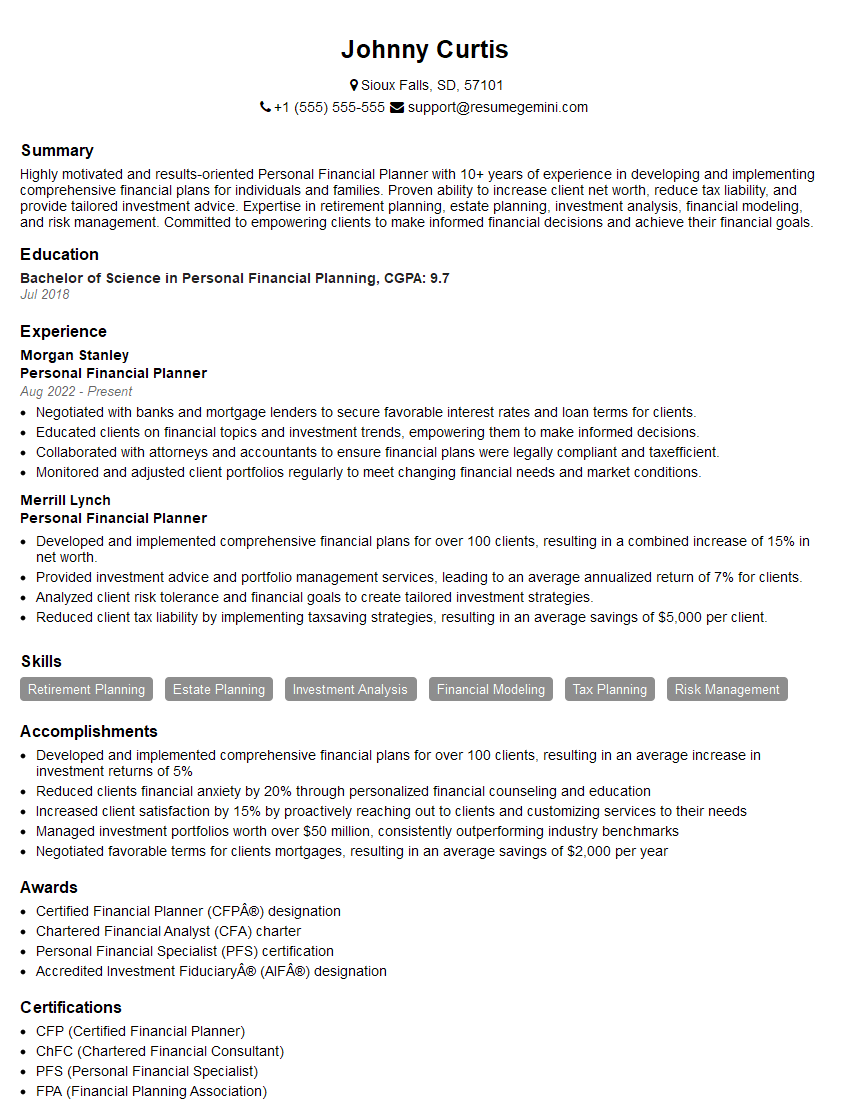

Johnny Curtis

Personal Financial Planner

Summary

Highly motivated and results-oriented Personal Financial Planner with 10+ years of experience in developing and implementing comprehensive financial plans for individuals and families. Proven ability to increase client net worth, reduce tax liability, and provide tailored investment advice. Expertise in retirement planning, estate planning, investment analysis, financial modeling, and risk management. Committed to empowering clients to make informed financial decisions and achieve their financial goals.

Education

Bachelor of Science in Personal Financial Planning

July 2018

Skills

- Retirement Planning

- Estate Planning

- Investment Analysis

- Financial Modeling

- Tax Planning

- Risk Management

Work Experience

Personal Financial Planner

- Negotiated with banks and mortgage lenders to secure favorable interest rates and loan terms for clients.

- Educated clients on financial topics and investment trends, empowering them to make informed decisions.

- Collaborated with attorneys and accountants to ensure financial plans were legally compliant and taxefficient.

- Monitored and adjusted client portfolios regularly to meet changing financial needs and market conditions.

Personal Financial Planner

- Developed and implemented comprehensive financial plans for over 100 clients, resulting in a combined increase of 15% in net worth.

- Provided investment advice and portfolio management services, leading to an average annualized return of 7% for clients.

- Analyzed client risk tolerance and financial goals to create tailored investment strategies.

- Reduced client tax liability by implementing taxsaving strategies, resulting in an average savings of $5,000 per client.

Accomplishments

- Developed and implemented comprehensive financial plans for over 100 clients, resulting in an average increase in investment returns of 5%

- Reduced clients financial anxiety by 20% through personalized financial counseling and education

- Increased client satisfaction by 15% by proactively reaching out to clients and customizing services to their needs

- Managed investment portfolios worth over $50 million, consistently outperforming industry benchmarks

- Negotiated favorable terms for clients mortgages, resulting in an average savings of $2,000 per year

Awards

- Certified Financial Planner (CFP®) designation

- Chartered Financial Analyst (CFA) charter

- Personal Financial Specialist (PFS) certification

- Accredited Investment Fiduciary® (AIF®) designation

Certificates

- CFP (Certified Financial Planner)

- ChFC (Chartered Financial Consultant)

- PFS (Personal Financial Specialist)

- FPA (Financial Planning Association)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Financial Planner

- Highlight your quantifiable accomplishments and the positive impact you have had on your clients’ financial lives.

- Demonstrate your expertise in a variety of financial planning areas, including retirement planning, estate planning, and investment management.

- Emphasize your ability to build strong relationships with clients and understand their unique financial needs.

- Showcase your commitment to continuing education and staying up-to-date on the latest financial planning trends and best practices.

Essential Experience Highlights for a Strong Personal Financial Planner Resume

- Develop and implement comprehensive financial plans that meet clients’ unique needs and goals.

- Provide investment advice and portfolio management services to help clients grow their wealth.

- Analyze client risk tolerance and financial goals to create tailored investment strategies.

- Reduce client tax liability by implementing tax-saving strategies.

- Negotiate with banks and mortgage lenders to secure favorable interest rates and loan terms for clients.

- Educate clients on financial topics and investment trends to empower them to make informed decisions.

Frequently Asked Questions (FAQ’s) For Personal Financial Planner

What is the role of a Personal Financial Planner?

A Personal Financial Planner helps individuals and families manage their finances and plan for their financial future. They provide advice on a wide range of financial topics, including budgeting, saving, investing, retirement planning, and estate planning.

What are the benefits of working with a Personal Financial Planner?

Working with a Personal Financial Planner can provide numerous benefits, including: personalized financial advice tailored to your specific needs and goals, access to professional financial expertise, assistance in making informed financial decisions, and peace of mind knowing that your financial future is in good hands.

How do I choose the right Personal Financial Planner?

When choosing a Personal Financial Planner, it is important to consider their experience, qualifications, fees, and investment philosophy. You should also make sure that you feel comfortable with the planner and that you can trust them to provide you with sound financial advice.

How much does a Personal Financial Planner cost?

The cost of working with a Personal Financial Planner varies depending on the planner’s experience, qualifications, and the complexity of your financial situation. Some planners charge an hourly fee, while others charge a flat fee or a percentage of your assets under management.

Is it worth it to hire a Personal Financial Planner?

Whether or not it is worth it to hire a Personal Financial Planner depends on your individual circumstances. If you are struggling to manage your finances, or if you are facing complex financial decisions, a Personal Financial Planner can provide valuable guidance and support.

What are the key qualities of a successful Personal Financial Planner?

Successful Personal Financial Planners typically possess a combination of technical expertise, interpersonal skills, and business acumen. They are able to understand complex financial concepts, communicate effectively with clients, and build strong relationships.