Are you a seasoned Policy Change Clerks Supervisor seeking a new career path? Discover our professionally built Policy Change Clerks Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

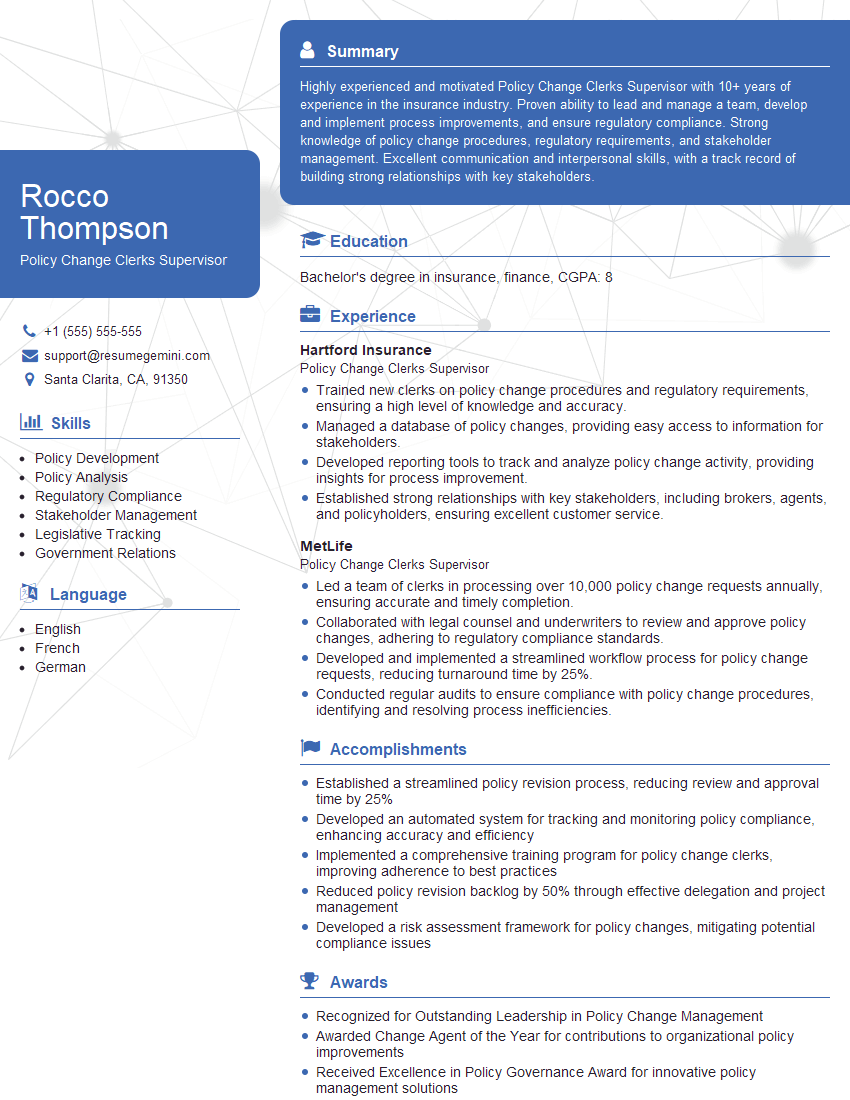

Rocco Thompson

Policy Change Clerks Supervisor

Summary

Highly experienced and motivated Policy Change Clerks Supervisor with 10+ years of experience in the insurance industry. Proven ability to lead and manage a team, develop and implement process improvements, and ensure regulatory compliance. Strong knowledge of policy change procedures, regulatory requirements, and stakeholder management. Excellent communication and interpersonal skills, with a track record of building strong relationships with key stakeholders.

Education

Bachelor’s degree in insurance, finance

November 2015

Skills

- Policy Development

- Policy Analysis

- Regulatory Compliance

- Stakeholder Management

- Legislative Tracking

- Government Relations

Work Experience

Policy Change Clerks Supervisor

- Trained new clerks on policy change procedures and regulatory requirements, ensuring a high level of knowledge and accuracy.

- Managed a database of policy changes, providing easy access to information for stakeholders.

- Developed reporting tools to track and analyze policy change activity, providing insights for process improvement.

- Established strong relationships with key stakeholders, including brokers, agents, and policyholders, ensuring excellent customer service.

Policy Change Clerks Supervisor

- Led a team of clerks in processing over 10,000 policy change requests annually, ensuring accurate and timely completion.

- Collaborated with legal counsel and underwriters to review and approve policy changes, adhering to regulatory compliance standards.

- Developed and implemented a streamlined workflow process for policy change requests, reducing turnaround time by 25%.

- Conducted regular audits to ensure compliance with policy change procedures, identifying and resolving process inefficiencies.

Accomplishments

- Established a streamlined policy revision process, reducing review and approval time by 25%

- Developed an automated system for tracking and monitoring policy compliance, enhancing accuracy and efficiency

- Implemented a comprehensive training program for policy change clerks, improving adherence to best practices

- Reduced policy revision backlog by 50% through effective delegation and project management

- Developed a risk assessment framework for policy changes, mitigating potential compliance issues

Awards

- Recognized for Outstanding Leadership in Policy Change Management

- Awarded Change Agent of the Year for contributions to organizational policy improvements

- Received Excellence in Policy Governance Award for innovative policy management solutions

- Recognized for Best Practices in Policy Change Management

Certificates

- Certified Policy Professional (CPP)

- Certified Government Relations Professional (CGRP)

- Certified Legislative Advocate (CLA)

- Certified Budget Analyst (CBA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Policy Change Clerks Supervisor

- Highlight your experience in managing teams and leading process improvement initiatives.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Showcase your knowledge of regulatory compliance and insurance industry best practices.

- Emphasize your strong communication and interpersonal skills, and your ability to build relationships with key stakeholders.

- Consider obtaining relevant certifications, such as the Associate in Policy Servicing (APS) or Certified Policy Compliance Specialist (CPCS), to enhance your credibility.

Essential Experience Highlights for a Strong Policy Change Clerks Supervisor Resume

- Supervise and manage a team of clerks responsible for processing policy change requests, ensuring accuracy and timely completion.

- Collaborate with legal counsel and underwriters to review and approve policy changes, adhering to regulatory compliance standards.

- Develop and implement streamlined workflow processes, reducing turnaround time and improving efficiency.

- Conduct regular audits to ensure compliance with policy change procedures, identifying and resolving process inefficiencies.

- Train new clerks on policy change procedures and regulatory requirements, ensuring a high level of knowledge and accuracy.

- Manage a database of policy changes, providing easy access to information for stakeholders.

- Develop reporting tools to track and analyze policy change activity, providing insights for process improvement.

- Establish strong relationships with key stakeholders, including brokers, agents, and policyholders, ensuring excellent customer service.

Frequently Asked Questions (FAQ’s) For Policy Change Clerks Supervisor

What are the key responsibilities of a Policy Change Clerks Supervisor?

Policy Change Clerks Supervisors are responsible for supervising a team of clerks who process policy change requests, ensuring accuracy and timely completion. They also collaborate with legal counsel and underwriters to review and approve policy changes, adhering to regulatory compliance standards. Additionally, they develop and implement streamlined workflow processes to improve efficiency and conduct regular audits to ensure compliance with policy change procedures.

What are the key skills required for a Policy Change Clerks Supervisor?

Key skills for a Policy Change Clerks Supervisor include policy development, policy analysis, regulatory compliance, stakeholder management, legislative tracking, and government relations.

What are the career prospects for a Policy Change Clerks Supervisor?

Policy Change Clerks Supervisors can advance to roles such as Policy Manager, Compliance Manager, or Underwriting Manager. They may also move into consulting or advisory roles within the insurance industry.

What is the typical salary range for a Policy Change Clerks Supervisor?

The typical salary range for a Policy Change Clerks Supervisor can vary depending on experience and location. According to Salary.com, the average salary for a Policy Change Clerks Supervisor in the United States is $65,000.

What is the job outlook for Policy Change Clerks Supervisors?

The job outlook for Policy Change Clerks Supervisors is expected to grow in the coming years. As insurance regulations become more complex and the demand for insurance products and services increases, the need for qualified Policy Change Clerks Supervisors will continue to rise.

How can I prepare for a career as a Policy Change Clerks Supervisor?

To prepare for a career as a Policy Change Clerks Supervisor, you can obtain a bachelor’s degree in insurance, finance, or a related field. You can also gain experience in the insurance industry, particularly in policy change processing or underwriting. Additionally, you can obtain relevant certifications, such as the Associate in Policy Servicing (APS) or Certified Policy Compliance Specialist (CPCS), to enhance your credibility.