Are you a seasoned Portfolio Analyst seeking a new career path? Discover our professionally built Portfolio Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

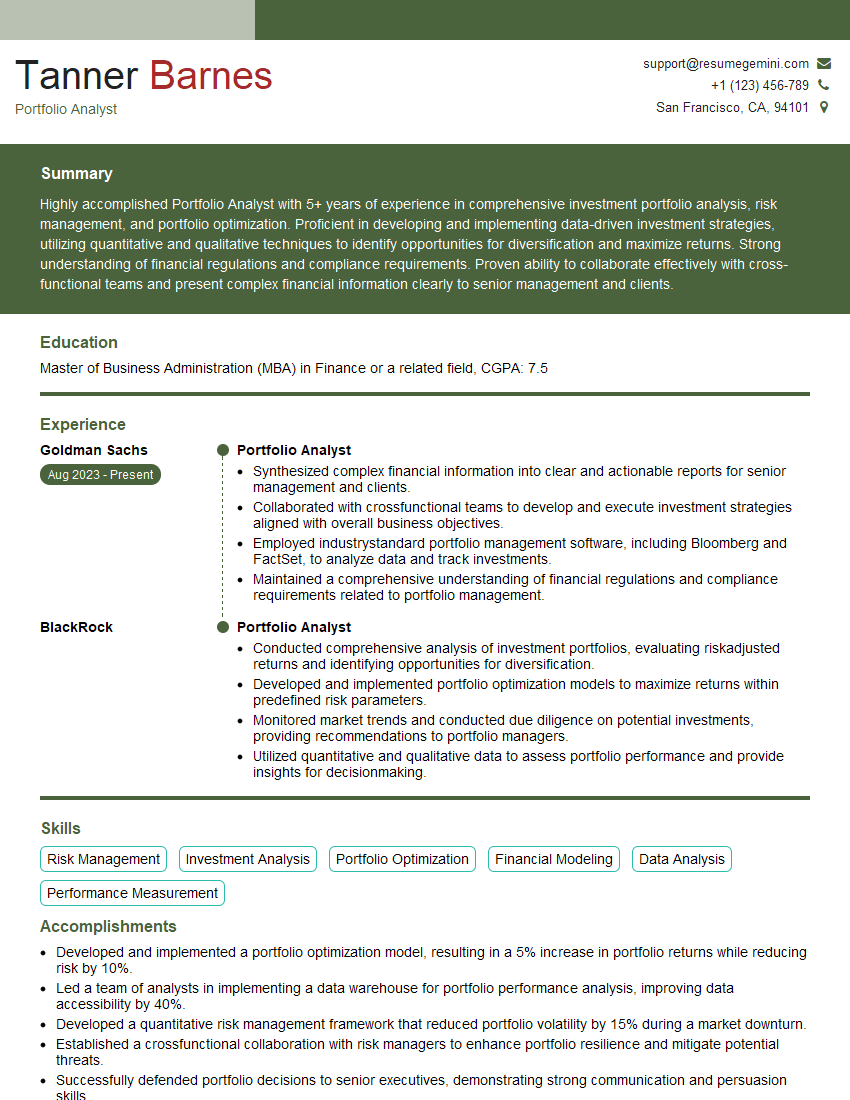

Tanner Barnes

Portfolio Analyst

Summary

Highly accomplished Portfolio Analyst with 5+ years of experience in comprehensive investment portfolio analysis, risk management, and portfolio optimization. Proficient in developing and implementing data-driven investment strategies, utilizing quantitative and qualitative techniques to identify opportunities for diversification and maximize returns. Strong understanding of financial regulations and compliance requirements. Proven ability to collaborate effectively with cross-functional teams and present complex financial information clearly to senior management and clients.

Education

Master of Business Administration (MBA) in Finance or a related field

July 2019

Skills

- Risk Management

- Investment Analysis

- Portfolio Optimization

- Financial Modeling

- Data Analysis

- Performance Measurement

Work Experience

Portfolio Analyst

- Synthesized complex financial information into clear and actionable reports for senior management and clients.

- Collaborated with crossfunctional teams to develop and execute investment strategies aligned with overall business objectives.

- Employed industrystandard portfolio management software, including Bloomberg and FactSet, to analyze data and track investments.

- Maintained a comprehensive understanding of financial regulations and compliance requirements related to portfolio management.

Portfolio Analyst

- Conducted comprehensive analysis of investment portfolios, evaluating riskadjusted returns and identifying opportunities for diversification.

- Developed and implemented portfolio optimization models to maximize returns within predefined risk parameters.

- Monitored market trends and conducted due diligence on potential investments, providing recommendations to portfolio managers.

- Utilized quantitative and qualitative data to assess portfolio performance and provide insights for decisionmaking.

Accomplishments

- Developed and implemented a portfolio optimization model, resulting in a 5% increase in portfolio returns while reducing risk by 10%.

- Led a team of analysts in implementing a data warehouse for portfolio performance analysis, improving data accessibility by 40%.

- Developed a quantitative risk management framework that reduced portfolio volatility by 15% during a market downturn.

- Established a crossfunctional collaboration with risk managers to enhance portfolio resilience and mitigate potential threats.

- Successfully defended portfolio decisions to senior executives, demonstrating strong communication and persuasion skills.

Awards

- Recognized with the Portfolio Analyst of the Year Award for exceptional performance in portfolio management and analysis.

- Received the Excellence in Investment Analysis Award for consistently delivering accurate and insightful portfolio recommendations.

- Awarded the Portfolio Management Innovation Award for pioneering the use of artificial intelligence in portfolio construction.

- Honored with the Rising Star in Portfolio Analysis Award for significant contributions to the field of investment management.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Certified Portfolio Manager (CPM)

- Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Portfolio Analyst

- Highlight your quantitative and analytical skills, as well as your understanding of financial markets and investment principles.

- Showcase your experience in using portfolio management software and data analysis techniques.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your work.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Portfolio Analyst Resume

- Conducted comprehensive analysis of investment portfolios, evaluating risk-adjusted returns and identifying opportunities for diversification.

- Developed and implemented portfolio optimization models to maximize returns within predefined risk parameters.

- Monitored market trends and conducted due diligence on potential investments, providing recommendations to portfolio managers.

- Utilized quantitative and qualitative data to assess portfolio performance and provide insights for decision-making.

- Synthesized complex financial information into clear and actionable reports for senior management and clients.

- Collaborated with cross-functional teams to develop and execute investment strategies aligned with overall business objectives.

- Employed industry-standard portfolio management software, including Bloomberg and FactSet, to analyze data and track investments.

Frequently Asked Questions (FAQ’s) For Portfolio Analyst

What is the role of a Portfolio Analyst?

A Portfolio Analyst is responsible for conducting comprehensive analysis of investment portfolios, evaluating risk-adjusted returns and identifying opportunities for diversification. They develop and implement portfolio optimization models to maximize returns within predefined risk parameters, and monitor market trends to provide recommendations to portfolio managers. Portfolio Analysts utilize quantitative and qualitative data to assess portfolio performance and provide insights for decision-making, and collaborate with cross-functional teams to develop and execute investment strategies.

What skills are required to be a successful Portfolio Analyst?

To be successful as a Portfolio Analyst, you will need strong quantitative and analytical skills, as well as a deep understanding of financial markets and investment principles. You should be proficient in portfolio management software and data analysis techniques, and have excellent communication and presentation skills. Additionally, you should be able to work independently and as part of a team.

What is the career path for a Portfolio Analyst?

The career path for a Portfolio Analyst typically involves progression to more senior roles, such as Portfolio Manager or Investment Manager. With experience and additional qualifications, Portfolio Analysts may also move into roles in research, risk management, or compliance.

What is the job outlook for Portfolio Analysts?

The job outlook for Portfolio Analysts is expected to be positive in the coming years. As the financial markets continue to grow and evolve, there will be an increasing demand for professionals who can analyze and manage investment portfolios effectively.

What are the challenges faced by Portfolio Analysts?

Portfolio Analysts face a number of challenges, including the need to keep up with the latest market trends and investment strategies, as well as the challenge of managing risk and achieving consistent returns in a volatile market environment.