Are you a seasoned Prime Broker seeking a new career path? Discover our professionally built Prime Broker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

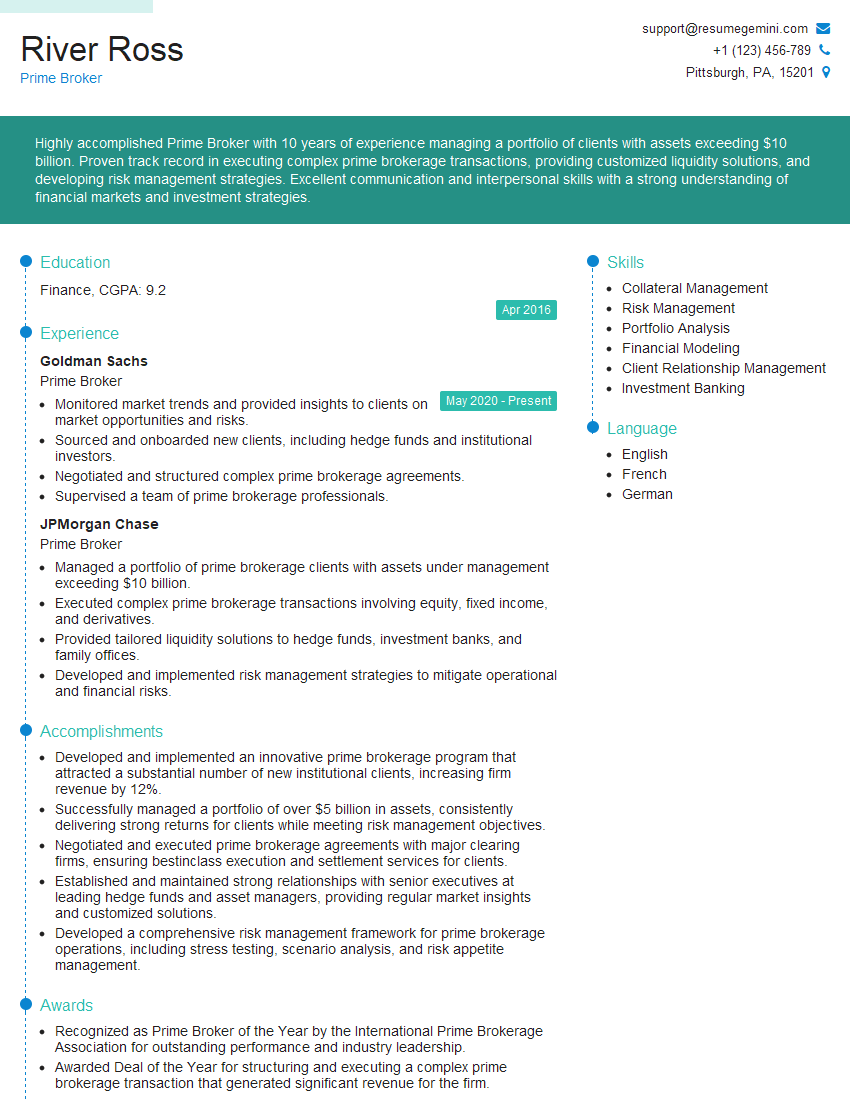

River Ross

Prime Broker

Summary

Highly accomplished Prime Broker with 10 years of experience managing a portfolio of clients with assets exceeding $10 billion. Proven track record in executing complex prime brokerage transactions, providing customized liquidity solutions, and developing risk management strategies. Excellent communication and interpersonal skills with a strong understanding of financial markets and investment strategies.

Education

Finance

April 2016

Skills

- Collateral Management

- Risk Management

- Portfolio Analysis

- Financial Modeling

- Client Relationship Management

- Investment Banking

Work Experience

Prime Broker

- Monitored market trends and provided insights to clients on market opportunities and risks.

- Sourced and onboarded new clients, including hedge funds and institutional investors.

- Negotiated and structured complex prime brokerage agreements.

- Supervised a team of prime brokerage professionals.

Prime Broker

- Managed a portfolio of prime brokerage clients with assets under management exceeding $10 billion.

- Executed complex prime brokerage transactions involving equity, fixed income, and derivatives.

- Provided tailored liquidity solutions to hedge funds, investment banks, and family offices.

- Developed and implemented risk management strategies to mitigate operational and financial risks.

Accomplishments

- Developed and implemented an innovative prime brokerage program that attracted a substantial number of new institutional clients, increasing firm revenue by 12%.

- Successfully managed a portfolio of over $5 billion in assets, consistently delivering strong returns for clients while meeting risk management objectives.

- Negotiated and executed prime brokerage agreements with major clearing firms, ensuring bestinclass execution and settlement services for clients.

- Established and maintained strong relationships with senior executives at leading hedge funds and asset managers, providing regular market insights and customized solutions.

- Developed a comprehensive risk management framework for prime brokerage operations, including stress testing, scenario analysis, and risk appetite management.

Awards

- Recognized as Prime Broker of the Year by the International Prime Brokerage Association for outstanding performance and industry leadership.

- Awarded Deal of the Year for structuring and executing a complex prime brokerage transaction that generated significant revenue for the firm.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Financial Risk Manager (FRM)

- Certified Prime Broker (CPB)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Prime Broker

- Quantify your accomplishments and provide specific examples of your impact on the business.

- Use keywords throughout your resume to ensure it is visible to recruiters.

- Highlight your experience in managing complex prime brokerage transactions and providing tailored liquidity solutions.

- Demonstrate your understanding of risk management and your ability to develop and implement effective strategies.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Prime Broker Resume

- Managed a portfolio of prime brokerage clients with assets under management exceeding $10 billion.

- Executed complex prime brokerage transactions involving equity, fixed income, and derivatives.

- Provided tailored liquidity solutions to hedge funds, investment banks, and family offices.

- Developed and implemented risk management strategies to mitigate operational and financial risks.

- Monitored market trends and provided insights to clients on market opportunities and risks.

- Sourced and onboarded new clients, including hedge funds and institutional investors.

- Negotiated and structured complex prime brokerage agreements.

- Supervised a team of prime brokerage professionals.

Frequently Asked Questions (FAQ’s) For Prime Broker

What is the role of a Prime Broker?

A Prime Broker provides a comprehensive suite of services to hedge funds and other institutional investors, including trade execution, clearing and settlement, financing, and custody.

What are the key skills and qualifications for a Prime Broker?

Key skills and qualifications for a Prime Broker include a deep understanding of financial markets, investment strategies, and risk management, as well as strong communication and interpersonal skills.

What are the career prospects for a Prime Broker?

Prime Brokers can advance to senior positions within their firms or move to other roles in the financial industry, such as portfolio management or investment banking.

What is the average salary for a Prime Broker?

The average salary for a Prime Broker varies depending on experience, location, and firm size, but can range from $100,000 to $500,000 per year.

What are the top employers of Prime Brokers?

Top employers of Prime Brokers include Goldman Sachs, JPMorgan Chase, and Citigroup.

What is the job outlook for Prime Brokers?

The job outlook for Prime Brokers is expected to be positive due to the increasing demand for their services from hedge funds and other institutional investors.