Are you a seasoned Property and Casualty Insurance Claims Examiner seeking a new career path? Discover our professionally built Property and Casualty Insurance Claims Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

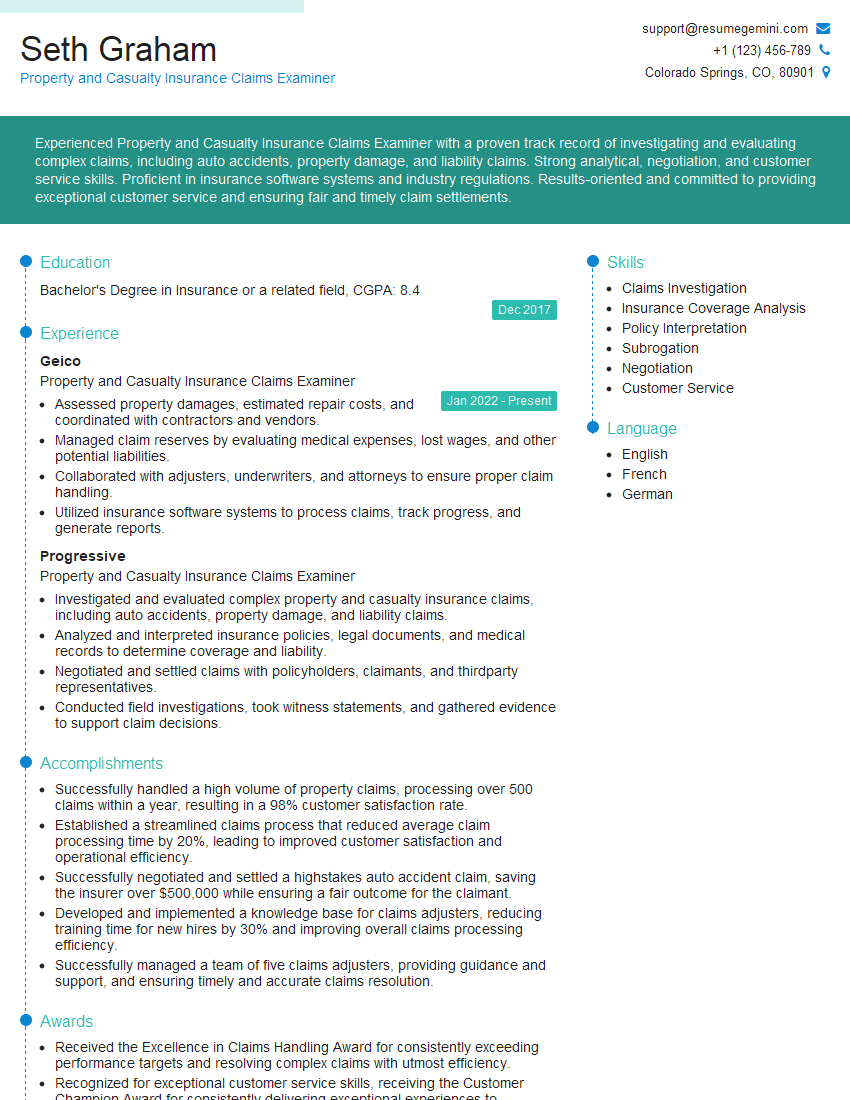

Seth Graham

Property and Casualty Insurance Claims Examiner

Summary

Experienced Property and Casualty Insurance Claims Examiner with a proven track record of investigating and evaluating complex claims, including auto accidents, property damage, and liability claims. Strong analytical, negotiation, and customer service skills. Proficient in insurance software systems and industry regulations. Results-oriented and committed to providing exceptional customer service and ensuring fair and timely claim settlements.

Education

Bachelor’s Degree in Insurance or a related field

December 2017

Skills

- Claims Investigation

- Insurance Coverage Analysis

- Policy Interpretation

- Subrogation

- Negotiation

- Customer Service

Work Experience

Property and Casualty Insurance Claims Examiner

- Assessed property damages, estimated repair costs, and coordinated with contractors and vendors.

- Managed claim reserves by evaluating medical expenses, lost wages, and other potential liabilities.

- Collaborated with adjusters, underwriters, and attorneys to ensure proper claim handling.

- Utilized insurance software systems to process claims, track progress, and generate reports.

Property and Casualty Insurance Claims Examiner

- Investigated and evaluated complex property and casualty insurance claims, including auto accidents, property damage, and liability claims.

- Analyzed and interpreted insurance policies, legal documents, and medical records to determine coverage and liability.

- Negotiated and settled claims with policyholders, claimants, and thirdparty representatives.

- Conducted field investigations, took witness statements, and gathered evidence to support claim decisions.

Accomplishments

- Successfully handled a high volume of property claims, processing over 500 claims within a year, resulting in a 98% customer satisfaction rate.

- Established a streamlined claims process that reduced average claim processing time by 20%, leading to improved customer satisfaction and operational efficiency.

- Successfully negotiated and settled a highstakes auto accident claim, saving the insurer over $500,000 while ensuring a fair outcome for the claimant.

- Developed and implemented a knowledge base for claims adjusters, reducing training time for new hires by 30% and improving overall claims processing efficiency.

- Successfully managed a team of five claims adjusters, providing guidance and support, and ensuring timely and accurate claims resolution.

Awards

- Received the Excellence in Claims Handling Award for consistently exceeding performance targets and resolving complex claims with utmost efficiency.

- Recognized for exceptional customer service skills, receiving the Customer Champion Award for consistently delivering exceptional experiences to policyholders.

- Honored with the Claims Innovation Award for developing a novel approach to complex liability claims, resulting in significant cost savings for the insurer.

- Received the Claims Proficiency Award for maintaining an impeccable accuracy record, with zero errors in claims processing over a twoyear period.

Certificates

- Associate in Insurance Services (AIS)

- Certified Insurance Professional (CIC)

- Certified Insurance Claims Professional (CICP)

- Associate in Claims (AIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Property and Casualty Insurance Claims Examiner

- Use strong action verbs and quantify your accomplishments whenever possible.

- Highlight your skills in claims investigation, policy interpretation, and negotiation.

- Emphasize your customer service skills and experience working with claimants and policyholders.

- Tailor your resume to the specific job you are applying for and highlight the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Property and Casualty Insurance Claims Examiner Resume

- Investigate and evaluate complex property and casualty insurance claims, including auto accidents, property damage, and liability claims.

- Analyze and interpret insurance policies, legal documents, and medical records to determine coverage and liability.

- Negotiate and settle claims with policyholders, claimants, and third-party representatives.

- Conduct field investigations, take witness statements, and gather evidence to support claim decisions.

- Assess property damages, estimate repair costs, and coordinate with contractors and vendors.

- Manage claim reserves by evaluating medical expenses, lost wages, and other potential liabilities.

- Collaborate with adjusters, underwriters, and attorneys to ensure proper claim handling.

Frequently Asked Questions (FAQ’s) For Property and Casualty Insurance Claims Examiner

What are the key skills required for a successful Property and Casualty Insurance Claims Examiner?

The key skills required for a successful Property and Casualty Insurance Claims Examiner include investigation, policy interpretation, negotiation, problem-solving, communication, and customer service.

What are the different types of claims that a Property and Casualty Insurance Claims Examiner may handle?

The different types of claims that a Property and Casualty Insurance Claims Examiner may handle include auto accidents, property damage, liability claims, workers’ compensation claims, and more.

What is the career path for a Property and Casualty Insurance Claims Examiner?

The career path for a Property and Casualty Insurance Claims Examiner can include promotion to a senior claims examiner, claims manager, or other leadership positions within the insurance industry.

What are the earning potential for a Property and Casualty Insurance Claims Examiner?

The earning potential for a Property and Casualty Insurance Claims Examiner can vary depending on factors such as experience, location, and the size of the insurance company.

What are the educational requirements for a Property and Casualty Insurance Claims Examiner?

The educational requirements for a Property and Casualty Insurance Claims Examiner typically include a bachelor’s degree in insurance or a related field.

What certifications are available for a Property and Casualty Insurance Claims Examiner?

There are a number of certifications available for Property and Casualty Insurance Claims Examiners, including the Associate in Claims (AIC) and the Chartered Property Casualty Underwriter (CPCU).