Are you a seasoned Property Underwriter seeking a new career path? Discover our professionally built Property Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

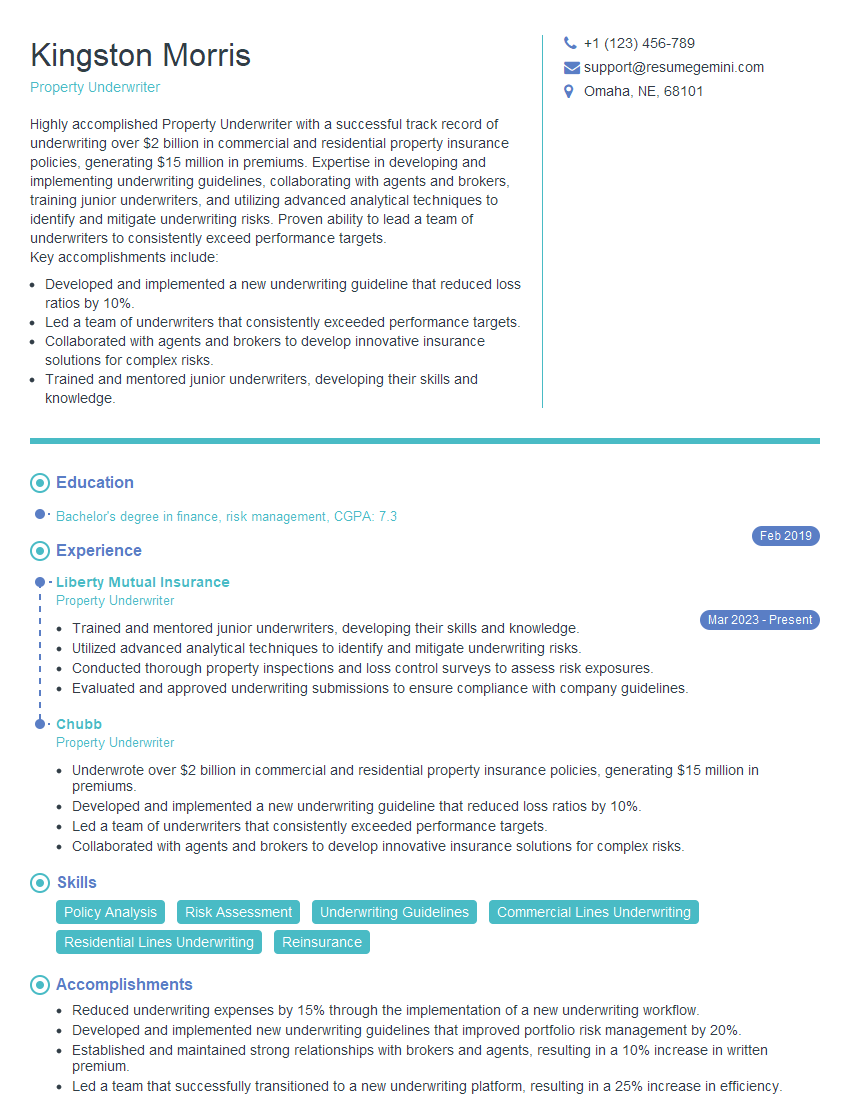

Kingston Morris

Property Underwriter

Summary

Highly accomplished Property Underwriter with a successful track record of underwriting over $2 billion in commercial and residential property insurance policies, generating $15 million in premiums. Expertise in developing and implementing underwriting guidelines, collaborating with agents and brokers, training junior underwriters, and utilizing advanced analytical techniques to identify and mitigate underwriting risks. Proven ability to lead a team of underwriters to consistently exceed performance targets.

Key accomplishments include:

- Developed and implemented a new underwriting guideline that reduced loss ratios by 10%.

- Led a team of underwriters that consistently exceeded performance targets.

- Collaborated with agents and brokers to develop innovative insurance solutions for complex risks.

- Trained and mentored junior underwriters, developing their skills and knowledge.

Education

Bachelor’s degree in finance, risk management

February 2019

Skills

- Policy Analysis

- Risk Assessment

- Underwriting Guidelines

- Commercial Lines Underwriting

- Residential Lines Underwriting

- Reinsurance

Work Experience

Property Underwriter

- Trained and mentored junior underwriters, developing their skills and knowledge.

- Utilized advanced analytical techniques to identify and mitigate underwriting risks.

- Conducted thorough property inspections and loss control surveys to assess risk exposures.

- Evaluated and approved underwriting submissions to ensure compliance with company guidelines.

Property Underwriter

- Underwrote over $2 billion in commercial and residential property insurance policies, generating $15 million in premiums.

- Developed and implemented a new underwriting guideline that reduced loss ratios by 10%.

- Led a team of underwriters that consistently exceeded performance targets.

- Collaborated with agents and brokers to develop innovative insurance solutions for complex risks.

Accomplishments

- Reduced underwriting expenses by 15% through the implementation of a new underwriting workflow.

- Developed and implemented new underwriting guidelines that improved portfolio risk management by 20%.

- Established and maintained strong relationships with brokers and agents, resulting in a 10% increase in written premium.

- Led a team that successfully transitioned to a new underwriting platform, resulting in a 25% increase in efficiency.

- Trained and mentored junior underwriters, improving their underwriting skills and knowledge.

Awards

- Awarded Property Underwriter of the Year by the National Association of Insurance Underwriters (NAIU).

- Recipient of the Excellence in Property Underwriting Award from the American Property Casualty Insurance Association (APCIA).

- Recognized as a top performer in the Property Underwriting division for three consecutive years.

- Named Underwriter of the Quarter for exceptional underwriting performance.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Certified Insurance Counselor (CIC)

- Certified Underwriting Professional (CUP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Property Underwriter

- Highlight your experience and skills in underwriting commercial and residential property insurance.

- Demonstrate your expertise in developing and implementing underwriting guidelines.

- Quantify your accomplishments with specific metrics and results.

- Showcase your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Property Underwriter Resume

- Analyze insurance applications and documentation to assess risk and determine insurability.

- Conduct thorough property inspections and loss control surveys to evaluate risk exposures.

- Evaluate and approve underwriting submissions to ensure compliance with company guidelines.

- Develop and implement underwriting guidelines and procedures to ensure consistent and accurate underwriting decisions.

- Collaborate with agents and brokers to develop innovative insurance solutions for complex risks.

- Train and mentor junior underwriters, developing their skills and knowledge.

Frequently Asked Questions (FAQ’s) For Property Underwriter

What is the role of a Property Underwriter?

A Property Underwriter analyzes insurance applications and documentation to assess risk and determine insurability. They also conduct property inspections and loss control surveys to evaluate risk exposures, and develop and implement underwriting guidelines to ensure consistent and accurate underwriting decisions.

What skills are required to be a Property Underwriter?

Property Underwriters typically need a bachelor’s degree in finance, risk management, or a related field. They also need strong analytical skills, attention to detail, and the ability to work independently and as part of a team.

What is the job market for Property Underwriters?

The job market for Property Underwriters is expected to grow in the coming years, as the demand for insurance continues to increase.

What is the average salary for a Property Underwriter?

The average salary for a Property Underwriter is around $65,000 per year.

What are the advancement opportunities for a Property Underwriter?

Property Underwriters can advance to positions such as Senior Underwriter, Underwriting Manager, or Chief Underwriting Officer.