Are you a seasoned Rate Supervisor seeking a new career path? Discover our professionally built Rate Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

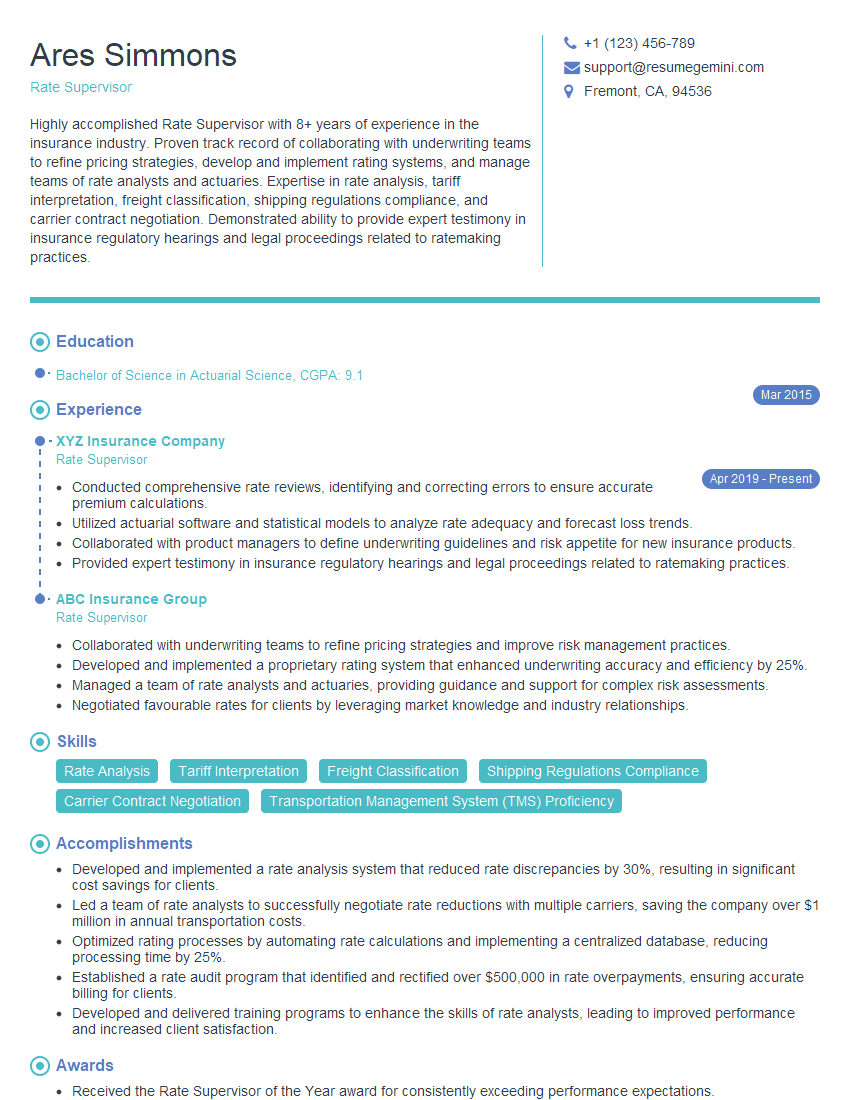

Ares Simmons

Rate Supervisor

Summary

Highly accomplished Rate Supervisor with 8+ years of experience in the insurance industry. Proven track record of collaborating with underwriting teams to refine pricing strategies, develop and implement rating systems, and manage teams of rate analysts and actuaries. Expertise in rate analysis, tariff interpretation, freight classification, shipping regulations compliance, and carrier contract negotiation. Demonstrated ability to provide expert testimony in insurance regulatory hearings and legal proceedings related to ratemaking practices.

Education

Bachelor of Science in Actuarial Science

March 2015

Skills

- Rate Analysis

- Tariff Interpretation

- Freight Classification

- Shipping Regulations Compliance

- Carrier Contract Negotiation

- Transportation Management System (TMS) Proficiency

Work Experience

Rate Supervisor

- Conducted comprehensive rate reviews, identifying and correcting errors to ensure accurate premium calculations.

- Utilized actuarial software and statistical models to analyze rate adequacy and forecast loss trends.

- Collaborated with product managers to define underwriting guidelines and risk appetite for new insurance products.

- Provided expert testimony in insurance regulatory hearings and legal proceedings related to ratemaking practices.

Rate Supervisor

- Collaborated with underwriting teams to refine pricing strategies and improve risk management practices.

- Developed and implemented a proprietary rating system that enhanced underwriting accuracy and efficiency by 25%.

- Managed a team of rate analysts and actuaries, providing guidance and support for complex risk assessments.

- Negotiated favourable rates for clients by leveraging market knowledge and industry relationships.

Accomplishments

- Developed and implemented a rate analysis system that reduced rate discrepancies by 30%, resulting in significant cost savings for clients.

- Led a team of rate analysts to successfully negotiate rate reductions with multiple carriers, saving the company over $1 million in annual transportation costs.

- Optimized rating processes by automating rate calculations and implementing a centralized database, reducing processing time by 25%.

- Established a rate audit program that identified and rectified over $500,000 in rate overpayments, ensuring accurate billing for clients.

- Developed and delivered training programs to enhance the skills of rate analysts, leading to improved performance and increased client satisfaction.

Awards

- Received the Rate Supervisor of the Year award for consistently exceeding performance expectations.

- Recognized with the Excellence in Rate Analysis award for innovative and datadriven approach to rate optimization.

- Awarded the Outstanding Contribution to Rate Management award for developing and implementing a highly effective rate management strategy.

Certificates

- Certified Rate and Tariff Analyst (CRTA)

- Certified Transportation Broker (CTB)

- Certified Logistics Manager (CLM)

- Certified Supply Chain Professional (CSCP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Rate Supervisor

- Quantify your accomplishments with specific metrics to demonstrate your impact.

- Showcase your expertise in rate analysis, tariff interpretation, and other relevant skills.

- Highlight your experience in managing a team and providing guidance to junior analysts.

- Demonstrate your knowledge of insurance regulations and regulatory hearings.

Essential Experience Highlights for a Strong Rate Supervisor Resume

- Collaborate with underwriting teams to refine pricing strategies and improve risk management practices.

- Develop and implement rating systems to enhance underwriting accuracy and efficiency.

- Manage a team of rate analysts and actuaries, providing guidance and support.

- Negotiate favorable rates for clients by leveraging market knowledge and industry relationships.

- Conduct comprehensive rate reviews to identify and correct errors.

- Utilize actuarial software and statistical models to analyze rate adequacy and forecast loss trends.

- Provide expert testimony in insurance regulatory hearings and legal proceedings.

Frequently Asked Questions (FAQ’s) For Rate Supervisor

What is the primary role of a Rate Supervisor?

The primary role of a Rate Supervisor is to oversee the development, implementation, and maintenance of insurance rate plans and rating systems.

What are the key qualities and skills required for this role?

Key qualities and skills for a Rate Supervisor include strong analytical and problem-solving abilities, expertise in ratemaking principles and actuarial techniques, and excellent communication and interpersonal skills.

What are the career prospects for a Rate Supervisor?

Rate Supervisors can advance to senior roles within the insurance industry, such as Chief Actuary, Ratemaking Analyst Manager, or Underwriting Manager.

What is the salary range for a Rate Supervisor?

The salary range for a Rate Supervisor can vary depending on experience, location, and company size, but typically falls between $70,000 and $120,000 per year.

What are the educational requirements for a Rate Supervisor?

Most Rate Supervisors hold a bachelor’s degree in Actuarial Science, Mathematics, or a related field.

What are the professional development opportunities for a Rate Supervisor?

Rate Supervisors can pursue professional certifications, such as the Associate in Insurance Services (AIS) or the Fellowship of the Casualty Actuarial Society (FCAS), to enhance their knowledge and skills.

What are the challenges faced by Rate Supervisors?

Rate Supervisors may face challenges related to market volatility, regulatory changes, and the need to balance profitability with customer affordability.