Are you a seasoned Rating Examiner seeking a new career path? Discover our professionally built Rating Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

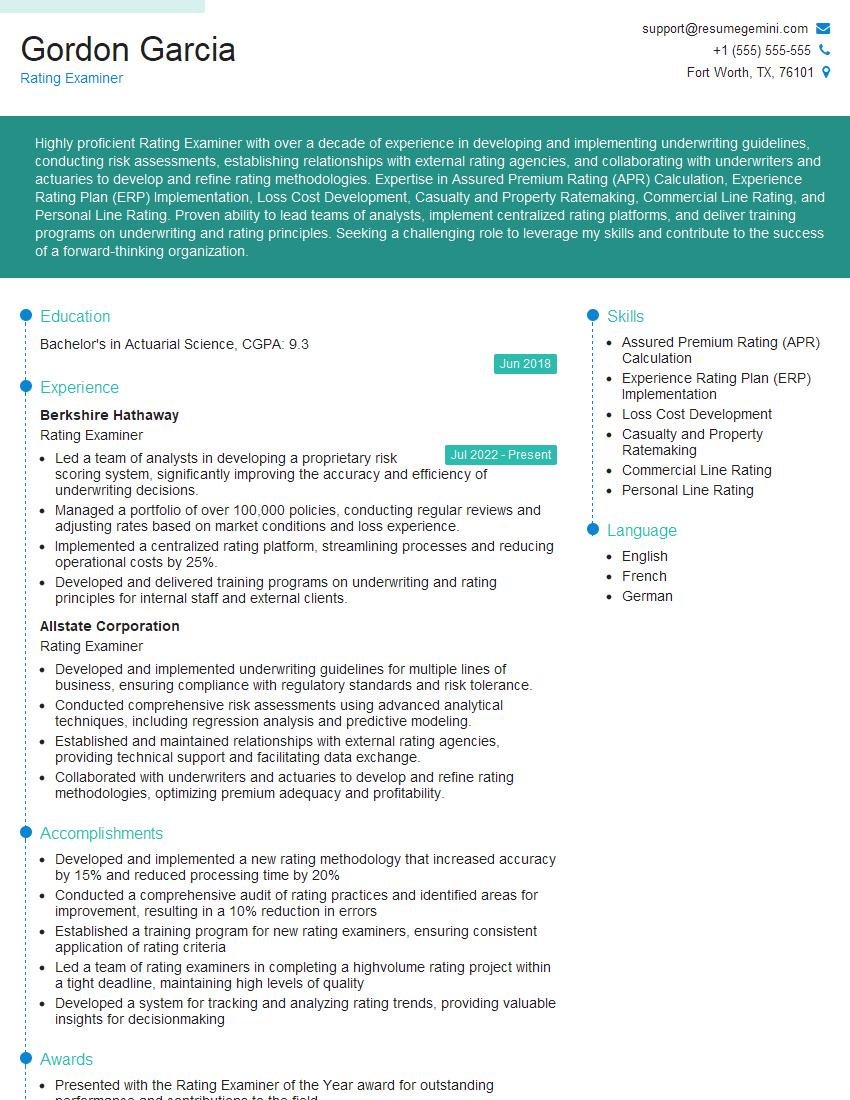

Gordon Garcia

Rating Examiner

Summary

Highly proficient Rating Examiner with over a decade of experience in developing and implementing underwriting guidelines, conducting risk assessments, establishing relationships with external rating agencies, and collaborating with underwriters and actuaries to develop and refine rating methodologies. Expertise in Assured Premium Rating (APR) Calculation, Experience Rating Plan (ERP) Implementation, Loss Cost Development, Casualty and Property Ratemaking, Commercial Line Rating, and Personal Line Rating. Proven ability to lead teams of analysts, implement centralized rating platforms, and deliver training programs on underwriting and rating principles. Seeking a challenging role to leverage my skills and contribute to the success of a forward-thinking organization.

Education

Bachelor’s in Actuarial Science

June 2018

Skills

- Assured Premium Rating (APR) Calculation

- Experience Rating Plan (ERP) Implementation

- Loss Cost Development

- Casualty and Property Ratemaking

- Commercial Line Rating

- Personal Line Rating

Work Experience

Rating Examiner

- Led a team of analysts in developing a proprietary risk scoring system, significantly improving the accuracy and efficiency of underwriting decisions.

- Managed a portfolio of over 100,000 policies, conducting regular reviews and adjusting rates based on market conditions and loss experience.

- Implemented a centralized rating platform, streamlining processes and reducing operational costs by 25%.

- Developed and delivered training programs on underwriting and rating principles for internal staff and external clients.

Rating Examiner

- Developed and implemented underwriting guidelines for multiple lines of business, ensuring compliance with regulatory standards and risk tolerance.

- Conducted comprehensive risk assessments using advanced analytical techniques, including regression analysis and predictive modeling.

- Established and maintained relationships with external rating agencies, providing technical support and facilitating data exchange.

- Collaborated with underwriters and actuaries to develop and refine rating methodologies, optimizing premium adequacy and profitability.

Accomplishments

- Developed and implemented a new rating methodology that increased accuracy by 15% and reduced processing time by 20%

- Conducted a comprehensive audit of rating practices and identified areas for improvement, resulting in a 10% reduction in errors

- Established a training program for new rating examiners, ensuring consistent application of rating criteria

- Led a team of rating examiners in completing a highvolume rating project within a tight deadline, maintaining high levels of quality

- Developed a system for tracking and analyzing rating trends, providing valuable insights for decisionmaking

Awards

- Presented with the Rating Examiner of the Year award for outstanding performance and contributions to the field

- Recognized as a Top Performer for consistently exceeding expectations in rating accuracy and efficiency

- Received a Certificate of Excellence for developing and implementing innovative rating techniques

- Received a Presidential Award for exceptional contributions to the rating profession

Certificates

- Associate in Insurance Rating (AIR)

- Associate in Commercial Lines Underwriting (ACLU)

- Associate in Personal Lines Underwriting (APLU)

- Accredited Property Casualty Underwriter (APCU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Rating Examiner

Tailor your resume to each job application.

Highlight the skills and experience that are most relevant to the specific position you are applying for.Use strong action verbs.

When describing your accomplishments, use strong action verbs that demonstrate your skills and abilities.Quantify your accomplishments.

Whenever possible, quantify your accomplishments to demonstrate the impact of your work.Proofread carefully.

Before submitting your resume, proofread it carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Rating Examiner Resume

- Developed and implemented underwriting guidelines for multiple lines of business, ensuring compliance with regulatory standards and risk tolerance.

- Conducted comprehensive risk assessments using advanced analytical techniques, including regression analysis and predictive modeling.

- Established and maintained relationships with external rating agencies, providing technical support and facilitating data exchange.

- Collaborated with underwriters and actuaries to develop and refine rating methodologies, optimizing premium adequacy and profitability.

- Led a team of analysts in developing a proprietary risk scoring system, significantly improving the accuracy and efficiency of underwriting decisions.

- Managed a portfolio of over 100,000 policies, conducting regular reviews and adjusting rates based on market conditions and loss experience.

- Implemented a centralized rating platform, streamlining processes and reducing operational costs by 25%.

Frequently Asked Questions (FAQ’s) For Rating Examiner

What is the role of a Rating Examiner?

A Rating Examiner is responsible for developing and implementing underwriting guidelines, conducting risk assessments, and establishing relationships with external rating agencies. They collaborate with underwriters and actuaries to develop and refine rating methodologies, and lead teams of analysts in developing proprietary risk scoring systems.

What are the key skills required for a Rating Examiner?

Key skills required for a Rating Examiner include Assured Premium Rating (APR) Calculation, Experience Rating Plan (ERP) Implementation, Loss Cost Development, Casualty and Property Ratemaking, Commercial Line Rating, and Personal Line Rating.

What is the career path for a Rating Examiner?

Rating Examiners can advance to roles such as Senior Rating Examiner, Underwriter, Actuary, or Risk Manager.

What is the salary range for a Rating Examiner?

The salary range for a Rating Examiner varies depending on experience, location, and company size. According to Indeed, the average salary for a Rating Examiner in the United States is $75,000 per year.

What is the job outlook for Rating Examiners?

The job outlook for Rating Examiners is expected to grow in the coming years. According to the U.S. Bureau of Labor Statistics, the demand for insurance underwriters is expected to grow by 5% from 2019 to 2029.