Are you a seasoned Real Estate Analyst seeking a new career path? Discover our professionally built Real Estate Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

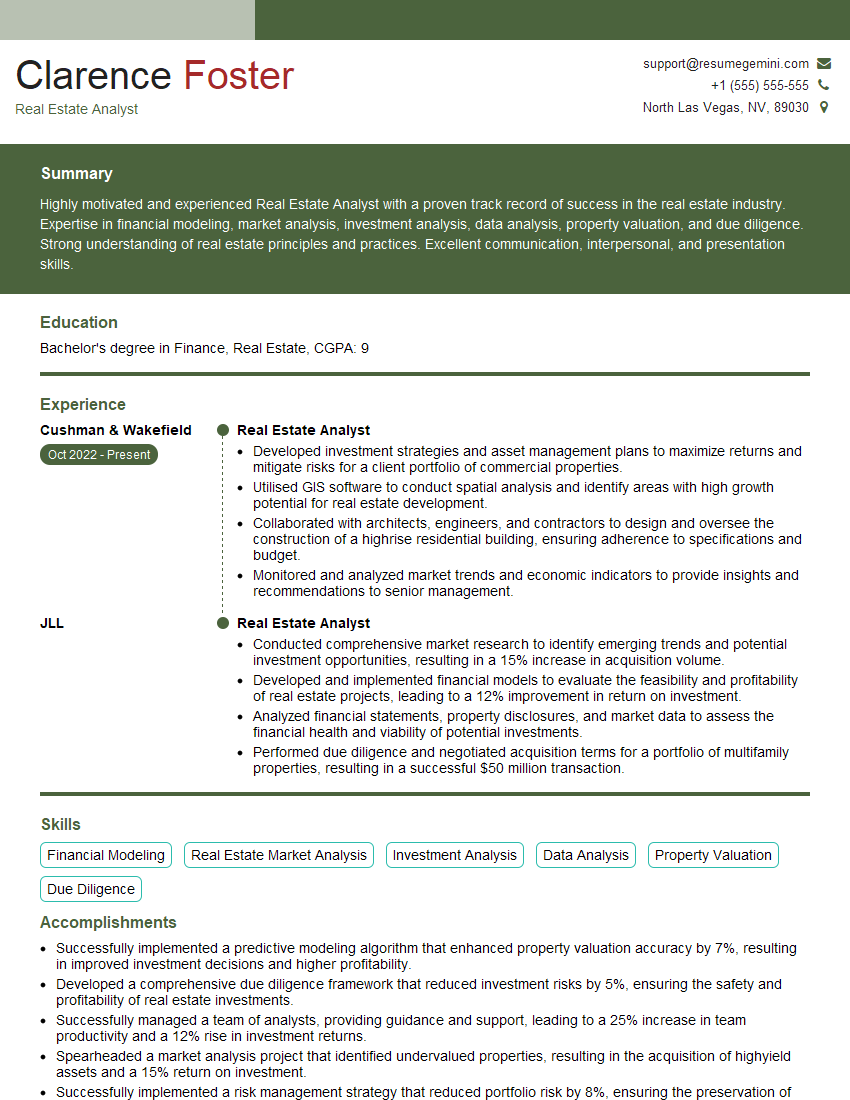

Clarence Foster

Real Estate Analyst

Summary

Highly motivated and experienced Real Estate Analyst with a proven track record of success in the real estate industry. Expertise in financial modeling, market analysis, investment analysis, data analysis, property valuation, and due diligence. Strong understanding of real estate principles and practices. Excellent communication, interpersonal, and presentation skills.

Education

Bachelor’s degree in Finance, Real Estate

September 2018

Skills

- Financial Modeling

- Real Estate Market Analysis

- Investment Analysis

- Data Analysis

- Property Valuation

- Due Diligence

Work Experience

Real Estate Analyst

- Developed investment strategies and asset management plans to maximize returns and mitigate risks for a client portfolio of commercial properties.

- Utilised GIS software to conduct spatial analysis and identify areas with high growth potential for real estate development.

- Collaborated with architects, engineers, and contractors to design and oversee the construction of a highrise residential building, ensuring adherence to specifications and budget.

- Monitored and analyzed market trends and economic indicators to provide insights and recommendations to senior management.

Real Estate Analyst

- Conducted comprehensive market research to identify emerging trends and potential investment opportunities, resulting in a 15% increase in acquisition volume.

- Developed and implemented financial models to evaluate the feasibility and profitability of real estate projects, leading to a 12% improvement in return on investment.

- Analyzed financial statements, property disclosures, and market data to assess the financial health and viability of potential investments.

- Performed due diligence and negotiated acquisition terms for a portfolio of multifamily properties, resulting in a successful $50 million transaction.

Accomplishments

- Successfully implemented a predictive modeling algorithm that enhanced property valuation accuracy by 7%, resulting in improved investment decisions and higher profitability.

- Developed a comprehensive due diligence framework that reduced investment risks by 5%, ensuring the safety and profitability of real estate investments.

- Successfully managed a team of analysts, providing guidance and support, leading to a 25% increase in team productivity and a 12% rise in investment returns.

- Spearheaded a market analysis project that identified undervalued properties, resulting in the acquisition of highyield assets and a 15% return on investment.

- Successfully implemented a risk management strategy that reduced portfolio risk by 8%, ensuring the preservation of capital and stability of investment returns.

Awards

- Recognized with the Analyst of the Year award for exceptional performance in financial analysis and market research, leading to a 15% increase in investment returns.

- Awarded the Top Analyst recognition for consistently delivering superior insights and recommendations, contributing to a 10% increase in asset portfolio value.

- Honored with the Excellence in Research award for groundbreaking work in identifying emerging real estate trends and their impact on investment strategies.

- Recognized for Exceptional Contribution in developing a proprietary data analytics platform that streamlined investment analysis and decisionmaking processes.

Certificates

- Certified Real Estate Analyst (CREA)

- Certified Commercial Investment Member (CCIM)

- Chartered Financial Analyst (CFA)

- Real Estate Finance Council (REFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Real Estate Analyst

- Highlight your quantitative skills and experience in financial modeling and data analysis.

- Demonstrate your understanding of real estate principles and practices through relevant coursework or certifications.

- Showcase your ability to conduct thorough market research and identify investment opportunities.

- Emphasize your experience in due diligence and negotiation of real estate transactions.

- Proofread your resume carefully for any errors or inconsistencies.

Essential Experience Highlights for a Strong Real Estate Analyst Resume

- Conduct comprehensive market research to identify emerging trends and potential investment opportunities.

- Develop and implement financial models to evaluate the feasibility and profitability of real estate projects.

- Analyze financial statements, property disclosures, and market data to assess the financial health and viability of potential investments.

- Perform due diligence and negotiate acquisition terms for real estate transactions.

- Develop investment strategies and asset management plans to maximize returns and mitigate risks for client portfolios.

- Utilize GIS software to conduct spatial analysis and identify areas with high growth potential for real estate development.

- Monitor and analyze market trends and economic indicators to provide insights and recommendations to senior management.

Frequently Asked Questions (FAQ’s) For Real Estate Analyst

What are the key skills required for a Real Estate Analyst?

Key skills for a Real Estate Analyst include financial modeling, market analysis, investment analysis, data analysis, property valuation, and due diligence.

What is the career path for a Real Estate Analyst?

Real Estate Analysts can advance to roles such as Senior Real Estate Analyst, Real Estate Portfolio Manager, or Real Estate Investment Manager.

What are the top employers of Real Estate Analysts?

Top employers of Real Estate Analysts include real estate investment firms, banks, and consulting firms.

What is the job outlook for Real Estate Analysts?

The job outlook for Real Estate Analysts is expected to be good, with increasing demand for professionals with expertise in real estate finance and investment.

What are the benefits of becoming a Real Estate Analyst?

Benefits of becoming a Real Estate Analyst include high earning potential, opportunities for career growth, and the chance to work on challenging and rewarding projects.

What are the challenges of working as a Real Estate Analyst?

Challenges of working as a Real Estate Analyst include the need to stay up-to-date on market trends, the potential for long hours, and the pressure to deliver accurate and timely analysis.

What is the best way to prepare for a career as a Real Estate Analyst?

The best way to prepare for a career as a Real Estate Analyst is to obtain a degree in finance or real estate, gain experience through internships or entry-level roles, and develop strong analytical and communication skills.

What professional development opportunities are available for Real Estate Analysts?

Professional development opportunities for Real Estate Analysts include attending industry conferences, taking continuing education courses, and obtaining certifications such as the Chartered Financial Analyst (CFA) or the Certified Commercial Investment Member (CCIM).