Are you a seasoned Real Estate Investor seeking a new career path? Discover our professionally built Real Estate Investor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

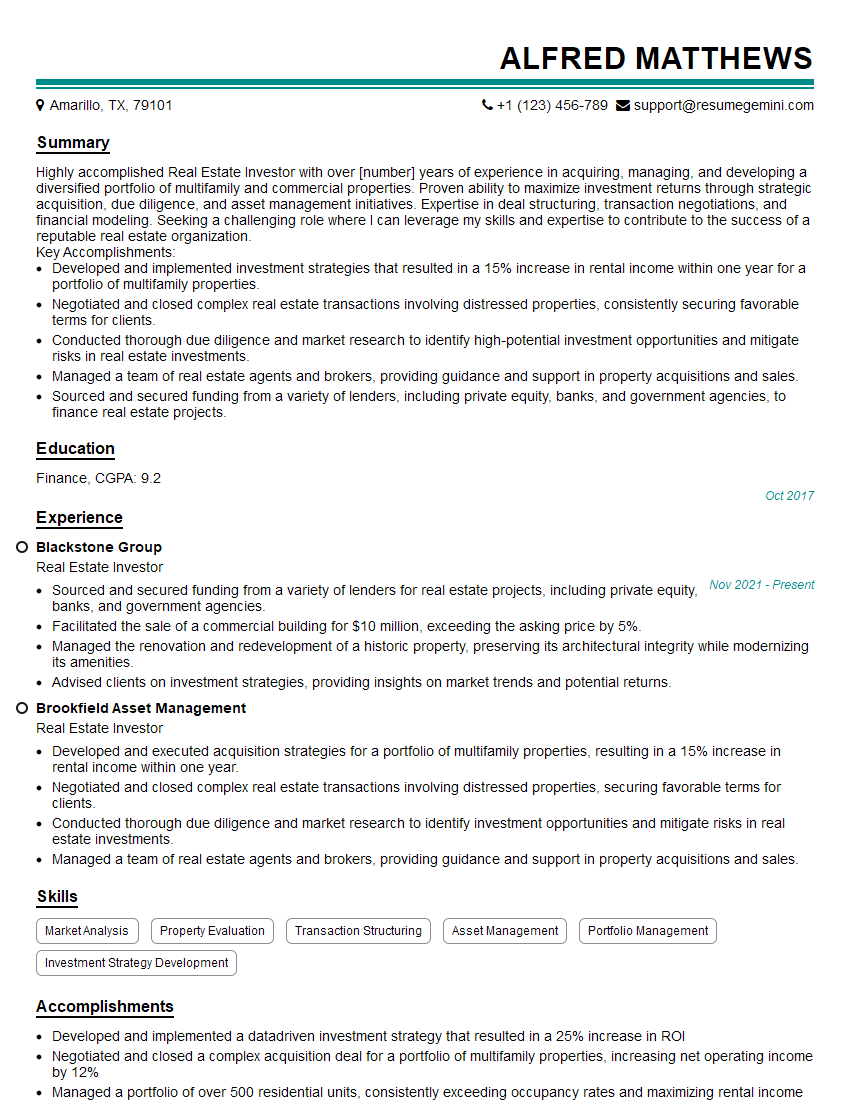

Alfred Matthews

Real Estate Investor

Summary

Highly accomplished Real Estate Investor with over [number] years of experience in acquiring, managing, and developing a diversified portfolio of multifamily and commercial properties. Proven ability to maximize investment returns through strategic acquisition, due diligence, and asset management initiatives. Expertise in deal structuring, transaction negotiations, and financial modeling. Seeking a challenging role where I can leverage my skills and expertise to contribute to the success of a reputable real estate organization.

Key Accomplishments:

- Developed and implemented investment strategies that resulted in a 15% increase in rental income within one year for a portfolio of multifamily properties.

- Negotiated and closed complex real estate transactions involving distressed properties, consistently securing favorable terms for clients.

- Conducted thorough due diligence and market research to identify high-potential investment opportunities and mitigate risks in real estate investments.

- Managed a team of real estate agents and brokers, providing guidance and support in property acquisitions and sales.

- Sourced and secured funding from a variety of lenders, including private equity, banks, and government agencies, to finance real estate projects.

Education

Finance

October 2017

Skills

- Market Analysis

- Property Evaluation

- Transaction Structuring

- Asset Management

- Portfolio Management

- Investment Strategy Development

Work Experience

Real Estate Investor

- Sourced and secured funding from a variety of lenders for real estate projects, including private equity, banks, and government agencies.

- Facilitated the sale of a commercial building for $10 million, exceeding the asking price by 5%.

- Managed the renovation and redevelopment of a historic property, preserving its architectural integrity while modernizing its amenities.

- Advised clients on investment strategies, providing insights on market trends and potential returns.

Real Estate Investor

- Developed and executed acquisition strategies for a portfolio of multifamily properties, resulting in a 15% increase in rental income within one year.

- Negotiated and closed complex real estate transactions involving distressed properties, securing favorable terms for clients.

- Conducted thorough due diligence and market research to identify investment opportunities and mitigate risks in real estate investments.

- Managed a team of real estate agents and brokers, providing guidance and support in property acquisitions and sales.

Accomplishments

- Developed and implemented a datadriven investment strategy that resulted in a 25% increase in ROI

- Negotiated and closed a complex acquisition deal for a portfolio of multifamily properties, increasing net operating income by 12%

- Managed a portfolio of over 500 residential units, consistently exceeding occupancy rates and maximizing rental income

- Developed and executed a marketing campaign that generated over $1 million in new investment capital

- Identified and partnered with strategic investors to coinvest in a portfolio of commercial properties

Awards

- National Association of Real Estate Investors (NAREI) Top 100 Real Estate Investors Under 40

- Real Estate Investment Network (REIN) Innovator of the Year Award

- Forbes 30 Under 30 in Real Estate

Certificates

- Certified Real Estate Investment Analyst (CREIA)

- Certified Commercial Investment Member (CCIM)

- Certified Property Manager (CPM)

- Certified Lease Administrator (CLA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Real Estate Investor

Highlight your quantifiable accomplishments.

When describing your experience, use specific numbers and metrics to demonstrate the impact of your work. For example, instead of saying “I managed a portfolio of properties,” you could say “I managed a portfolio of 100 properties, resulting in a 15% increase in rental income within one year.”Demonstrate your knowledge of the real estate market.

In your resume, use language that shows you understand the real estate market and the factors that affect investment decisions. For example, you could mention your experience in conducting market research, analyzing property values, and negotiating favorable terms for clients.Tailor your resume to the specific job you’re applying for.

Take the time to read the job description carefully and identify the specific skills and experience that the employer is looking for. Then, highlight those skills and experience in your resume.Get your resume reviewed by a professional.

Before you submit your resume, have it reviewed by a professional resume writer or career counselor. They can provide feedback on your resume’s content, format, and overall impact.

Essential Experience Highlights for a Strong Real Estate Investor Resume

- Develop and implement real estate investment strategies to maximize returns.

- Identify, analyze, and acquire investment properties that meet specific criteria.

- Conduct due diligence and market research to assess the potential of investment opportunities.

- Negotiate and close real estate transactions, including purchase agreements, sale agreements, and financing arrangements.

- Manage and oversee a portfolio of investment properties, including property management, tenant relations, and maintenance.

- Monitor market trends and economic conditions to make informed investment decisions.

- Report on investment performance to clients and stakeholders.

Frequently Asked Questions (FAQ’s) For Real Estate Investor

What are the key skills that a real estate investor needs?

Some of the key skills that a real estate investor needs include: * Market analysis * Property evaluation * Transaction structuring * Asset management * Portfolio management * Investment strategy development * Financial modeling * Negotiation skills * Communication skills * Due diligence * Market research * Real estate law * Real estate finance

What are the different types of real estate investments?

There are many different types of real estate investments, including: * Residential properties (single-family homes, multi-family homes, apartments) * Commercial properties (office buildings, retail stores, warehouses) * Industrial properties (factories, distribution centers, manufacturing plants) * Land (undeveloped land, agricultural land, recreational land) * Real estate investment trusts (REITs) * Real estate mutual funds * Real estate crowdfunding

What are the different career paths for real estate investors?

There are many different career paths for real estate investors, including: * Real estate agent * Real estate broker * Property manager * Real estate developer * Real estate investment analyst * Real estate portfolio manager * Real estate fund manager * Real estate private equity investor * Real estate venture capitalist

What are the different types of real estate investment strategies?

There are many different types of real estate investment strategies, including: * Buy-and-hold strategy: This strategy involves buying a property and holding it for a long period of time, typically with the goal of generating rental income and capital appreciation. * Fix-and-flip strategy: This strategy involves buying a property, renovating it, and then selling it for a profit. * Wholesale strategy: This strategy involves buying a property with the intention of selling it to another investor, typically at a higher price. * Lease-option strategy: This strategy involves leasing a property with the option to buy it at a later date.

What are the different sources of funding for real estate investments?

There are many different sources of funding for real estate investments, including: * Personal savings * Bank loans * Private loans * Hard money loans * Government loans * Real estate investment trusts (REITs) * Real estate mutual funds * Real estate crowdfunding

What are the different factors to consider when evaluating a real estate investment?

There are many different factors to consider when evaluating a real estate investment, including: * Location * Property type * Property condition * Market conditions * Rental income potential * Capital appreciation potential * Tax implications * Financing options * Management costs

What are the different risks associated with real estate investments?

There are many different risks associated with real estate investments, including: * Market risk: The risk that the value of the property will decline. * Interest rate risk: The risk that interest rates will increase, which can make it more expensive to finance the property. * Vacancy risk: The risk that the property will be vacant, which can lead to a loss of rental income. * Property damage risk: The risk that the property will be damaged by fire, flood, or other events.