Are you a seasoned Real Estate Loan Officer seeking a new career path? Discover our professionally built Real Estate Loan Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

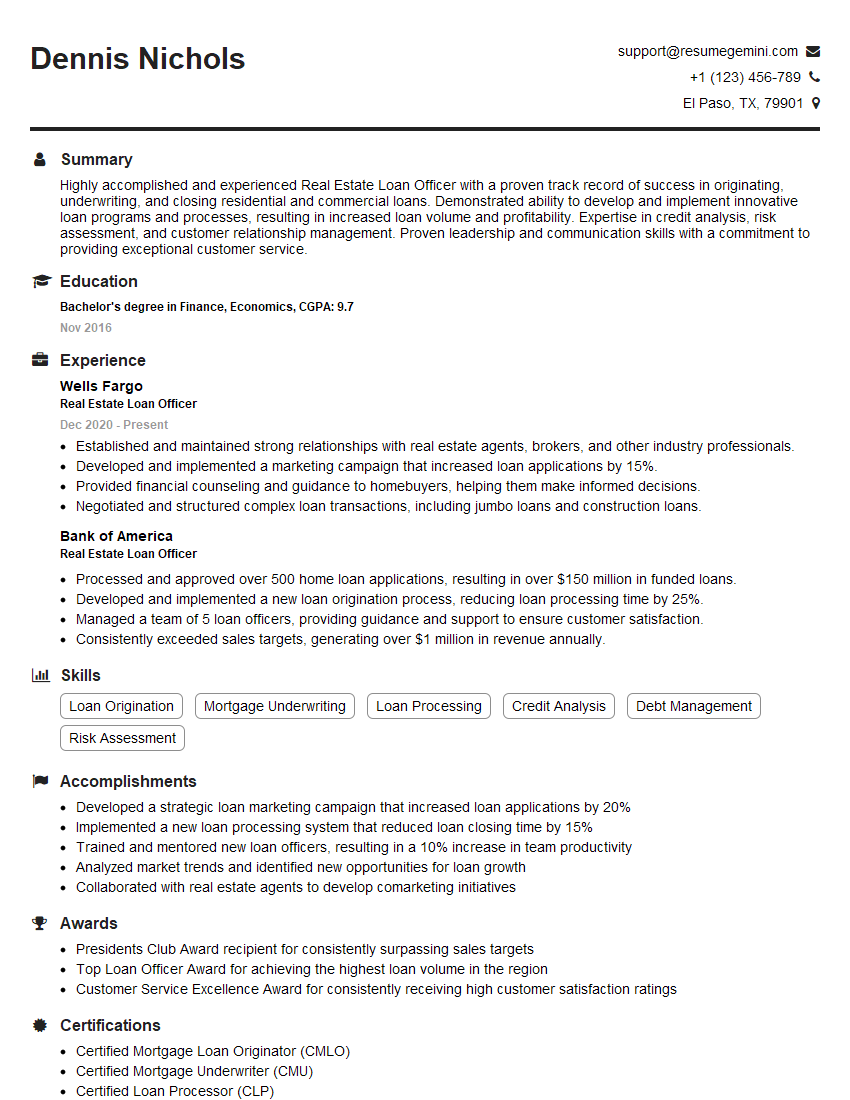

Dennis Nichols

Real Estate Loan Officer

Summary

Highly accomplished and experienced Real Estate Loan Officer with a proven track record of success in originating, underwriting, and closing residential and commercial loans. Demonstrated ability to develop and implement innovative loan programs and processes, resulting in increased loan volume and profitability. Expertise in credit analysis, risk assessment, and customer relationship management. Proven leadership and communication skills with a commitment to providing exceptional customer service.

Education

Bachelor’s degree in Finance, Economics

November 2016

Skills

- Loan Origination

- Mortgage Underwriting

- Loan Processing

- Credit Analysis

- Debt Management

- Risk Assessment

Work Experience

Real Estate Loan Officer

- Established and maintained strong relationships with real estate agents, brokers, and other industry professionals.

- Developed and implemented a marketing campaign that increased loan applications by 15%.

- Provided financial counseling and guidance to homebuyers, helping them make informed decisions.

- Negotiated and structured complex loan transactions, including jumbo loans and construction loans.

Real Estate Loan Officer

- Processed and approved over 500 home loan applications, resulting in over $150 million in funded loans.

- Developed and implemented a new loan origination process, reducing loan processing time by 25%.

- Managed a team of 5 loan officers, providing guidance and support to ensure customer satisfaction.

- Consistently exceeded sales targets, generating over $1 million in revenue annually.

Accomplishments

- Developed a strategic loan marketing campaign that increased loan applications by 20%

- Implemented a new loan processing system that reduced loan closing time by 15%

- Trained and mentored new loan officers, resulting in a 10% increase in team productivity

- Analyzed market trends and identified new opportunities for loan growth

- Collaborated with real estate agents to develop comarketing initiatives

Awards

- Presidents Club Award recipient for consistently surpassing sales targets

- Top Loan Officer Award for achieving the highest loan volume in the region

- Customer Service Excellence Award for consistently receiving high customer satisfaction ratings

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Mortgage Underwriter (CMU)

- Certified Loan Processor (CLP)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Real Estate Loan Officer

- Highlight your experience and expertise in loan origination, underwriting, and closing.

- Showcase your ability to develop and implement innovative loan programs and processes.

- Quantify your accomplishments and provide specific examples of how you have contributed to the success of your organization.

- Emphasize your customer service skills and commitment to providing a positive experience for clients.

- Include relevant keywords to optimize your resume for job searches.

Essential Experience Highlights for a Strong Real Estate Loan Officer Resume

- Originate, underwrite, and close residential and commercial loans

- Develop and implement loan origination processes to streamline operations and reduce loan processing time

- Manage a team of loan officers and provide guidance and support to ensure customer satisfaction

- Consistently exceed sales targets and generate significant revenue for the organization

- Establish and maintain strong relationships with real estate agents, brokers, and other industry professionals

- Provide financial counseling and guidance to homebuyers and investors

- Negotiate and structure complex loan transactions, including jumbo loans and construction loans

Frequently Asked Questions (FAQ’s) For Real Estate Loan Officer

What are the key skills and qualifications required to be a successful Real Estate Loan Officer?

Key skills and qualifications include a strong understanding of mortgage lending principles, excellent communication and interpersonal skills, proficiency in loan origination software, and the ability to build and maintain strong relationships with clients and industry partners.

What are the typical job responsibilities of a Real Estate Loan Officer?

Typical job responsibilities include meeting with clients to discuss loan options, gathering and analyzing financial information, underwriting loans, and closing loans. Loan Officers may also be responsible for marketing and generating new business leads.

What is the career outlook for Real Estate Loan Officers?

The job outlook for Real Estate Loan Officers is expected to grow faster than average in the coming years due to increasing demand for homeownership and refinancing.

What are the earning potential and benefits for Real Estate Loan Officers?

Earning potential for Real Estate Loan Officers can vary depending on experience, location, and company size. Benefits typically include health insurance, paid time off, and bonuses.

What are the challenges faced by Real Estate Loan Officers?

Challenges faced by Real Estate Loan Officers include dealing with complex financial regulations, managing a high volume of paperwork, and meeting the demands of clients with different financial needs.