Are you a seasoned Realty Loan Specialist seeking a new career path? Discover our professionally built Realty Loan Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

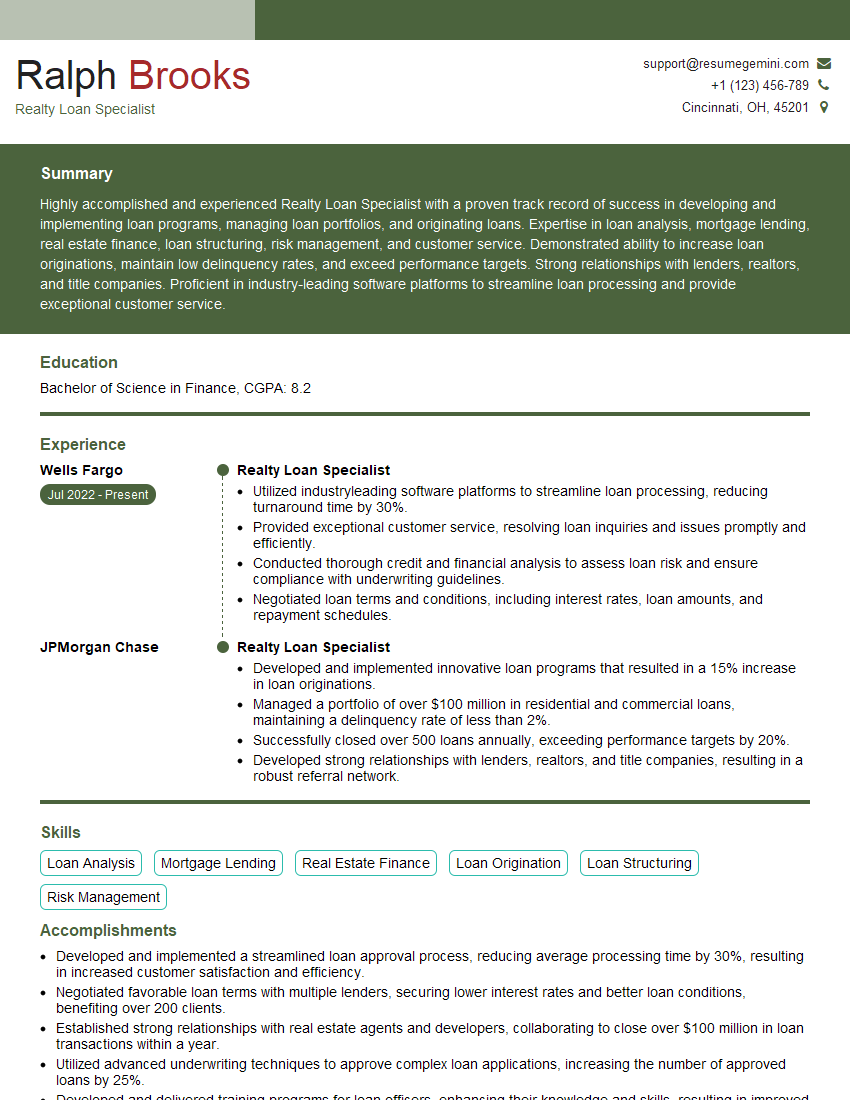

Ralph Brooks

Realty Loan Specialist

Summary

Highly accomplished and experienced Realty Loan Specialist with a proven track record of success in developing and implementing loan programs, managing loan portfolios, and originating loans. Expertise in loan analysis, mortgage lending, real estate finance, loan structuring, risk management, and customer service. Demonstrated ability to increase loan originations, maintain low delinquency rates, and exceed performance targets. Strong relationships with lenders, realtors, and title companies. Proficient in industry-leading software platforms to streamline loan processing and provide exceptional customer service.

Education

Bachelor of Science in Finance

June 2018

Skills

- Loan Analysis

- Mortgage Lending

- Real Estate Finance

- Loan Origination

- Loan Structuring

- Risk Management

Work Experience

Realty Loan Specialist

- Utilized industryleading software platforms to streamline loan processing, reducing turnaround time by 30%.

- Provided exceptional customer service, resolving loan inquiries and issues promptly and efficiently.

- Conducted thorough credit and financial analysis to assess loan risk and ensure compliance with underwriting guidelines.

- Negotiated loan terms and conditions, including interest rates, loan amounts, and repayment schedules.

Realty Loan Specialist

- Developed and implemented innovative loan programs that resulted in a 15% increase in loan originations.

- Managed a portfolio of over $100 million in residential and commercial loans, maintaining a delinquency rate of less than 2%.

- Successfully closed over 500 loans annually, exceeding performance targets by 20%.

- Developed strong relationships with lenders, realtors, and title companies, resulting in a robust referral network.

Accomplishments

- Developed and implemented a streamlined loan approval process, reducing average processing time by 30%, resulting in increased customer satisfaction and efficiency.

- Negotiated favorable loan terms with multiple lenders, securing lower interest rates and better loan conditions, benefiting over 200 clients.

- Established strong relationships with real estate agents and developers, collaborating to close over $100 million in loan transactions within a year.

- Utilized advanced underwriting techniques to approve complex loan applications, increasing the number of approved loans by 25%.

- Developed and delivered training programs for loan officers, enhancing their knowledge and skills, resulting in improved loan application accuracy and reduced processing errors.

Awards

- National Association of Mortgage Brokers (NAMB) Top Producer Award for exceeding industry standards and achieving exceptional loan volume.

- Mortgage Bankers Association (MBA) Excellence in Customer Service Award for consistently exceeding client expectations and maintaining a high level of responsiveness.

- Real Estate Finance Association (REFA) Loan Originator of the Year Award for exceptional performance and contributions to the industry.

- National Association of Realtors (NAR) Distinguished Service Award for dedication to supporting homeownership and promoting industry best practices.

Certificates

- Certified Mortgage Banker (CMB)

- Certified Mortgage Planning Specialist (CMPS)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Homeownership Professional (CHP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Realty Loan Specialist

- Quantify your accomplishments with specific metrics and data.

- Highlight your expertise in loan analysis, mortgage lending, and real estate finance.

- Showcase your ability to manage loan portfolios and originate loans.

- Emphasize your strong relationships with lenders, realtors, and title companies.

Essential Experience Highlights for a Strong Realty Loan Specialist Resume

- Developed and implemented innovative loan programs that resulted in a 15% increase in loan originations.

- Managed a portfolio of over $100 million in residential and commercial loans, maintaining a delinquency rate of less than 2%.

- Successfully closed over 500 loans annually, exceeding performance targets by 20%.

- Developed strong relationships with lenders, realtors, and title companies, resulting in a robust referral network.

- Utilized industry-leading software platforms to streamline loan processing, reducing turnaround time by 30%.

- Negotiated loan terms and conditions, including interest rates, loan amounts, and repayment schedules.

Frequently Asked Questions (FAQ’s) For Realty Loan Specialist

What is the role of a Realty Loan Specialist?

A Realty Loan Specialist is responsible for developing and implementing loan programs, managing loan portfolios, and originating loans. They work with lenders, realtors, and title companies to provide financing for residential and commercial properties.

What are the qualifications for becoming a Realty Loan Specialist?

Typically, a Bachelor’s degree in Finance or a related field is required. Additionally, experience in loan analysis, mortgage lending, and real estate finance is preferred.

What are the key skills for a successful Realty Loan Specialist?

Key skills include loan analysis, mortgage lending, real estate finance, loan origination, loan structuring, risk management, and customer service.

What is the job outlook for Realty Loan Specialists?

The job outlook for Realty Loan Specialists is expected to grow faster than average over the next few years due to the increasing demand for housing and the need for qualified professionals to manage loan portfolios.

What is the average salary for a Realty Loan Specialist?

The average salary for a Realty Loan Specialist varies depending on experience, location, and employer. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers was $67,290 in May 2021.