Are you a seasoned Reconciling Clerk seeking a new career path? Discover our professionally built Reconciling Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

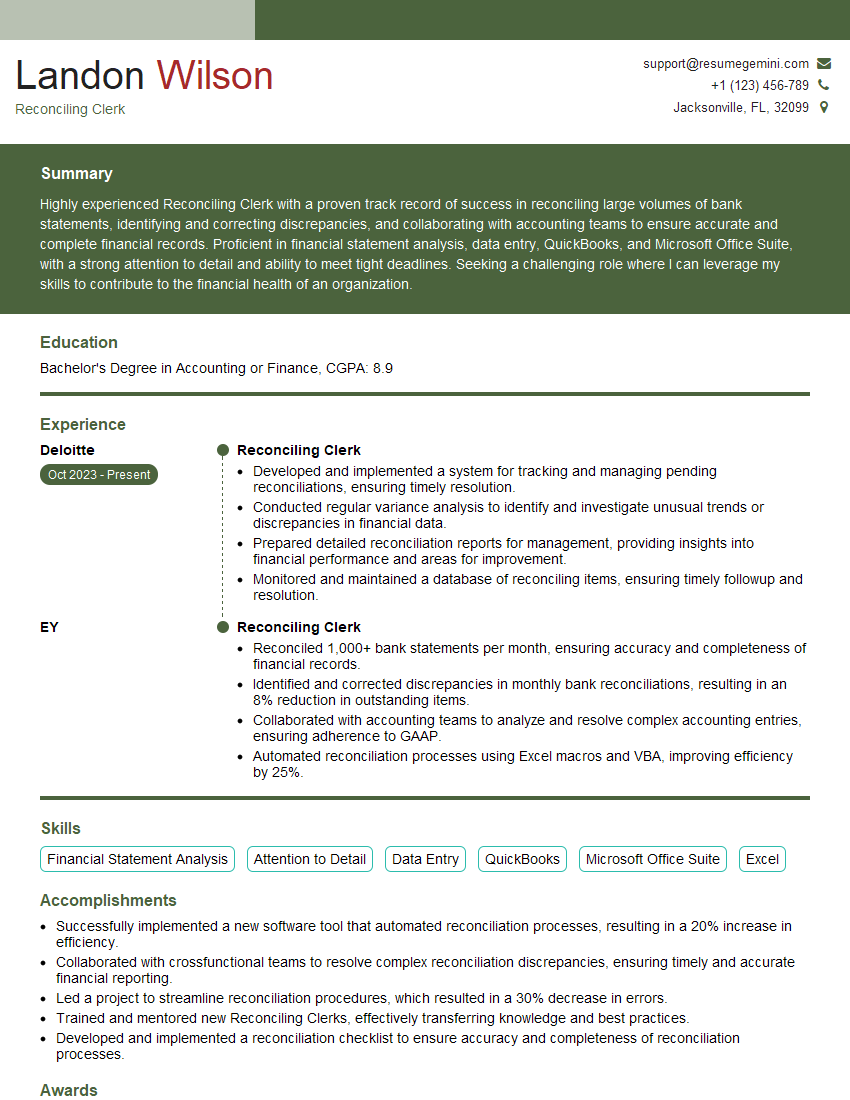

Landon Wilson

Reconciling Clerk

Summary

Highly experienced Reconciling Clerk with a proven track record of success in reconciling large volumes of bank statements, identifying and correcting discrepancies, and collaborating with accounting teams to ensure accurate and complete financial records. Proficient in financial statement analysis, data entry, QuickBooks, and Microsoft Office Suite, with a strong attention to detail and ability to meet tight deadlines. Seeking a challenging role where I can leverage my skills to contribute to the financial health of an organization.

Education

Bachelor’s Degree in Accounting or Finance

September 2019

Skills

- Financial Statement Analysis

- Attention to Detail

- Data Entry

- QuickBooks

- Microsoft Office Suite

- Excel

Work Experience

Reconciling Clerk

- Developed and implemented a system for tracking and managing pending reconciliations, ensuring timely resolution.

- Conducted regular variance analysis to identify and investigate unusual trends or discrepancies in financial data.

- Prepared detailed reconciliation reports for management, providing insights into financial performance and areas for improvement.

- Monitored and maintained a database of reconciling items, ensuring timely followup and resolution.

Reconciling Clerk

- Reconciled 1,000+ bank statements per month, ensuring accuracy and completeness of financial records.

- Identified and corrected discrepancies in monthly bank reconciliations, resulting in an 8% reduction in outstanding items.

- Collaborated with accounting teams to analyze and resolve complex accounting entries, ensuring adherence to GAAP.

- Automated reconciliation processes using Excel macros and VBA, improving efficiency by 25%.

Accomplishments

- Successfully implemented a new software tool that automated reconciliation processes, resulting in a 20% increase in efficiency.

- Collaborated with crossfunctional teams to resolve complex reconciliation discrepancies, ensuring timely and accurate financial reporting.

- Led a project to streamline reconciliation procedures, which resulted in a 30% decrease in errors.

- Trained and mentored new Reconciling Clerks, effectively transferring knowledge and best practices.

- Developed and implemented a reconciliation checklist to ensure accuracy and completeness of reconciliation processes.

Awards

- Received Outstanding Performance Award for consistently exceeding reconciliation accuracy targets.

- Recognized for developing and implementing innovative reconciliation techniques that reduced reconciliation time by 15%.

- Nominated for the Reconciliation Excellence Award for exceptional contributions to maintaining financial integrity.

- Recipient of the Reconciliation Star Award for superior performance in maintaining accurate and timely reconciliations.

Certificates

- Certified Professional Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Reconciling Clerk

- Quantify your accomplishments and use specific metrics to demonstrate your impact on the organization.

- Highlight your proficiency in relevant software and technologies, such as QuickBooks and Excel.

- Emphasize your attention to detail and ability to work accurately in a fast-paced environment.

- Include keywords from the job description in your resume to increase its visibility to potential employers.

Essential Experience Highlights for a Strong Reconciling Clerk Resume

- Reconciled 1,000+ bank statements per month, ensuring accuracy and completeness of financial records.

- Identified and corrected discrepancies in monthly bank reconciliations, resulting in an 8% reduction in outstanding items.

- Collaborated with accounting teams to analyze and resolve complex accounting entries, ensuring adherence to GAAP.

- Automated reconciliation processes using Excel macros and VBA, improving efficiency by 25%.

- Developed and implemented a system for tracking and managing pending reconciliations, ensuring timely resolution.

- Conducted regular variance analysis to identify and investigate unusual trends or discrepancies in financial data.

- Prepared detailed reconciliation reports for management, providing insights into financial performance and areas for improvement.

Frequently Asked Questions (FAQ’s) For Reconciling Clerk

What are the key skills and qualifications required for a Reconciling Clerk?

The key skills and qualifications required for a Reconciling Clerk include a strong attention to detail, proficiency in financial statement analysis, data entry, and accounting software such as QuickBooks. A Bachelor’s Degree in Accounting or Finance is preferred.

What are the primary responsibilities of a Reconciling Clerk?

The primary responsibilities of a Reconciling Clerk include reconciling bank statements, identifying and correcting discrepancies, collaborating with accounting teams to resolve complex accounting entries, and preparing detailed reconciliation reports for management.

What career advancement opportunities are available for Reconciling Clerks?

Reconciling Clerks can advance their careers by pursuing roles such as Accountant, Financial Analyst, or Auditor. With experience and additional qualifications, they can also move into management positions such as Accounting Manager or Controller.

What is the average salary range for Reconciling Clerks?

The average salary range for Reconciling Clerks in the United States is between $40,000 and $60,000 per year, depending on experience, qualifications, and location.

What are the key challenges faced by Reconciling Clerks?

The key challenges faced by Reconciling Clerks include working with large volumes of data, meeting tight deadlines, and ensuring the accuracy and completeness of financial records.

What are the top industries that hire Reconciling Clerks?

The top industries that hire Reconciling Clerks include accounting, finance, banking, healthcare, and government.